(This is an excerpt from an article I originally published on Seeking Alpha on July 17, 2013. Click here to read the entire piece.)

The Reserve Bank of Australia (RBA) released the minutes from its monetary policy decision meeting earlier this month. It contains some great detail on the RBA’s assessment of global financial conditions. Of particular interest to me was the RBA’s observations on the Federal Reserve’s recent discussion of policy normalization and the market’s subsequent reactions… {snip}

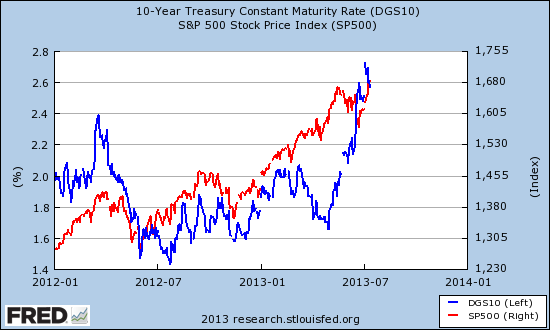

The S&P 500 (SPY) has now fully recovered from this sell-off with new all-time closing highs, seemingly affirming the fact that the Fed said nothing new about the direction and conditions for monetary policy. The U.S. stock market stands tall in its interest rate resilience. The recovery from the interest rate blues has been uneven and perhaps speaks volumes on where the vulnerabilities exist if rates manage to continue climbing.

{snip}

Only time will tell the full significance of the ability of any given stock, ETF, or sector to recover from interest rate blues. Of the group mentioned above, only the S&P 500 was strong going into the interest rate blues. {snip}

{snip}

Related charts…

Source: St. Louis Federal Reserve

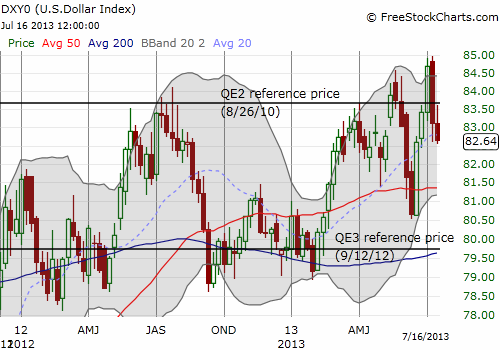

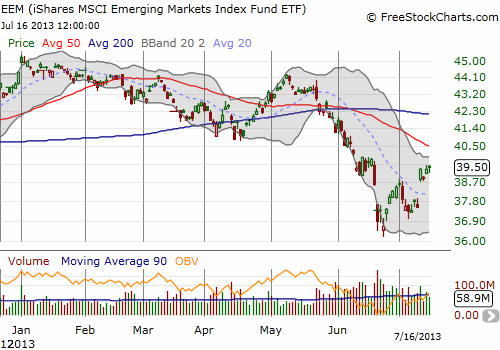

Source: FreeStockCharts.com

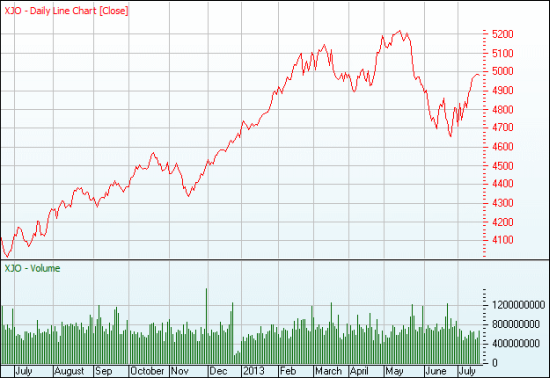

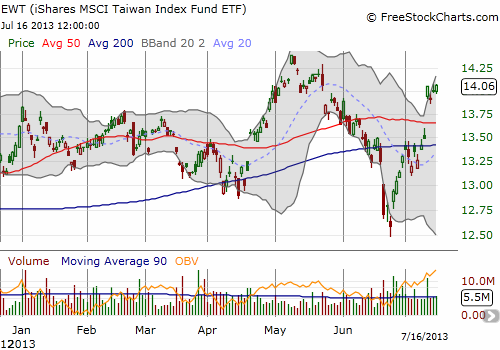

Source: FreeStockCharts.com

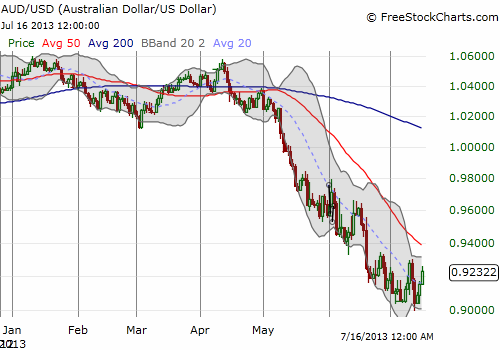

Source: FreeStockCharts.com

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on July 17, 2013. Click here to read the entire piece.)

Full disclosure: long EEM puts, net short Australian dollar