(This is an excerpt from an article I originally published on Seeking Alpha on September 16, 2012. Click here to read the entire piece.)

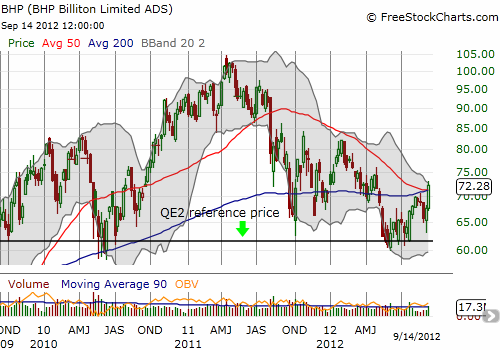

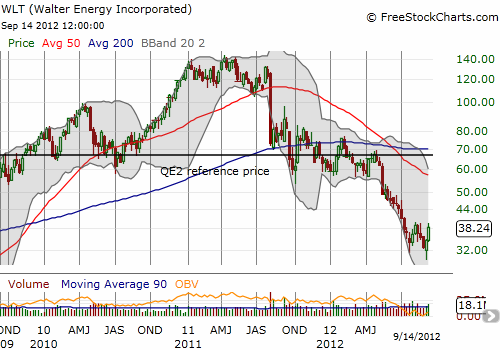

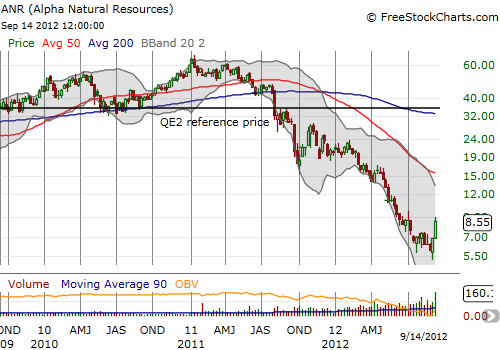

Last week, I demonstrated how the timing of QE2 provided a useful reference point for buying Freeport-McMoran (FCX) as part of a coming revision of the commodity crash playbook. In this piece, I show how the QE2 reference price can be used to separate the stronger from the weaker plays on iron ore and metallurgical coal (also called coking coal). The QE2 reference price has not served as a floor for most of the stocks in this space. This behavior served as an important reminder that the QE2 reference price served as the starting point for buying into a crash/sell-off. The good news is that using this reference price significantly improved the risk/reward of trading these stocks…{snip}…

{snip}

BHP’s relative resilience likely comes from its well-diversified mining operations across many commodities and many countries. So while I sold off a few commodity-related plays into Friday’s rally, I decided to hold firm to BHP. {snip}

Given my longer-term bullishness on Brazil, I continue to build my position in VALE. {snip}

While BHP has operations in metallurgical coal, the companies in focus for met coal are Cliffs Natural Resources Inc Co (CLF), Alpha Natural Resources, Inc (ANR), Walter Energy, Inc. (WLT), and Consol Energy (CNX). Of this list, only CNX has survived the QE2 support test, thus making it the best pick of the bunch. {snip}

Notice that with the exception of the disaster that is ANR, the first QE2 purchase for each of these iron ore and met coal plays eventually yielded great gains in 2011. At the time, I sold all of them because the anticipated crash in Chinese demand had not yet come. {snip}

In other words, this latest round of stimulus spending is far from a done deal. {snip}

Shorts are also coming after iron ore plays. {snip}

In the meantime, industry is quickly moving to cut capacity which should help put a floor under future prices. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on September 16, 2012. Click here to read the entire piece.)

Full disclosure: long VALE, BHP, ANR