(This is an excerpt from an article I originally published on Seeking Alpha on December 11, 2014. Click here to read the entire piece.)

According to the Swiss National Bank (SNB), inflation is returning to negative territory in 2015. In its December 11, 2014 assessment of monetary policy, the SNB once again adjusted its inflation forecast downward.

Source: Swiss National Bank

The succession of downward forecasts for inflation make rising inflation in outer years look more and more optimistic. Despite the best efforts of the SNB to guard its 1.20 floor against the euro (FXE), inflation has proven next to impossible to resurrect in Switzerland. The currency market’s trigger response to the statement was to actually strengthen the Swiss franc (FXF) despite the SNB’s standard warning that “…the Swiss franc is still high.” At the time of writing, the Swiss franc got as low as 1.20169 (and dropping) in the EUR/CHF currency pair in the immediate wake of the policy statement.

Source: FreeStockCharts.com

The SNB’s challenge is that the European Central Bank will likely continue easing monetary policy which should in turn continue pressuring the euro lower. {snip}

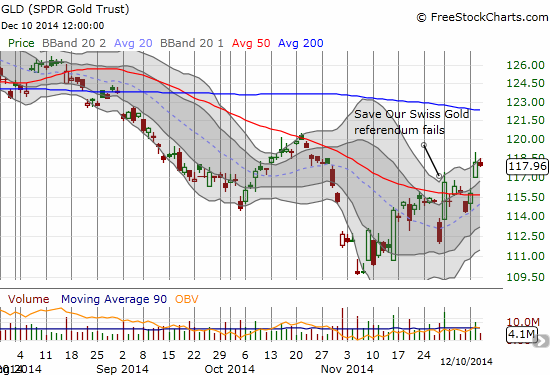

There was also no mention of the SNB’s “victory” over the “Save Our Swiss Gold” referendum which would have surely made it next to impossible for the SNB to prevent a deepening of deflationary pressures in the economy. {snip}

GLD gapped down on the Friday before the vote and surged higher the Monday after the vote. The overall change was marginally higher, but I certainly did not anticipate that gold would lose as much as it did right before the vote.

Source: FreeStockCharts.com

In choppy fashion, GLD has continued higher. This move likely has little to nothing to do with the Swiss vote which would have bolstered the price of gold. {snip}

Going forward, I remain bearish on the Swiss franc. This bearishness is effectively an extension of bearishness on the euro. As the euro goes lower one outstanding question is what measures will the SNB take “immediately” in the face of “an undesirable tightening of monetary conditions.”

Be careful out there!

Full disclosure: long GLD, short the Swiss franc

(This is an excerpt from an article I originally published on Seeking Alpha on December 11, 2014. Click here to read the entire piece.)