(This is an excerpt from an article I originally published on Seeking Alpha on January 9, 2015. Click here to read the entire piece.)

It is still very early in the new year, but I cannot help notice the relative strength exhibited by iShares Trust – iShares U.S. Home Construction ETF (ITB) and several major home builder stocks. {snip}

{snip}

The strength seemed to come courtesy of a proposal from President Obama to reduce a loan insurance fee from the Federal Housing Authority (FHA). However, given the varied response across the stocks of individual home builders, I think the news provided more of an excuse than a true driver. Before I make this case, here are the elements of the proposal that are supposed to provide a boost to the housing market according to quotes from Bloomberg:

{snip}

…If the difference between buying a home or not is $2700 over three years, it is likely the FHA is targeting very marginal buyers, not the type of buyers home builders in general have targeted (so far) in this housing recovery.

{snip}

The response to the proposal was even more telling after observing the behavior of individual home builders. {snip}

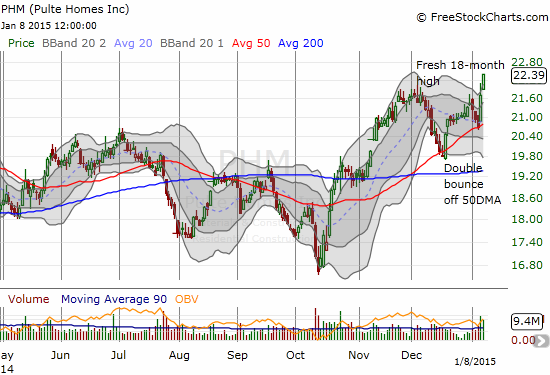

One of the biggest beneficiaries of the bounce on January 7th was Pulte Homes (PHM). {snip}

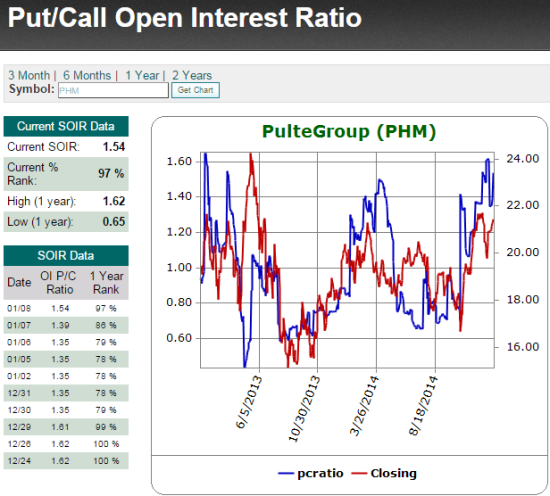

CNBC’s show on options trading pointed out the activity with the tantalizing headline “Behind the $50 million bet against home builders.” {snip}

In the case of PHM, the sellers of the call options are taking on a tremendous risk for what I see as little reward. {snip}

That pain of being a seller of those calls is now extremely high. {snip}

A closer examination of PHM also made me wonder whether this options bet was really against the stock. {snip}

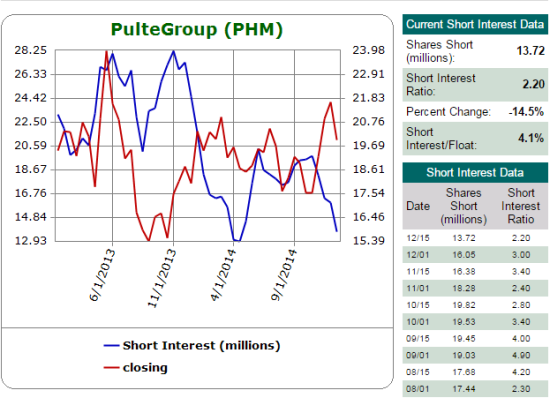

Source: Schaeffer’s Investment Research

{snip}

Source: Schaeffer’s Investment Research

{snip}

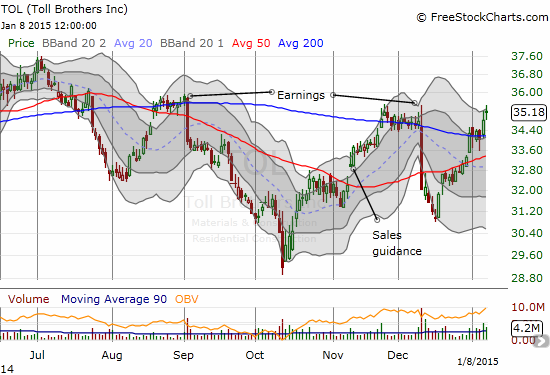

Source for charts: FreeStockCharts.com

Overall PHM, like other major home builders, is riding high on a combination of favorable technical factors and relatively attractive valuations. {snip} The first test point is coming soon with the 2015 Spring selling season. Perhaps that $50M bet was actually a big bullish bet that traders would bid up home builders ahead of the results from Spring sales.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on January 9, 2015. Click here to read the entire piece.)

Full disclosure: long TOL, LEN, DHI, LGIH, ITB