(This is an excerpt from an article I originally published on Seeking Alpha on June 20, 2013. Click here to read the entire piece.)

{snip}

The Federal Reserve announcement sounded a bit like something former governor Mervyn King might say about the prospects for the Bank of England’s bond purchase program:

{snip}

I imagine believers in the recent bond-tapering hype will zero in on the non-zero probability that the Fed could end its bond purchases at anytime. I choose to focus on the following:

{snip}

In other words, the Fed has absolutely no interest in squelching a nascent recovery by responding with an immediate tightening in monetary policy. This has been the case, it is the case, and it will continue to be the case. My interpretation of the Fed’s interest in accommodative policy is what keeps me locked into keeping gold (GLD) and silver (SLV) in the portfolio.

{snip}

The U.S. Dollar

Clear winner. From this point forward, the pace of the dollar’s recent decline should significantly slow if not end altogether. {snip}

{snip}

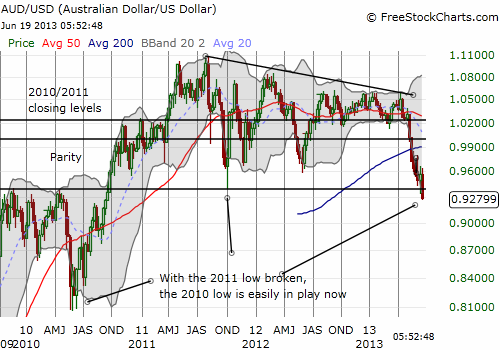

Australian dollar (FXA)

A clear LOSER. {snip}

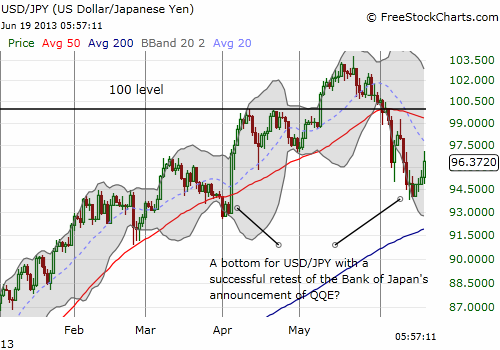

Japanese yen (FXY)

Neutral. While the U.S. dollar gained on the Japanese yen (validating my assumption that the 94 level on USD/JPY represented a fresh buying opportunity), the yen was mainly flat against the euro and the pound. {snip}

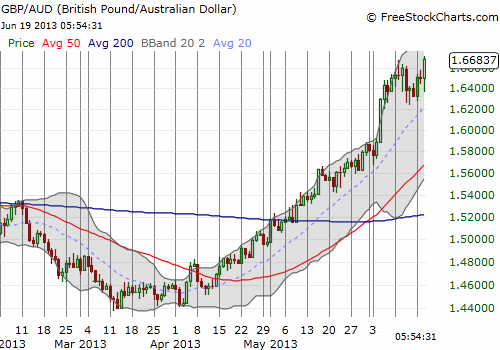

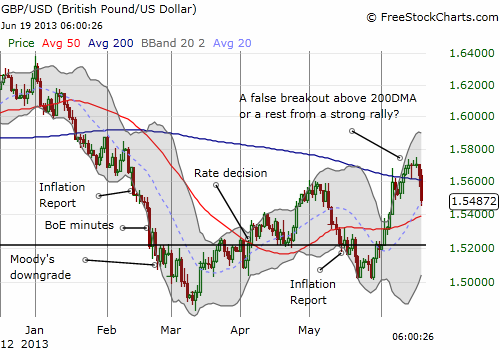

British Pound (FXB)

Mild loser. I am still bullish on the British pound, and I am looking forward to increasing my position on the current weakness in GBP/USD. {snip}

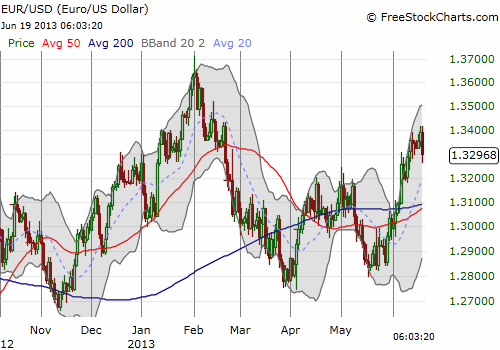

Euro (FXE)

Like the pound, the euro had been gaining ground rapidly on the U.S. dollar going into the Fed meeting. {snip}

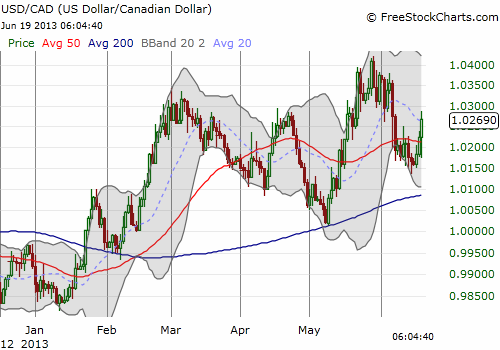

Canadian dollar (FXC)

Mild loser. {snip}

Source for charts: FreeStockCharts.com

{snip{

While the post-Fed action generated some dramatic reactions, I do not expect the follow-up to stay dramatic. Trading ranges will re-establish themselves in due time. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on June 20, 2013. Click here to read the entire piece.)

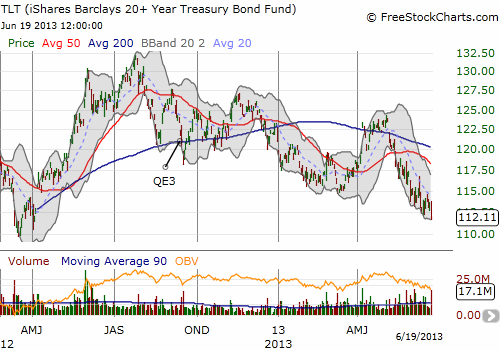

Full disclosure: long GBP/USD, short EUR/JPY, net neutral Australian dollar, long TLT puts, TBT