(This is an excerpt from an article I originally published on Seeking Alpha on December 29, 2015. Click here to read the entire piece.)

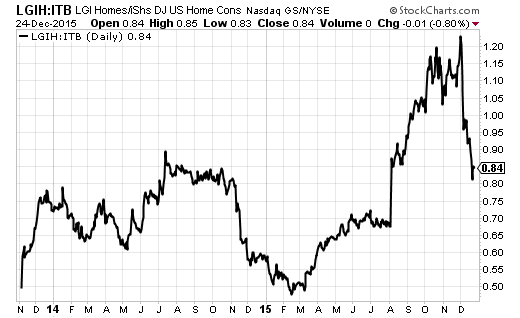

In mid-September, I wrote “LGI Homes Is Now A Bit Hot To The Touch.” LGI Homes (LGIH) is down 18% since then. LGIH also hit an all-time high on December 1st that represented a 25% gain from the point of my article. The descent since that all-time high has been dramatic and has occurred on very high selling volume.

Source: FreeStockCharts.com

{snip}

Source: StockCharts.com

{snip}

As promised, I sold my position in LGIH shortly after publishing the September article on LGIH. Since I prefer to follow a buy-the-dip strategy when it comes to the stocks of home builders, I am now left to wonder whether the current selling in LGIH creates a new buying opportunity. {snip}

There are no smoking guns to explain the selling from the recent SEC fillings for LGIH. The company has not had any troubling press releases. In fact, on December 2, LGIH once again reported another month of strong home closings.

{snip}

LGIH has produced a slight overhang to its stock as the company is a net seller. {snip}

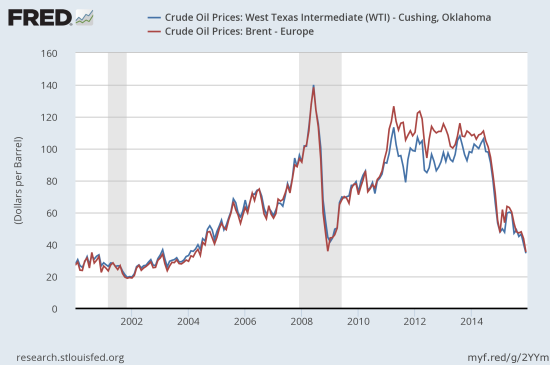

One likely correlation to LGIH’s drop is the acceleration in the plunge in oil prices. I first pointed out LGIH’s vulnerability to the fresh decline in oil back on December 8th.

Source: US. Energy Information Administration, Crude Oil Prices: West Texas Intermediate (WTI) – Cushing, Oklahoma [DCOILWTICO], retrieved from FRED, Federal Reserve Bank of St. Louis, December 24, 2015.

US. Energy Information Administration, Crude Oil Prices: Brent – Europe [DCOILBRENTEU], retrieved from FRED, Federal Reserve Bank of St. Louis, December 24, 2015.

Since LGIH has previously proven resilient to oil’s collapse, a more precise assessment might include the impact of OPEC’s last production meeting. {snip}

The link between LGIH and oil is the company’s heavy share of business in Texas and Houston in particular. This connection is another big test for LGIH. Fortunately, this dependence is in decline. {snip}

{snip}

Full disclosure: long ITB call options

(This is an excerpt from an article I originally published on Seeking Alpha on December 29, 2015. Click here to read the entire piece.)