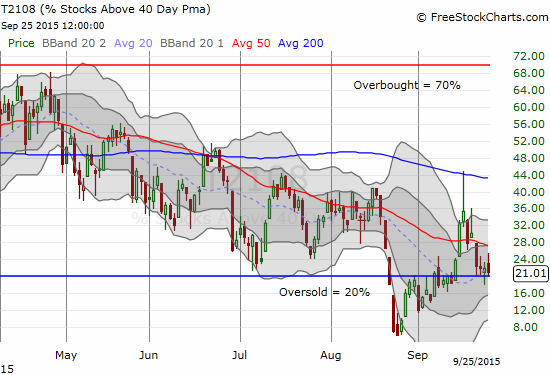

(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. It helps to identify extremes in market sentiment that are likely to reverse. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are occasionally posted on twitter using the #120trade hashtag. T2107 measures the percentage of stocks trading above their respective 200DMAs)

T2108 Status: 21.0%

T2107 Status: 20.8%

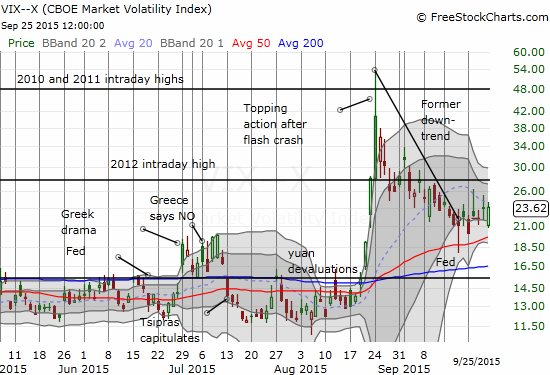

VIX Status: 23.6

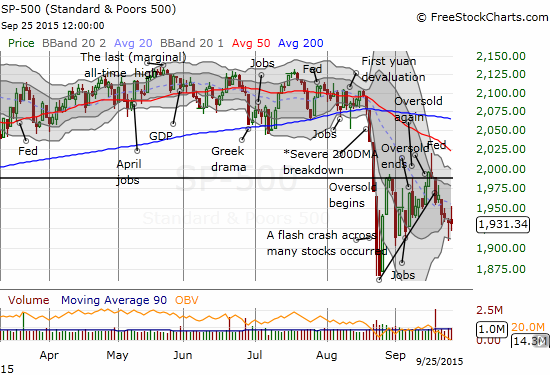

General (Short-term) Trading Call: Bullish (upside target of 1996 on the S&P 500 before overbought conditions finally occur again. See “From the Edge of A Breakout to the Ledge of A Breakdown” for more details).

Active T2108 periods: Day #9 over 20%, Day #6 under 30% (underperiod), Day #28 under 40%, Day #88 under 50%, Day #105 under 60%, Day #310 under 70%

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

EEM (iShares MSCI Emerging Markets)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar).

Commentary

Last week was a week of close calls.

On Tuesday, September 22, 2015, T2108 plunged toward oversold conditions (below 20%). T2108 traded as low as 20.4% before a small bounce. The next day, T2108 traded as low as 20.2% before bouncing. On Thursday, the breakdown finally happened with T2108 trading as low as 17.8%. I went into action by first purchasing additional (incremental) shares of ProShares Short VIX Short-Term Futures (SVXY). To my surprise (and partial relief), T2108 rebounded to close at 22.0%; I did not have a chance to think about any additional purchases. Apparently, the market rallied in giddy anticipation of Janet Yellen’s upcoming speech that afternoon (for more details on that see “The Simple Calculus for the Timing of The Fed’s First Rate Hike“). I immediately took my profits on the incremental SVXY shares going into the close. Finally, on Friday, T2108 closed the week at 21.0% as the S&P 500 (SPY) fell sharply into the close to end the day flat.

The volatility index, the VIX, reflects some of the drama. This measure of market fear has remained elevated since the Federal Reserve’s September meeting.

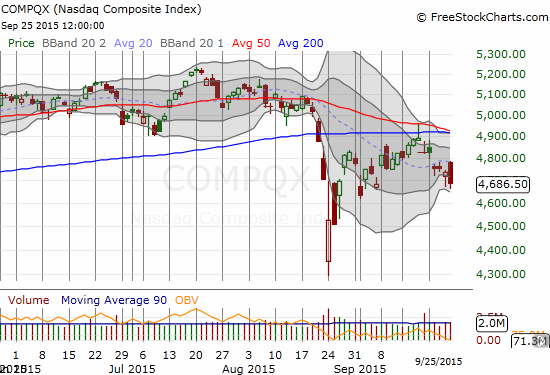

The NASDAQ (QQQ) sustained a 1.0% loss on the day. This tech-laden index is suddenly looking a lot worse than the S&P 500. Only one other day has closed lower since the flash crash. The momentum is ominously pointing downward for the NASDAQ.

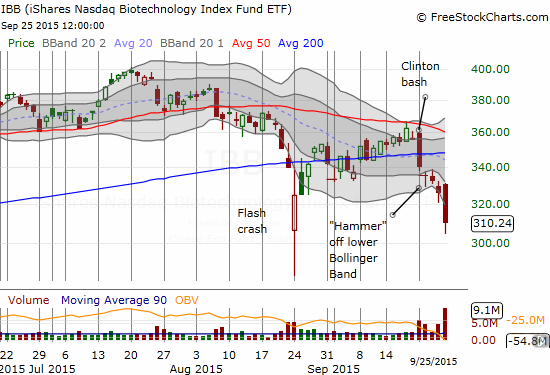

Biotech shares are freshly weighing on the NASDAQ and contributing to the downward momentum. Last week I wrote “Hillary Clinton Takes Down the iShares Nasdaq Biotechnology: Buy the News?” to express my skepticism over the sustainability of the Clinton-generated loss on the iShares Nasdaq Biotechnology ETF (IBB). The next day, I followed up by buying call options into the follow-through selling. I was fortunate to record a 30% gain by the close as IBB bounced. It was a very fleeting victory! On Friday, IBB lost 4.9% for a true bout of follow-through selling. Selling volume was extremely high at 4.5x times the 3-month daily average. The 9.1M shares traded are a RECORD (using data downloaded from Yahoo!Finance).

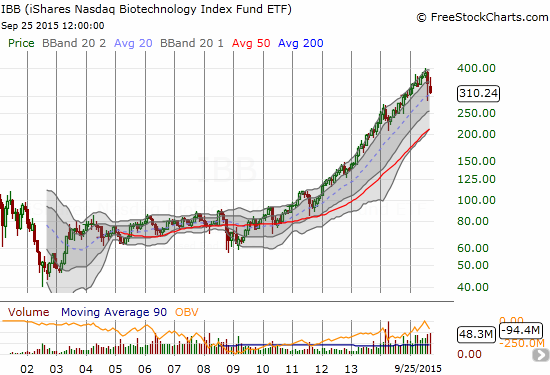

This selling represents a serious flashpoint for IBB. The record trading volume resembles true panic. The plunge takes IBB to a near flat year-to-date performance. Traders and investors who have grown accustomed to IBB cruising ever higher have one of their biggest challenges and face one of their biggest decisions in a long time. For some perspective, this monthly chart shows how even the financial crisis looks like a blip for IBB. Indeed, the post-crisis era has delivered a fantastic lift-off for IBB.

On principle, I refreshed my IBB position with a new tranche of call options: I prefer to be contrarian in the face of outright panic like this. Once again, I was fortunate enough to end the day with a gain in the options (around 20% this time). Once again, I held on. I am focused on the big prize: an eventual reversal of the “Clinton bash.” If time runs out on my call options, I will go to considering shares, especially if IBB remains weak going into mid to late October ahead of what is typically a seasonally strong period for stocks (November to April).

Of course, I will not be dogmatic about playing an eventual reversal of selling on IBB. I am using call options to tightly constrain my risk and to provide large upside potential. If IBB manages to crater below the flash crash intraday low of $284, I will go back to the drawing board and reassess the situation. However, if T2108 drops into oversold territory, IBB will be at the top of my list of buys for whenever volatility surges during that oversold period. (Note I am still not predicting or anticipating the start of yet another oversold period).

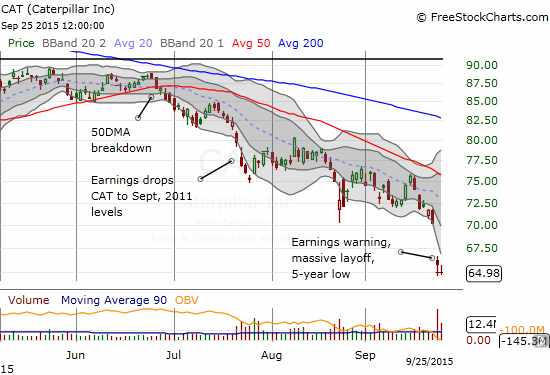

While most eyes are on the drama of IBB, I am keenly focused on Caterpillar (CAT). As regular readers know, CAT is my favorite hedge against bullishness. This time around, my timing was just a day off. I locked in the profits of my last tranche of CAT put options the day before the company’s huge earnings warning.

My reasoning at the time was that CAT was pushing on its lower-Bollinger Band (BB). The stock was reaching technical ovresold conditions just as T2108 looked ready to break down into oversold territory. One of the rules for oversold trading is to reduce exposure to bearish positions. The CAT put options looked like a prime candidate. I never even thought about a “worse case” scenario for CAT shares as trading volume was very normal even with the shares closing near the intraday low of the flash crash. I even had plenty of time for holding onto the put options given an October expiration.

Now, it is hard to use CAT as a hedge again until it experiences some kind of relief rally. I hope to write some more detail on CAT’s earnings warning as it has important implications for the on-going collapse in commodities and my related “Commodity Crash Playbook.”

I WOULD have said that CAT’s continued demise spelled more trouble ahead for the market as it re-emphasizes the trouble that is China. I would have relented on my line in the sand at oversold territory for T2108. BUT, Nike (NKE) arrived just in time to prevent me from over-extrapolating downward.

Perhaps Apple (AAPL) will provide the final signal. On Friday, it looked ready to make a very bullish breakout above 50DMA resistance. The stock promptly faded as tech shares weighed on the action. Stay tuned…

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Weekly T2108

*All charts created using freestockcharts.com unless otherwise stated

The charts above are the my LATEST updates independent of the date of this given T2108 post. For my latest T2108 post click here.

Related links:

The T2108 Resource Page

Expanded daily chart of T2108 versus the S&P 500

Expanded weekly chart of T2108

Be careful out there!

Full disclosure: long SVXY shares, long SSO shares, long UVXY put options, long AAPL put spread, long IBB call options

It seems likely that the “Clinton Bash” will dissipate over time in the same manner that the “Henry Bash” (Henry being Henry Waxman)did some time back. You might recall that scenario.

Henry also bashed tobacco stocks a number of years ago, and as the charts indicate, these came back quite nicely too. Henry has a penchant for trying to torpedo capitalism, but the ironic silver lining is that this idiot seems to have created lucrative opportunities for stock and option capitalists in the past. Maybe Clinton has as well.

I do recall and that’s a relevant connection. It also means that I will do better to accumulate shares soon rather than bet on a comeback in a few weeks with call options!