(This is an excerpt from an article I originally published on Seeking Alpha on March 2, 2014. Click here to read the entire piece.)

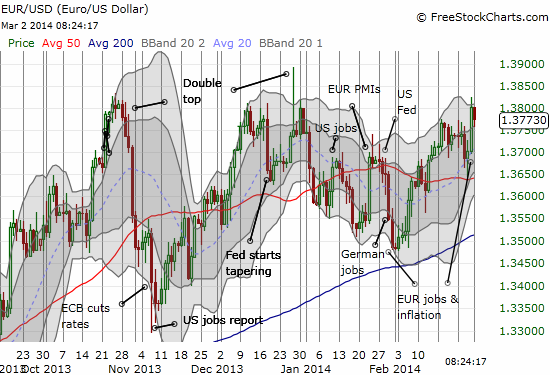

I last wrote about the euro (FXE) in the wake of January unemployment and inflation numbers that triggered a sharp sell-off. I took the opportunity to lock in profits on my short EUR/USD position. A good thing. That point turned out to be a bottom with EUR/USD grinding ever higher ever since.

One month after that point, eurostat reported the exact same inflation reading – “Euro area annual inflation is expected to be 0.8% in February 2014, stable compared with January, according to a flash estimate from Eurostat, the statistical office of the European Union” – and the exact same unemployment data:

{snip}

Yet, the reaction in forex markets was exactly opposite the reaction at the end of January. {snip}

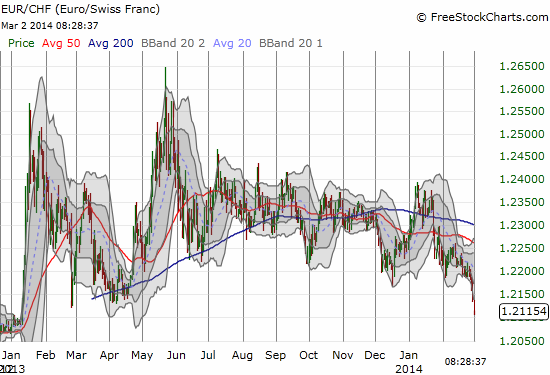

I remain bearish on the euro and have used these higher levels to rescale into a fresh short position. One of the interesting developments alongside the euro’s growing strength is the accelerating strength of the Swiss franc (FXF), a move I am fading as well. {snip}

Source for charts: FreeStockCharts.com

Note how EUR/CHF is within “shouting distance” of the 1.20 floor. I fully expect the Swiss National Bank (SNB) to get a little louder than usual about its resolve to defend that level. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on March 2, 2014. Click here to read the entire piece.)

Full disclosure: net short the euro and franc