(This is an excerpt from an article I originally published on Seeking Alpha on July 11, 2013. Click here to read the entire piece.)

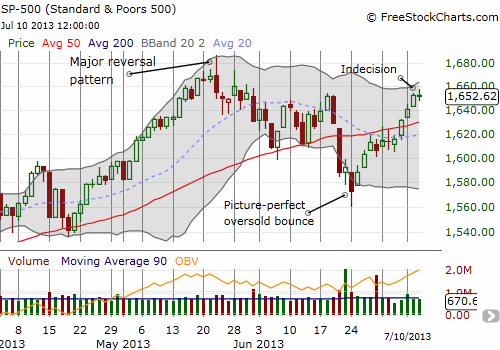

Ordinarily, I would have called Wednesday’s (July 10, 2013) close on the S&P 500 (SPY) a stalemate that potentially signals a reversal in fortunes for the index. The flat close occurred right at resistance from the June highs.

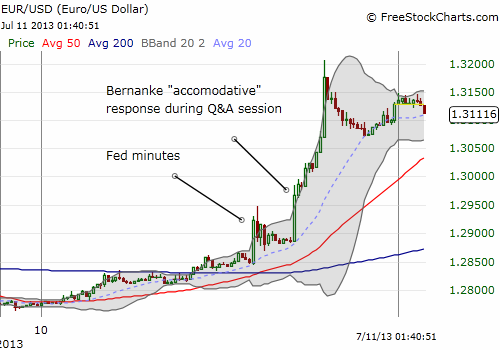

The news cycle rules right now. This earnings season promises to be full of market mood swings if the reaction to the Federal Reserve minutes for June’s monetary policy meeting and Chairman Ben Bernanke’s Q&A session following a speech are any indication. The stalemate in the S&P 500 during U.S. market hours occurred as the market dipped ahead of the release of the minutes of the last Federal Reserve meeting on monetary policy, spiked up in trigger-finger response to the release, and then calmed back down to settle at flatline. Overall, the minutes contained no new information. What Bernanke said during the Q&A of a speech later in the day apparently tipped the balance. {snip}

Bernanke’s response was an implicit reference to the labor market’s poor participation rate and likely also an implicit reference to persistent underemployment in the economy. {snip}

{snip}

{snip}

{snip}

{snip}

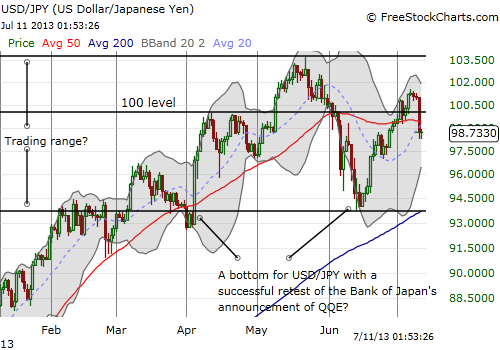

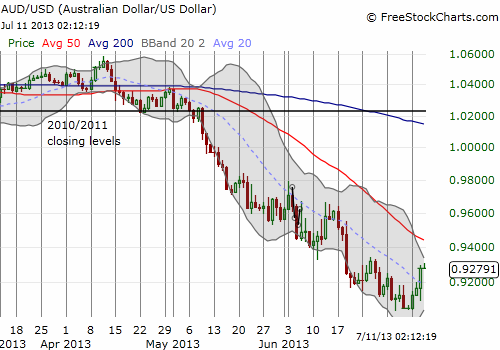

Source for charts: FreeStockCharts.com

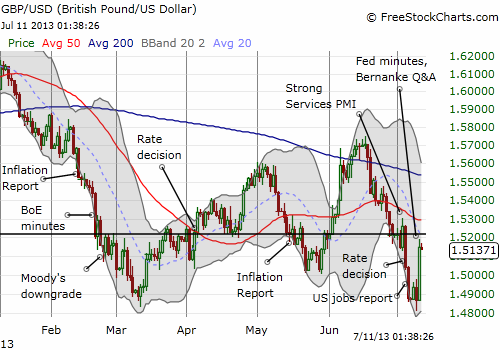

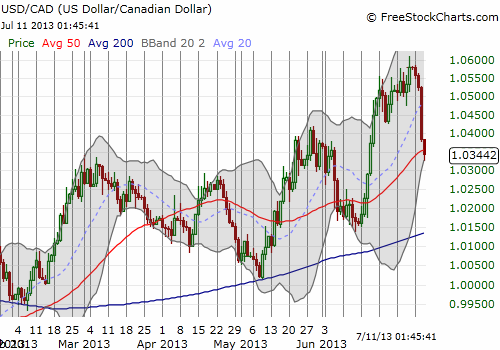

While it seems the accumulated sharp reversals in U.S. dollar currency pairs signals an end to its rally, I do not think this next equates to a sustained sell-off in the U.S. dollar…even against the British pound. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on July 11, 2013. Click here to read the entire piece.)

Full disclosure: long EEM put spread, short Australian dollar, short euro, long British pound, short Canadian dollar