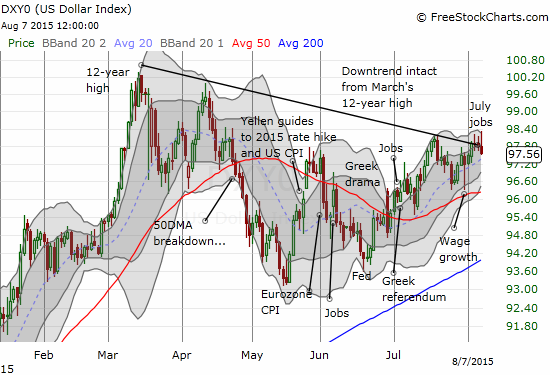

The U.S. dollar index (USDX) remains stuck in its downtrend by a thread.

Source: FreeStockCharts.com

The long-awaited catalyst was the U.S. jobs report for July, 2015. In my opinion, the report shed no new light on the timing for a Fed rate hike. It was pretty much more of the same. The stalemate on the U.S. dollar seems to underline my assessment. My trading strategy for the U.S. dollar thus remains the same as I continue to make many short-term bets that do not over-extend their stays.

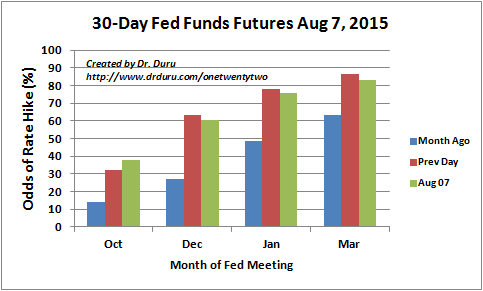

The odds for the timing of the first Fed rate hike decreased across all months in reaction to the jobs report. Note that the CME Group has decided to drop calculating odds for the nearest meeting month. The odds were zero for a long time, and I suspect they are still the same. We at least know the odds are no higher than October’s odds. I continue to scratch my head over the numerous analysts and pundits who still cling to a September rate hike narrative. For example, Bank of America Merrill Lynch economist Michael Hanson believes not only is the Fed “more likely than not” to raise in September but also the July jobs numbers nudged the odds even more in favor of a September hike. The video clip below from Friday’s Nightly Business Report starts with Hanson’s commentary at the 3:49 point (the show also begins with a good summary of the jobs numbers):

The Fed is not in the business of delivering negative surprises for the market, so I remain extremely skeptical that these analysts and pundits have some insight that is better than the collective insight of the market where real money is on the line.

Source for data: CME Group Fedwatch

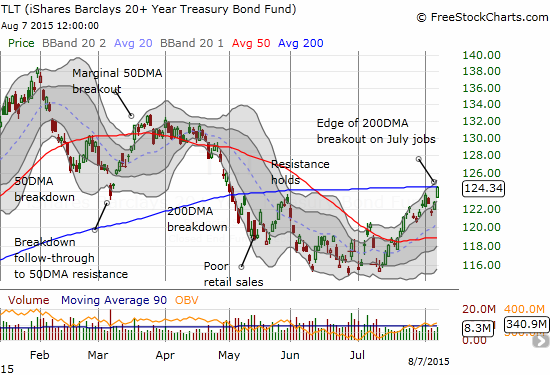

The most interesting move on the day was the latest surge in iShares 20+ Year Treasury Bond (TLT).

Source: FreeStockCharts.com

At the end of July, I noted the possibility of a breakout. Now that possibility seems all but assured.

Looks like bond bears may once again get frustrated. Bull run still not over as $TLT consolidation looks ready to pop to upside.

— Dr. Duru (@DrDuru) July 31, 2015

Even as the Fed gets ready to hike rates, the multi-year sell-off in commodities has accelerated for almost a year and has developed into a complete collapse. Broad-based inflation is simply not a threat right now. This reality is at least preventing a massive sell-off in long-term bonds, and it could very well motivate buying. Regular readers may recall that I placed a bullish bet on TLT some time ago. From May 15, 2015:

“The 200DMA breakdown for the iShares 20+ Year Treasury Bond (TLT) continues, but TLT is not giving up easily. I am still expecting a rebound to at least the 50DMA – I guess I have just been burned too many times thinking that the rally in bonds has finally ended.”

At the time, I bought a bullish call spread (125/130 strikes) expiring in September. I have watched this thing bounce up and down in value since then. I even watched a small profit evaporate. With TLT on the verge of a breakout, I am back to even. The selection of the September expiration may yet prove fortuitous as many factors are set to collide: increasingly bearish signs in the stock market, on-going weakness in commodities, and SOMETHING that happens to finally force an end to the September rate hike narrative.

Be careful out there!

Full disclosure: long and short various currencies against the U.S. dollar, long TLT call spread