(This is an excerpt from an article I originally published on Seeking Alpha on February 2, 2014. Click here to read the entire piece.)

The euro (FXE) has been one stubborn currency. The short euro trade taught me and reminded me to be patient, to stay focused on the underlying thesis until it is proven wrong, that currency markets get distracted all the time and very easily, and that currency markets prefer to make life difficult for central bankers by forcing action over words.

In several posts toward the end of last year and starting this one, I pegged the euro as an ideal short to start 2014. This was a carryover of euro-bearishness that has grown over several months, and I still think the euro is very over-valued.

{snip}

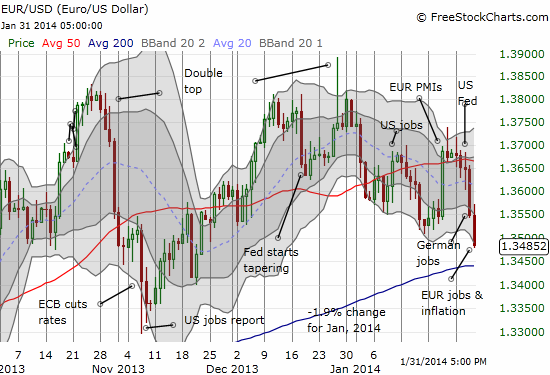

The chart below shows why I consider the euro so stubborn. All the losses for January occurred on the second trading day of the year (January 2) and the last three trading days of January. {snip}

Source: FreeStockCharts.com

Note that even after the euro’s loss in January, the currency still remains above its level when the ECB (European Central Bank) cut interest rates in November. {snip}

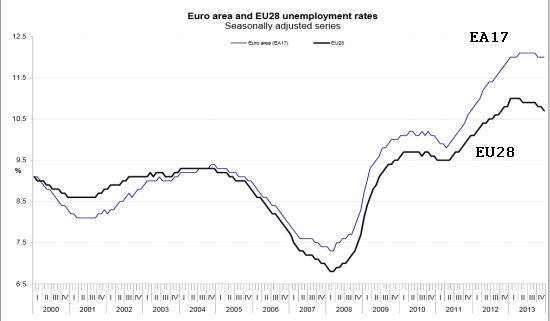

Source: Eurostat

After the euro’s drubbing to end January, I took profits by closing out my relatively large short EUR/USD positions. I still have very small positions net short the euro in other major currencies. Going forward, I will look to fade EUR/USD rallies and take profits much more quickly when/if they appear. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on February 2, 2014. Click here to read the entire piece.)

Full disclosure: net short the euro