(This is an excerpt from an article I originally published on Seeking Alpha on September 16, 2013. Click here to read the entire piece.)

As markets head into a much anticipated Federal Reserve decision that should feature some resolution on the tapering question, I found it interesting to rewind the tape back to the recent G20 summit held in Saint Petersburg, Russia. After the summit, CNBC interviewed IMF Managing Director (MD) Christine Lagarde to get her perspective on the proceedings. Lagarde noted the high level uncertainty about the impact of unconventional monetary policies and the resulting angst felt particularly in emerging countries over the Federal Reserve’s potential tapering. {snip}

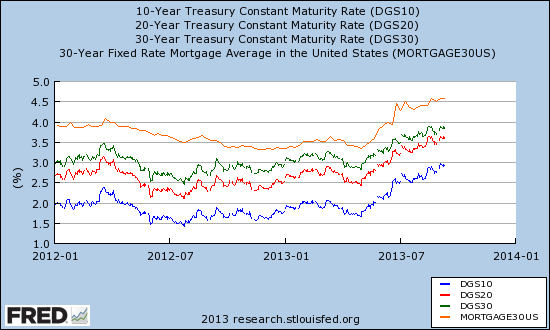

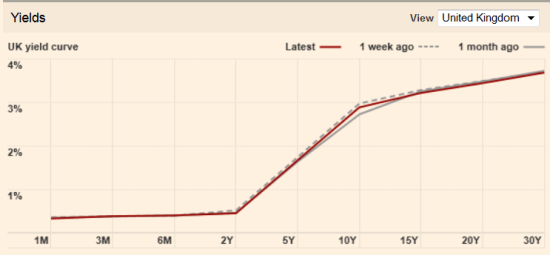

I find the angst in emerging countries interesting given the mixed signals in the markets. Sure interest rates have increased, but U.S. and international stock markets have shaken off those effects for months now.

Source: Financial Times

{snip}

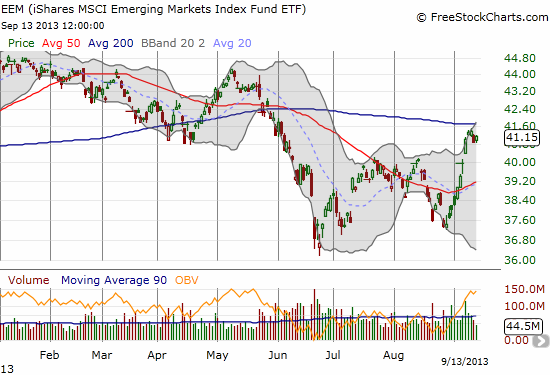

Source: FreeStockCharts.com

Other market indicators are also showing traders and investors are getting more comfortable with EEM. {snip}

Moving on to the African continent, the bond markets in many African countries have been quite active and healthy. It seems investors have no hesitation in chasing higher yields there. {snip}

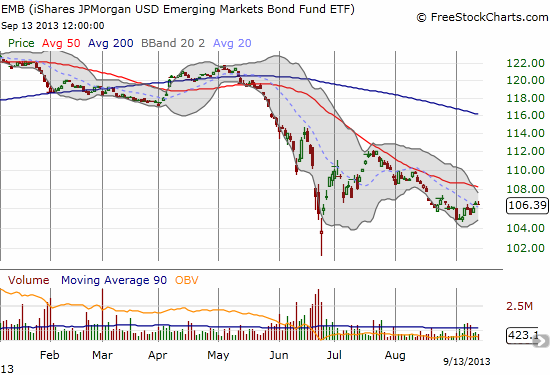

Somewhat tempering this picture, perhaps even paradoxically, are the large outflows of funds from emerging market equity and bond funds. {snip}

Source: FreeStockCharts.com

{snip}

Putting it altogether, the somewhat mixed signals in the trading in emerging markets underlines the potential for on-going, sporadic bursts of high volatility as the market’s assessments shift and swoon with the tides of sentiment. Even after the Federal Reserve provides clarity on tapering (assuming it does), the impact of its decision will be hotly debated and every little signal, like the latest major economic report from China, will get over-extrapolated into a conclusion. Under these conditions, I think it makes sense to avoid one-way thinking and to stay flexible. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on September 16, 2013. Click here to read the entire piece.)

Full disclosure: long EEM puts