(This is an excerpt from an article I originally published on Seeking Alpha on March 12, 2015. Click here to read the entire piece.)

When I last wrote about the colorful CEO of Cliffs Natural Resources (CLF), Lourenco Goncalves, he was lambasting the Australians for manipulating their currency as a last desperate measure to save the economy. Now, he has essentially recommended that the major producers of iron ore collude to constrict supply and help support prices. According to Goncalves, this cooperation will save Australia from bankruptcy and ruin. {snip}

{snip}

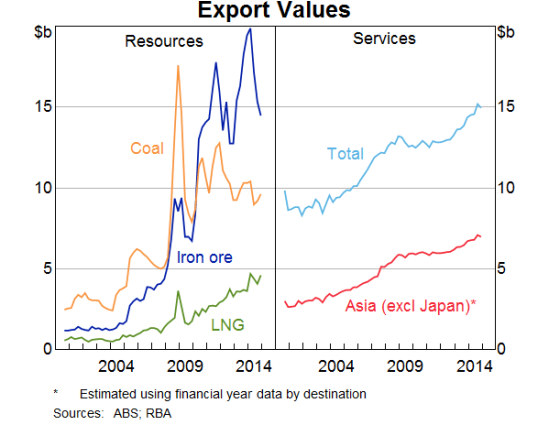

While these characterizations make for good headlines, Goncalves is not telling the whole story of the Australian economy. The economy is in transition from one that is excessively reliant on commodity exports. The decline in the Australian dollar (FXA) has not been about manipulation but a lot more about a market and economic adjustment to the fall in commodity prices and Australia’s terms of trade. It is NOT the Australian dollar that is driving commodity prices lower. Indeed, the Australian dollar has remained stubbornly higher than it should be as a result of global monetary policies and weaker currencies that still make the Australian dollar relatively attractive.

{snip}

Source: Reserve Bank of Australia

In other words, Australia will not likely go bankrupt as iron prices continue lower.

Of course, Goncalves’s concern is not for Australia per se but for the profitability of his own company. {snip}

I highly doubt the WTO can or will take action on companies behaving within the confines of expected competitive practices. {snip}

The brutal competition in iron ore is a result of over-investment when times were good and a very successful drive for efficiency and productivity. All the downstream customers of iron ore are benefiting from lower prices. {snip}

One commentator who buys into the argument that these lower prices benefit next to no one is Clyde Russell from Reuters. {snip} In other words, Russell completes the logic of Goncalves: the RBA is at the center of this price debacle. Surprisingly, Russell skips right by all the buyers in the supply chain. He generally cites low margins and weak demand to explain why buyers are not benefiting. Yet, it is low input costs that are surely keeping more of them in business than would otherwise be the case under current economic conditions.

{snip}

Russell even skips over the most dependent buyers of steel: “The main beneficiaries of the iron ore glut have to be makers of steel-intensive products, such as cars and white goods, but competition in their industries may not allow them to build margins on the back of lower input costs.” Since higher input costs will not help build margins or increase demand, a better perspective here is to think of the businesses that could not survive with higher iron ore prices (and thus higher steel prices) because they are less able to cut costs elsewhere. Or imagine how many more workers might lose their jobs as companies try to use wage savings to afford higher input costs.

{snip}

Source: barchart.com

Be careful out there!

Full disclosure: long RIO put options

(This is an excerpt from an article I originally published on Seeking Alpha on March 12, 2015. Click here to read the entire piece.)