(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. It helps to identify extremes in market sentiment that are likely to reverse. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are sometimes posted on twitter using the #120trade hashtag. T2107 measures the percentage of stocks trading above their respective 200DMAs)

T2108 Status: 64.3%

T2107 Status: 52.3%

VIX Status: 13.9

General (Short-term) Trading Call: Hold (bullish positions); aggressive bears should have stopped out (and I am still recommending that shorts stop trying to call a top here)

Active T2108 periods: Day #22 over 20%, Day #20 over 30%, Day #17 over 40%, Day #15 over 50%, Day #10 over 60% (overperiod), Day #92 under 70% (underperiod)

Reference Charts (click for view of last 6 months from Stockcharts.com):

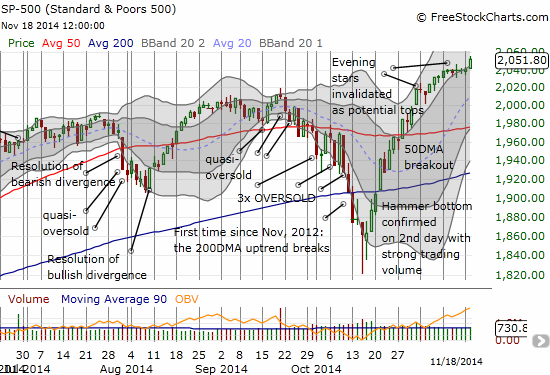

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

EEM (iShares MSCI Emerging Markets)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar).

Commentary

As posted on RealMoneyPro this morning – I have bought inverse ETFs "like a durnken sailor" in the early ramp. $SPY

— Douglas Kass (@DougKass) November 14, 2014

Two words I havent used in a while…"All In" short. Stay tuned.

— Douglas Kass (@DougKass) November 17, 2014

Bears are still itching for a top in the stock market, and the market continues to stubbornly refuse to comply. I post fund manager Doug Kass’s quotes in my blog not to pick on him specifically, but because I find them very useful accounts of bearish sentiment, especially the permabear kind. The aggressiveness of shorting into this strong uptrend surprises me, but it is indicative of the impatience that is likely growing among bears for a return to the palpable fear of October’s oversold period.

At this point, bears who continue to try to call a top are not using any definable method except that they do not like the market, think valuations are too high (probably for years at this point), are latched to memories of so many negative catalysts and headwinds that the market has long since left behind, and/or are over-estimating the small odds of a sudden market collapse and crash. Mind you – at SOME point, the bears will really nail it (and I hope to be there among them!). It will happen because the bears are consistently repeating the same song all the way up, and simple history tells us that sell-offs are inevitable. The problem of course is that it does us little good to miss, or even worse to FIGHT, a 20% rally to catch a 10% sell-off or anything similar. It is even sub-optimal to fade every little uptick and then cover on the next downtick while failing to notice the steady upward march of the indices (staring at trees and missing the forest). In an uptrend like this it is much better for bears to wait for SOME kind of confirmation; in other words, let the market come to you.

In the meantime, I am sticking by my favorite indicator T2108 to help identify the market’s extremes of sentiment – for both bullish and bearish seasons. I also continue to carry shorts where it seems the technicals support them, like last week’s short on Energy Select Sector SPDR ETF (XLE). That trade was a classic case of allowing a bearish trade to come to me rather than chase it. Overall, T2108 continues to allow me to stay firmly biased on the bullish side of the ledger.

Anyway, a top proved elusive yet again as the S&P 500 (SPY) made an impressive print to a new all-time high.

T2108 closed marginally higher at 64.3% and so just barely avoided another bearish divergence. Now, with T2108 likely back in sync with the S&P 500, a path opens for more upside as I anticipate the next rendezvous to overbought conditions. I have been VERY surprised at how long T2108 has been able to hover above 60% and not trip the overbought threshold of 70%. The 60% overperiod has now lasted 10 days. I hesitate to make another prediction at this point!

In the meantime, I finally sold my latest tranche of ProShares Ultra S&P500 (SSO) call options. They expire on Friday, and it made sense to lock in the profits from the breakout given the profits would likely not survive a pullback from here or even a lack of follow-through. My strategy remains the same – buy (any) dips aggressively with SSO call options and continue holding my SSO shares accumulated during October’s oversold periods at least into the Spring. The assumption is that the stock market will enjoy a seasonally strong period going into the Spring. I will revisit everything once/if the S&P 500 hits overbought conditions or defintively pulls away from the current “close call.”

In the last T2108 Update, I pointed to a fade in Apple (AAPL) as one potential sliver of hope for the bears. As you might guess with the S&P 500’s breakout, AAPL failed to confirm the fade. It too closed with a fresh all-time closing high. The day’s gains delivered another profitable day for the Apple Trading Model (ATM). The ATM is conflicted for Wednesday’s trading with essentially 50/50 odds of a gain. Odds are much higher for a gain from the open at around 80%. Note well that I trade more frequently off the odds of a gain from the previous day’s close. I like the odds from the day’s open when they agree with the core of the model. Also note that given Apple’s strong uptrend, the ATM SHOULD be doing pretty well as the general patterns are for upside on Mondays and Tuesdays, marginal odds for Wednesdays and Thursdays, and downside for Fridays. The main trick these past several weeks has just been getting good (meaning discounted) entry points.

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Weekly T2108

*All charts created using freestockcharts.com unless otherwise stated

The T2108 Resource Page

Expanded daily chart of T2108 versus the S&P 500

Expanded weekly chart of T2108

Be careful out there!

Full disclosure: long SSO shares