(This is an excerpt from an article I originally published on Seeking Alpha on September 28, 2012. Click here to read the entire piece.)

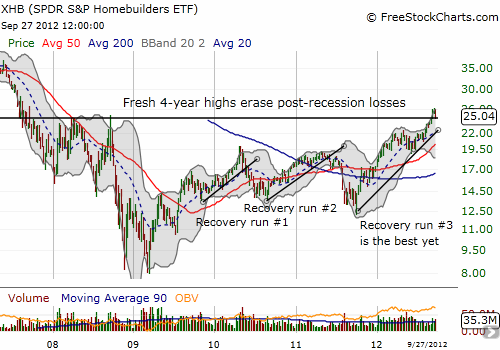

Congratulations to those of you who were able to ignore the bears on housing and stick with housing stocks this year. The SPDR S&P Homebuilders ETF (XHB) has finally recovered all its recession-driven losses and recently hit 5-year highs.

Source: FreeStockCharts.com

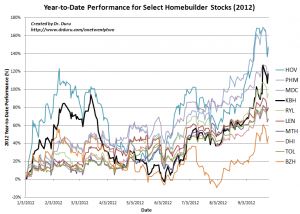

The gains in individual stocks have been breathtaking. {snip}

Click for larger view…

Source for prices: Yahoo! Finance

Key in order of performance shown in the above legend: Hovnanian Enterprises Inc. (HOV), PulteGroup, Inc. (PHM), MDC Holdings Inc. (MDC), KB Home (KBH), Ryland Group Inc. (RYL), Lennar Corp. (LEN), Meritage Homes Corporation (MTH), DR Horton Inc. (DHI), Toll Brothers Inc. (TOL), Beazer Homes USA Inc. (BZH)

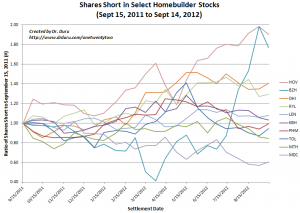

Despite these performance, or maybe because of these performances, bears remain unconvinced. {snip}

The chart’s legend lists the stocks in descending order of shares short. The shares short have been normalized to one versus September 15, 2011 for ease of comparison across stocks.

Source: NASDAQ Short Interest

After experiencing these kinds of gains it is natural to wonder whether it is time to lock in profits. {snip}

It is difficult to tell how long the pent-up demand from years of a housing depression will continue to drive this market, particularly because the NAR claims that “…if most of the financially qualified buyers could obtain financing, home sales would be about 10 to 15 percent stronger.” However, as the data stand now, it seems I can continue to stand by my expectations for a 2013 housing bottom – recognizing now that this bottom may have arrived “ahead of schedule.”

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on September 28, 2012. Click here to read the entire piece.)

Full disclosure: long KBH and short KBH calls (at the time of writing)