(This is an excerpt from an article I originally published on Seeking Alpha on September 9, 2013. Click here to read the entire piece.)

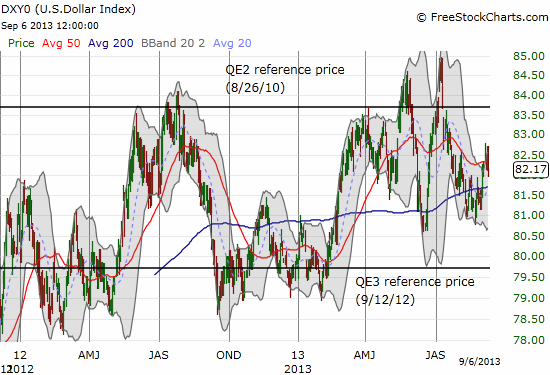

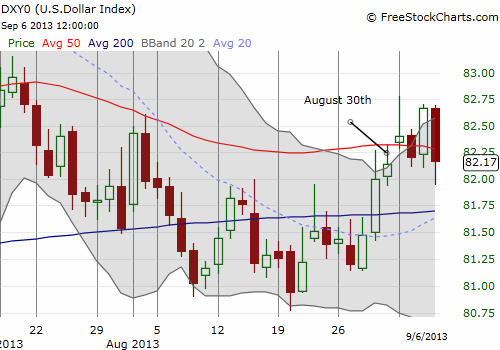

Last week was supposed to be a dramatic week with a whole host of pronouncements from the world’s major central banks, the aftermath of the Jackson Hole confab, and major economic numbers like the U.S. jobs report. Instead, after the dust settled, the U.S. Dollar index (UUP) ended the week right where it closed the previous week.

In particular, Friday’s jobs report was supposed to provide markets with definitive guidance on the Federal Reserve’s likely move regarding tapering. {snip} I tend to ignore these expectations because they are false anchors: it is never clear whether the gap between actual and reality is a function of a truly weak/strong report or just a measure of the difficulty in forecasting these numbers month-to-month. I took interest in the report’s breakdown of job growth. {snip}

{snip}

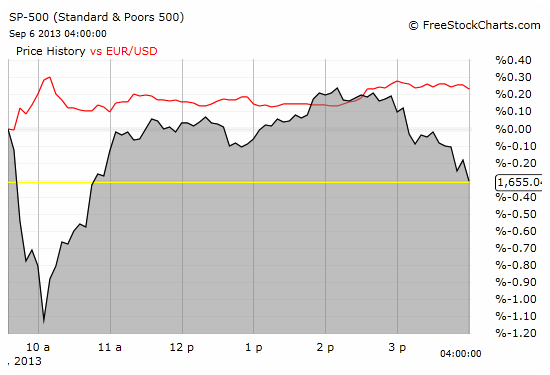

The swirling mix of good and bad news provides no additional clarity on what the Federal Reserve might do. There is plenty in the report to justify any assessment. This mix was reflected in trading. {snip}

{snip}

Source for chart: FreeStockCharts.com

This all adds to a continued lack of trend for the U.S. dollar. It is a strange set of affairs ahead of what should be considered a major change in monetary policy. While day-to-day the U.S. dollar index remains prone to sharp swings, it still seems that overall the market is content to wait for the Fed to act before defining a new trend.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on September 9, 2013. Click here to read the entire piece.)

Full disclosure: net long U.S. dollar, net short euro