It seems Friday’s stalemate was indeed a demonstration of Apple buyers finally putting up a fight. Apple’s stock is still in a short-term downtrend, but the trading action has been electrifying almost the entire way down. The wild swings and near symmetry of the move downward are the kind of “art” that only a chart technician and swing-trader could love.

On April 17th, Apple (AAPL) soared 5.0% in one day. For each of the previous five days, Apple sold off until finally losing 4.1% in one day. At the time, I wrote “Chart Review: Apple’s Revenge” to imply that AAPL selling had reached a crescendo. Four weeks later, Apple is 7.9% lower after another tremendous one-day gain, this time a historic gain of 5.8%. Volume remains much lower than April’s pre-earnings surge, but Apple bulls may finally put together a winning streak. Since Apple’s all-time high (or top), the stock has only twice put together two consecutive winning days. The last three-day win streak was at the end of March.

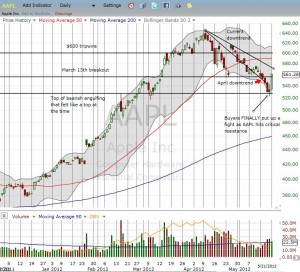

The chart below summarizes the current set-up. AAPL made a very impressive break of presumed resistance at $556, the location of the March 13th breakout. Note this point served as picture-perfect support before April’s earnings. Next up is a rendezvous with the overall downtrend and then the 50-day moving average (DMA).

Click image for larger view…

Source: FreeStockCharts.com

I came prepared for a wild WEEK in Apple, buying weekly calls and puts near Friday’s close with the overall market oversold. Once the calls gained enough to pay for the puts this morning, I bailed. I was trying to be clever and prepare for what I assumed would be an eventually pullback to support. A day like today was not even on my radar, much less wish list. A 6% WEEK perhaps, but not for a single day! So, unfortunately for me, I am left with unfulfilled promise and a handful of puts that are sure to expire worthless this Friday. Such is the irony of trading.

Be careful out there!

Full disclosure: long AAPL puts