(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. It helps to identify extremes in market sentiment that are likely to reverse. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are posted on twitter using the #120trade hashtag)

T2108 Status: 54.80%

VIX Status: 11.5

General (Short-term) Trading Call: Bullish bias now. Aggressive traders with shorts on the S&P 500 should be stopped out. Bulls continue holding. Bear/bull line remains at 1962.

Active T2108 periods: Day #263 over 20%, Day #115 over 40%, Day #4 over 50% (overperiod), Day #10 under 60% (underperiod), Day #13 under 70%

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

EEM (iShares MSCI Emerging Markets)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar).

Commentary

The S&P 500 (SPY) closed at a fresh (marginal) all-time high. T2108 trickled higher to 54.8%. The VIX, the volatility index, moved lower and is ever lower to completely reversing last Thursday’s monster surge in volatility. If it were not for the all-time high, this day would be unremarkable from a technical trading perspective.

For today’s T2108 Update, I am skipping straight to three stock reviews: Apple (AAPL), Intuitive Surgical (ISRG), and Whirlpool (WHR). All three stocks experienced notable post-earnings reactions that provide good trading lessons.

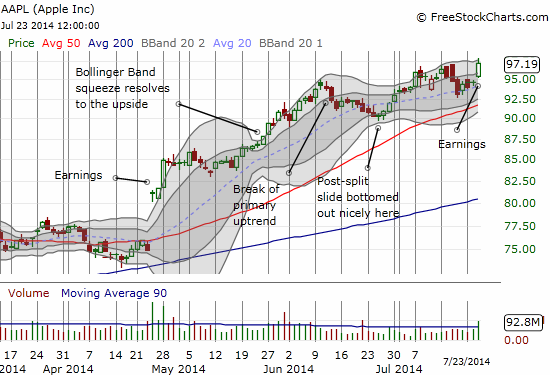

Apple (AAPL)

I covered the pre-earnings trade for AAPL in “The Apple Pre-Earnings Trade: July, 2014 Edition” and a quick follow-up in the last T2108 Update. I went to sleep thinking that I would have a chance to load up on call options at a steep discount based on AAPL trading down 0.5% or so in after hours. I was quite surprised to find the situation reversed in the morning with AAPL even gapping up slightly. With the stock closing the day at $97.19, up 2.6%, anyone who followed the original trading plan of a $95/96 call spread did very well with a rough doubling in value – as targeted. If only AAPL had traded DOWN ahead of earnings, I too would have been right there with you!

I did stay committed to the plan to get long post-earnings even with AAPL opening to the upside. I bought call options right after the open. Options across the board were all down significantly as the implied volatility premium evaporated quickly (and market makers celebrated). Whether up or down, AAPL’s small price move validated my assessment to play the pre-earnings trade conservatively with spreads. Even as the stock started higher, my call options first LOST value as the pre-earnings premium continued to seep away. I was of course dismayed, but at some point the tide turned and the options gained with the stock. (A limit order to double down on my position was never filled). I promptly sold when the value of the call options nearly doubled: quick doubles in options trading almost always get sold just on principle. I also consider myself fortunate to generate the same return as if I had followed the original plan.

Anticipating a typical Friday letdown I bought a small number of put options, but I think I was too early.

I listened to the earnings conference call and only heard one small thing that worried me slightly. It seems that the momentum in iPads has notably slowed and the prospects are lukewarm. Here is a quote from Seeking Alpha transcripts:

“iPad sales met our expectations but we realized they didn’t meet many of yours. Our sales were gated in-part by a reduction in channel inventory and in-part by market softness in certain parts of the world. For example IDC’s latest estimate indicates a 5% overall decline in the U.S. tablet market, as well as a decline in the Western European tablet market in the June quarter.

But what’s most important to us is that customers are enjoying their iPads and using them heavily. In a survey conducted in May by ChangeWave, iPad Air registered a 98% customer satisfaction rate, while iPad Mini with retina display received an astonishing 100% customer satisfaction rate. The survey also found that among people planning to purchase a tablet within 90 days, 63% plan to buy an iPad and our own data indicates that more than half of customers purchasing an iPad are buying their very first iPad.

Another recent study by Custora found that iPad accounts for 80% of all U.S. tablet based e-commerce purchases. We’re very bullish about the future of the tablet market and we’re confident that we can continue to bring significant innovation to this category through hardware, software and services. We think our partnership with IBM, providing a new generation of mobile enterprise applications, designed with iPad’s legendary ease of use and backed by IBM’s cloud services and data analytics will be one such catalyst for future iPad growth.”

First, I was surprised to hear Cook acknowledge that results did not meet analyst expectations. If they met company expectations, he should not really care about analyst expectations. The commentary on iPads gets a little stranger when Cook says that the most important thing is that customers enjoy their iPas and use them a lot. This sounds like a subtle nod to a soft upgrade cycle for iPads. Softness in consumer upgrades sure puts the IBM deal in a fresher light. It is certainly no accident that Cook ended his commentary connecting the iPad’s promise to the enterprise vistas opened wider with the IBM partnership.

Cook let slip another interesting point that I believe is new. It has become standard in earnings conference calls for Cook and team to brag about AAPL’s broad reach across companies in the Fortune and Global 500. However, THIS time Cook noted that the penetration rate into these companies is very low:

“We also are in the — virtually all Fortune 500 companies, we are in 99% of them to be exact and 93% of the Global 500. However, when we dig into the business market deeper, though our market share in the U.S., in the commercial sector is good at 76% — this is according to IDC; the penetration in business is low. It’s only 20%. And to put that in some kind of context, if you looked at penetration of notebooks in business, it would be over 60%.”

It seems to me that the penetration rates are just as important, if not more so, than the reach. Cook of course twists this low penetration into an opportunity given all the notebooks that can be cannibalized. Again, the IBM deal makes even MORE sense knowing the poor penetration rate.

Intuitive Surgical (ISRG)

I tried and tried to get long ISRG ahead of earnings but the spreads on the options were just too wide, and I was too cheap. I liked the stock’s stabilization at the 50DMA ahead of earnings. Given my bullish bias on the stock (as explained in earlier posts), I was inclined to give this trading action a positive interpretation.

ISRG did not report anything stellar, it just was not more bad news. Still, I was blown away by the 50 point, 13% gap up at the open. This action immediately put me on watch for a shorting opportunity to bet that such an extension above the upper-Bollinger Band (BB) would get faded as is usually the case, even post-earnings. However, after seeing ISRG’s continued strength in earlier over-extension episodes (see chart below), I decided to stay put. My bullish bias was the clincher in preventing me from making a regret-filled move: ISRG continued higher for 20 MORE points! The lessons here are never get over-confident about a technical trading pattern and always watch for confirmation/contradiction in the historical record for an individual stock.

Whirlpool (WHR)

WHR finally printed a stinker for its earnings report. The company guided down:

“Whirlpool Corporation has adjusted its full-year 2014 guidance to reflect trade customer inventory transitions in China related to the pending acquisition of a majority stake in Hefei Rongshida Sanyo Electric Co., Ltd. and investment expenses related to the pending acquisition of a majority stake in Indesit Company S.p.A. The company expects full-year net earnings per diluted share of $10.30 to $10.80 and full-year ongoing business earnings per diluted share of $11.50 to $12.00.”

Previous guidance was for FY14 EPS of $12.00 to $12.50. The stock gapped down abut 3%, and I braced for a fresh downward plunge on the fresh breakdown below 50DMA resistance. I practically fell out my chair when I saw how the stock closed. A sharp reversal for a GAIN of 1.4%. The stock was stopped cold just under its 200DMA. A close above that resistance would be a very bullish signal.

Earnings season so far has produced some good results and healthy stock reactions. The sporadic jitters going into earnings have almost all faded away. Traders should assume net-net that the market is back to looking for reasons to buy earnings stories, not sell them.

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Weekly T2108

*All charts created using freestockcharts.com unless otherwise stated

Related links:

The T2108 Resource Page

Expanded daily chart of T2108 versus the S&P 500

Expanded weekly chart of T2108

Be careful out there!

Full disclosure: long AAPL puts