(This is an excerpt from an article I originally published on Seeking Alpha on May 14, 2015. Click here to read the entire piece.)

Now that the Australian Competition and Consumer Commission (ACCC) has cleared Andrew Forrest of violating laws against anti-competitive business practices, the CEO of Fortescue Metals Group (FSUGY) (FSUMY) wasted no time in advancing his idea to cap production in a more nuanced yet even clearer format than the off-the-cuff comments that got him in trouble in the first place.

Andrew Forrest describes himself as “a philanthropist and job-creator who founded the only major iron ore mining company to break into the industry in over 40 years.” This description provides great context for his recent detailed diatribe against Rio Tinto (RIO) and BHP Billiton Limited (BHP) for their business practices regarding mining iron ore in Australia in an op-ed called “Big miners BHP Billiton and Rio Tinto’s ‘flood the market tactics’ threaten Australia’s prosperity.” Forrest has taken up a bully pulpit that seeks to rally Australian’s to take ownership of its natural resources and ensure high prices for them. It effectively calls upon a more effective quasi-nationalization of industry under the guise of national prosperity.

The nationalistic tone is clearly established with this accusation…

{snip}

In support of the nationalization concept is the euphemistic term “social license to operate.” The problem with all such arrangements is that determining the necessary production caps becomes more of a political exercise than an economic one. {snip}

{snip}

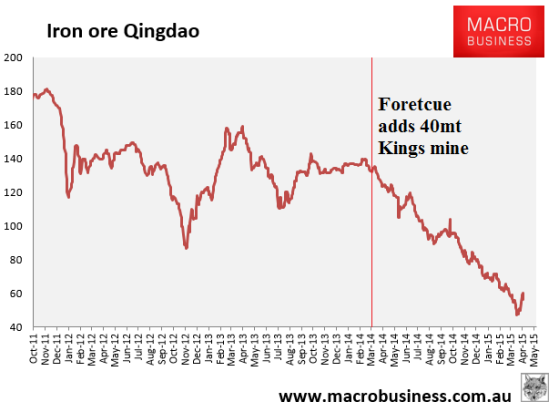

The rebuttal is aptly titled “Twiggy crowns himself Banana Republic king.” It begins by implying Fortescue is a part of the problem with this graphic:

{snip}

The resulting revenue for Australia looks dramatically different under the alternative scenarios…

In other words, if one accepts this analysis over Deloitte’s, Forrest’s argument is really about survival of his company. {snip}

Forrest’s bottom-line appeal speaks to a desire to ensure the wealth and well-being of Australians. The CEO has a laundry list of expenditures waiting for Australia’s iron ore profits: philanthropic work to end modern-day slavery, ending indigenous disparity through education and employment, attracting the best minds in the world to Australia’s universities, employing thousands of Australians, and paying billions in taxes and royalties. If Australians can rally around all these objectives, I have a third alternative for achieving these objectives without manipulating the market. Australia’s government could simply implement higher taxes on exports. One reader of some of prior pieces on iron ore has suggested this, and I see the wisdom now if it can be an alternative to market manipulation.

{snip}

Be careful out there!

Full disclosure: long VALE, short BHP, long call and put options on RIO

(This is an excerpt from an article I originally published on Seeking Alpha on May 14, 2015. Click here to read the entire piece.)