(This is an excerpt from an article I originally published on Seeking Alpha on December 12, 2013. Click here to read the entire piece.)

Last Thursday (December 12, 2013), U.S. initial jobless claims came in at 368,000. This number was above “expectations” and above the on-going declining trend in the 4-week moving average. {snip}

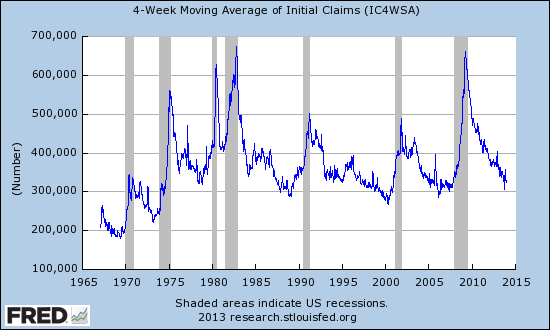

Source: St. Louis Federal Reserve

Initial claims numbers may get additional focus in coming weeks and months because, as the graph above seems to imply, this number may be reaching a cyclical low (note the graph does not include last Thursday’s pop to 368,000). {snip} In other words, the cyclical low in initial claims is part of the signal telling the Fed that monetary accommodation is no longer needed, and, ironically enough, it becomes the beginning of the end of a post-recession recovery. {snip}

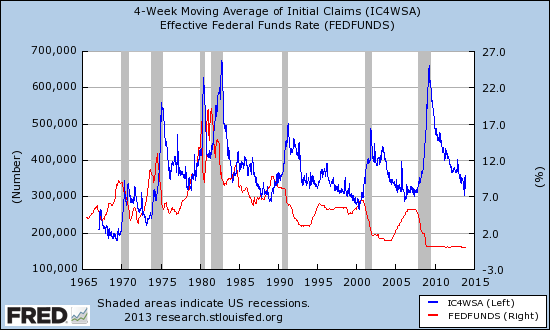

Source: St. Louis Federal Reserve

This chart is a handy reminder of one of several reasons markets get so obsessed with the possibility of rising rates (there are many other such charts we could examine). A tightening monetary policy is not only confirmation of a strong(er) economy, but it is also an indicator that the end of the cycle is somewhere on the horizon. I think it is pointless to try to predict exactly when that end will come, but the difficulty of such a prediction will not prevent the stock market from gyrating over the possibilities.

This quick review is also a handy reminder of why the Federal Reserve is going to such lengths to reassure the market that monetary policy will remain extremely accommodative even after the start of tapering of bond purchases. {snip}

I have not followed Achuthan’s latest predictions but as late as March of this year, he was insisting the U.S. was stuck in a recession that began in July, 2012. Of course, his stubbornness comes from his insistence throughout 2011 that a recession was on its way by mid-2012, and he underlined this insistence with his track record of never being wrong before. {snip}

As we wait for another monetary decision from the Fed, all the gains from the S&P 500 (SPY) following what I thought would be a pivotal jobs report have vanished. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on December 12, 2013. Click here to read the entire piece.)

Full disclosure: long SSO calls and puts, long SPLV and SPHB