(This is an excerpt from an article I originally published on Seeking Alpha on January 6, 2014. Click here to read the entire piece.)

{snip}

The above quote pretty much sums up the attitude of homebuilders (ITB) going into 2014. It sounds like a classic sales pitch from a real estate agent, but the evidence continues to indicate to me that 2014 could easily be a solid continuation year for the housing recovery. The first key is an economy that does not suffer any surprise shocks. A second key is the Spring 2014 selling season. An analyst on the last earnings conference call for Toll Brothers went as far as to say that the Spring selling season could be bigger than the Super Bowl.

The homebuilders are singing from similar hymnals when describing the prospects for the housing recovery in 2014:

- Still early in the recovery cycle.

- Supply constraints from under-building persist. This has created production deficits in single and multi-family buildings.

- Pent-up demand continues to grow with increasing population, on-going lending constraints, and delayed household formation.

- Continued economic recovery will overcome other headwinds such as higher mortgage rates and increased fees on government-guaranteed mortgages (FHFA-backed loans).

- Increasing rent levels sustaining an attractive buy over rent calculus.

- Economic recoveries in local areas are particularly important and specifically targeted for investment.

In this post, I highlight some choice quotes and themes from four major homebuilders who reported in the last six weeks of 2013… {snip}

2014 SPRING SELLING SEASON

All the builders are optimistic about the upcoming spring-selling season…{snip}

PRICES

At the crest of the robust price increases earlier in 2013, homebuilders forthrightly and correctly indicated that such price runs were not sustainable. {snip}

INCENTIVES

TOL dropped incentives year-over-year…{snip}

(PENT-UP) DEMAND

All the homebuilders talked about pent-up demand as part of the housing recovery story. {snip}

ACQUISITIONS

Merger and acquisition (M&A) activities can shed additional light on the strategy of homebuilders. They continue to operate very selectively, targeting areas where labor markets are strongest and land is tightly constrained.

{snip}

MARGINS

The story of the past two years or so has been about margin improvement…{snip}

The overall implication is that 2014 needs to be a year for more top-line improvement and sufficient pricing power to cover rising cost levels.

COSTS

TOL noted that the housing recovery is starting to attract workers back into the market…{snip}

CREDIT CONDITIONS

LEN believes credit conditions will continue to loosen. {snip}

OTHER REGION-SPECIFIC INFO

LEN slowed sales down in Southeast Florida…{snip}

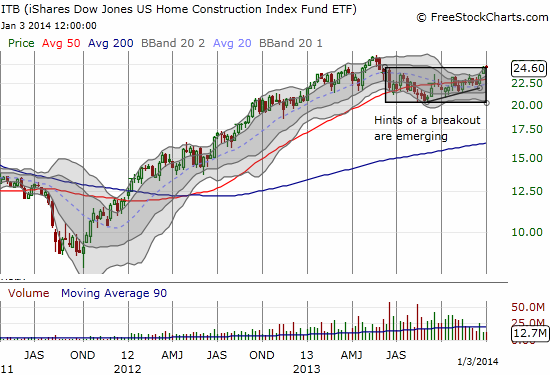

THE STOCKS

Put all this info together, and I see the conditions for a solid year with many key indicators to monitor progress…{snip}

Source of charts: FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on January 6, 2014. Click here to read the entire piece.)

Full disclosure: long KBH call options