(This is an excerpt from an article I originally published on Seeking Alpha on December 16, 2012. Click here to read the entire piece.)

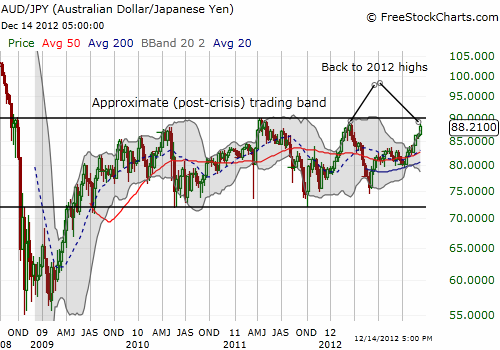

Almost two weeks ago, I noted that as long as the Australian dollar (FXA) maintained its stubborn strength, it made sense to play the currency long versus the weakening Japanese yen (FXY). Now, the Australian dollar has already traded to the top of the trading range for AUD/JPY.

With the Liberal Democratic Party winning in a landslide in Japan’s parliamentary elections, it seems the current trends are ready to accelerate. {snip} However, the election victory was well anticipated, and markets have a habit of selling the news in cases like these… {snip}

{snip}

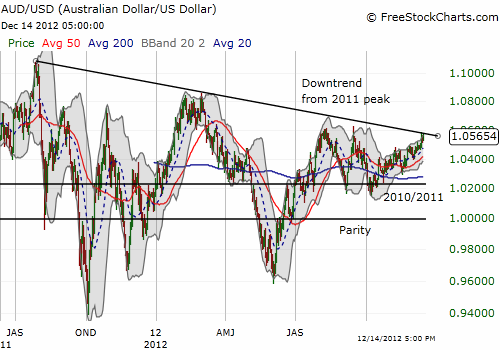

It is this resilience in the U.S. dollar that keeps me short AUD/USD with a small position. {snip} Through it all, it is helpful to remember that currency has remained range-bound against the yen and the U.S. dollar for the past 2-3 years…in other words, no need to get really excited until a breakout (or breakdown) finally happens.

As always, the big wildcards for the Australian dollar are commodity prices…{snip}

Source: Reserve Bank of Australia

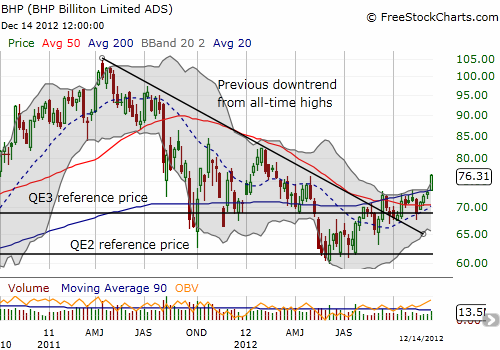

If the recent sharp run-up in the shares of diversified Australian commodity giant BHP Billiton Limited (BHP) is any indication, the year-long decline in commodity prices is set to moderate, not accelerate.

Source for graphs: FreeStockCharts.com

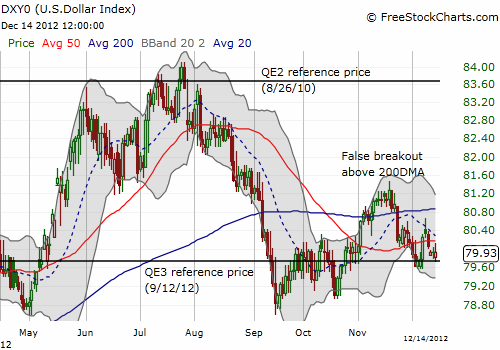

Note well that while the U.S. dollar has not responded to QE3, BHP has. {snip} Like the Australian dollar, I think it is time to pare back positions in BHP, but I think this stock should be a key indicator for sentiment regarding the health of the commodity complex and ultimately the Australian dollar.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on December 16, 2012. Click here to read the entire piece.)

Full disclosure: long AUD/JPY, short AUD/USD, long BHP