(This is an excerpt from an article I originally published on Seeking Alpha on July 29, 2013. Click here to read the entire piece.)

{snip}

When King uttered these words in his final Inflation Report as Governor of the Bank of England (BoE), there was no sudden surge in interest rates or sell-offs in financial markets as we saw when one week later Federal Reserve Chairman Ben Bernanke seemed to suggest that the Fed was getting ready to start the process of normalization. Yet, no one in the press conference questioned King’s premise.

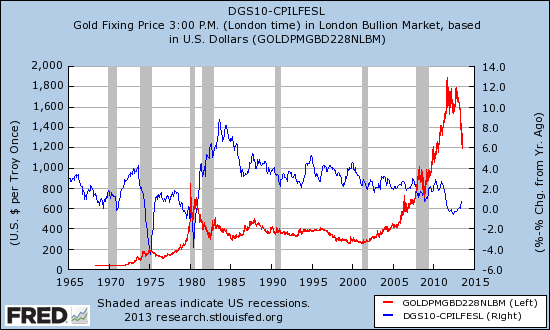

Assuming gold is an asset, its price seemingly violates this simple relationship. {snip}

Source: St. Louis Federal Reserve

While it is possible to explain the rapid rise in gold since 2005/2006 as an anticipation of negative real rates, it only took a small reversal in real rates to generate a rapid collapse in gold’s price. Inconsistent relationships like these form the crux of a larger conceptual dilemma that authors Claude B. Erb and Campbell R. Harvey (Duke University, National Bureau of Economic Research) attempt to tackle in a May, 2013 paper called “The Golden Dilemma.” {snip}

With gold prices steadily falling over the past two years, it has been much more difficult to be a gold bull. {snip}

Erb and Harvey (the “authors”) take on the task of deconstructing six reasons gold bulls commonly offer up for buying gold:

- protection against inflation

- protection against currency debasement (my favorite)

- alternative to assets with low real returns – attractive when rates are low

- safe haven (a reason I have never liked)

- preparation for a return to the gold standard (my least favorite)

- contrary position in an underowned asset

.

After digging through a mountain of data, Erb and Harvey conclude that gold is extremely over-valued although it could still go higher due to the purchases of central banks, particularly in emerging markets. The “dilemma” facing investors comes from assessing whether gold will revert to “the mean” based on historical relationships to inflation, disposable income, and GDP or whether a new era has arrived that justifies the high (and higher) valuations.

While the authors spend a lot of time wrestling with historical data in interesting ways, they spend little time assessing what gold bulls see as the core of a “new era”: a Federal Reserve since Alan Greenspan that is willing to debase the currency and otherwise implement extremely accommodative monetary policy in order to fight any and all economic malaise. {snip}

The authors go on to suggest that central banks have essentially colluded to prop up the price of gold. Positive price momentum has further discouraged them from selling gold:

{snip}

When the primary purveyors of paper currency are acting in a way consistent with higher gold prices, I want to stay invested.

Conclusion

{snip}

I was surprised that after all the evidence and analysis the authors provided, they still allowed for a lot of uncertainty in the “passage of time.” The new era explanation is not well-supported by their analysis. Their analysis heavily favors the conclusion that gold is extremely over-valued. For example, the authors estimate that gold as an inflation hedge should be valued around $780 per ounce, a 41% decline from today’s spot price of $1332.

{snip}

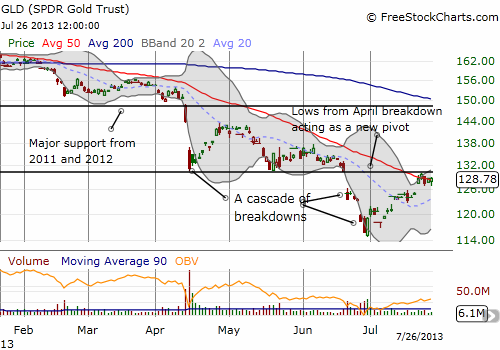

Source: FreeStockCharts.com

{snip}

Be careful out there!

From Saturday Morning Breakfast Cereal (SMBC) by Zach Weiner (thanks to a friend of mine):

(This is an excerpt from an article I originally published on Seeking Alpha on July 29, 2013. Click here to read the entire piece.)

Full disclosure: long GLD