Baidu (BIDU)

A little over a month ago I advised that traders watch the volume on Baidu (BIDU). I showed the history of false breakouts and of breakdowns on high volume. The bad news is that June’s breakout redux failed and led to false hopes once again that BIDU could finally end its 2-year slide. The good news is that THIS time, the breakdown back through the 200 and 50-day moving averages (DMAs) did NOT generate a surge in selling volume. Now, the stock is already bouncing back and is retesting its 200DMA as upper resistance.

This time marks a kind of technical moment of truth for BIDU. If it can break through resistance so soon after the last breakout, avoiding renewed selling interest, my guess and money go with BIDU FINALLY launching a sustained rally that breaks the overall downtrend.

In the last piece, I also pointed out how the 50 and 200-WEEK moving averages were converging, but I had no perspective on its implications. As it turned out, BIDU failed that test miserably. BIDU must break June’s high around $104 to overcome this stiff resistance. I think there is every reason to get aggressively bullish if this breakout happens, especially if it is on strong buying volume.

Amazon.com (AMZN)

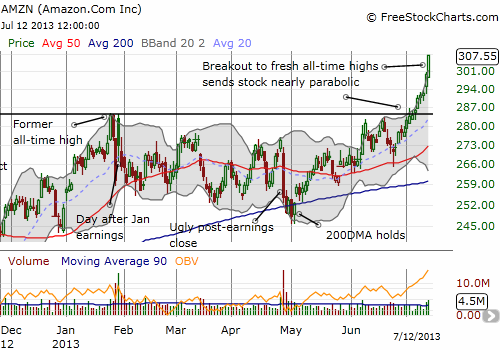

To me, AMZN is one of the most stubborn, most amazing stocks around. I simply do not understand why or how the stock can trade with such a lofty valuation on slim profit margins for so long. Profit margins recently went negative and the reward for stockholders is to send AMZN soaring to twice its value in sales and 16 times its book value. Bears have long since abandoned their bets against AMZN (only 2% of the float now), so this move in the stock is not the result of a short squeeze. It is old-fashioned, raw bullishness. (The open interest put/call ratio has surged on this breakout but at 1.23 is still only ranked at the 43rd percentile for the past 52-weeks).

I call this move old-fashioned bullishness because the stock chart has all the elements one might want in a bullish stock:

- Poor post-earnings performances that fail to break down the stock.

- A 200DMA that holds as general support for uptrend.

- A breakout from a long period of consolidation (essentially the entire first half of this year).

- A rise in buying volume as the stock’s rally picks up steam.

- An ability to plow through a psychologically important round number ($300) with little hesitation.

Source for charts: FreeStockCharts.com

Now mind you, I am definitely not advising that traders rush out and buy this stock. Parabolic moves are usually very short-lived. But this is a stock that can still be bought on dips. My particular trading strategy has been to buy AMZN right at a post-earnings open and/or to go bearish if the stock closes below the intraday low of the first day of post-earnings trading. These past two earnings cycles have not provided the follow-through I expect out of the strategy. Both times, the stock tripped bearish thresholds only to recover quickly; so neither the bullish nor the bearish strategies worked. I now find irony in my sideline position as AMZN rolls through on this bullrush. For additional background, see “The Amazon.com Post-Earnings Trade Quickly Turns Bearish” (Feb 3) and/or a description of my attempt to trade the last earnings play.

I strongly suspect that fortunate investors and traders will look to take profits right before and/or after earnings are next announced on July 25th. My current plan is to adjust the AMAZN post-earnings trading strategy to just wait out the entire first day and make the buying decision after that. Stay tuned…!

Be careful out there!

Full disclosure: long BIDU call options