Everywhere I read or watched coverage of Amazon.com’s earnings announcement, the theme was “are investors fed up with Amazon.com’s constant spending and lack of profits???” I have never understood why investors are willing to cut Amazon.com (AMZN) so much slack, but it is a resilience that should be held in awe…and traded.

Over the past few years, I have concentrated on a very simple post-earnings trade on AMZN: buy the open and sell within two weeks. Stop out if AMZN closes below its low on the first post-earnings day. Shorts are OK after that, but they are even riskier than the buying strategy. One of my last articles on the trade was aptly titled “Amazon.com Returns to Typical Post-Earnings Behavior.” The trade was relatively consistent from 2010 to 2012 and started breaking down from there. I documented results through April, 2013 in a Google spreadsheet. I will be updating it again soon after Friday’s tremendous return of the trade.

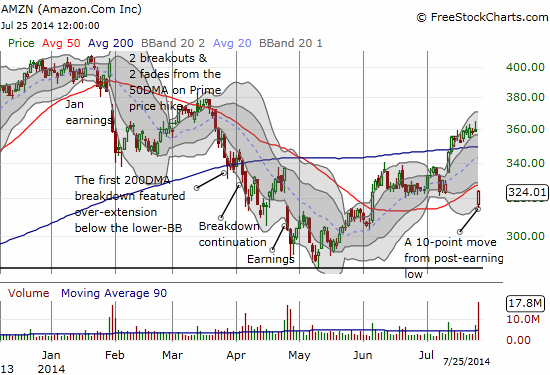

Source: FreeStockCharts.com

AMZN jumped in choppy intraday fashion from its post-earnings open that happened to also be near the low of the day and the lower-Bollinger Band (BB). I bought shares and call options as I have done in previous times: call options to be sold on a quick pop and shares held for the potential of additional gains over the next two weeks. I held the call options for as high as a 73% gain before stopping out to preserve a 38% gain. I am still holding the shares. The big caveat with this trade this time around is AMZN trades below its 50DMA which also happens to align roughly with the lows of a trading range/consolidation phase from June 6 to July 10th. This could/should be stiff resistance.

Nightly Business Report covered AMZN’s earnings and covered all the themes and protestations that have accompanied AMZN’s latest display of losses:

Start at the 5:20 market…

Full disclosure: long AMZN