(This is an excerpt from an article I originally published on Seeking Alpha on April 30, 2012. Click here to read the entire piece.)

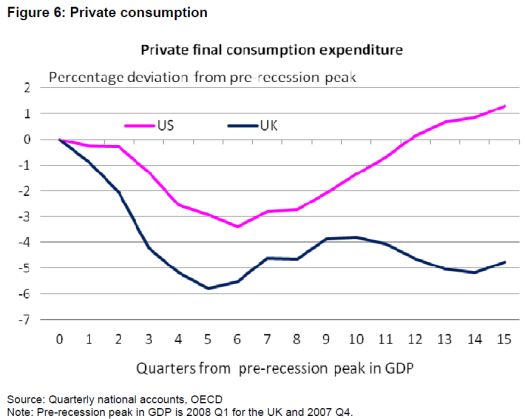

As recession descends across Europe, fiscal policies have received extra scrutiny. Austerity measures have been promoted as keys for long-term economic stability but the necessary short-term pains have been understated. Without preparation (or the ability) to endure the short-term tumult to get to “the other side,” fiscal authorities will have an even more difficult time with long-term adjustments – especially when the short-term adjustments have been particularly severe. The divergent economic paths between the U.S. and the U.K. provide some insights on the short-term impacts of contractionary fiscal policies.

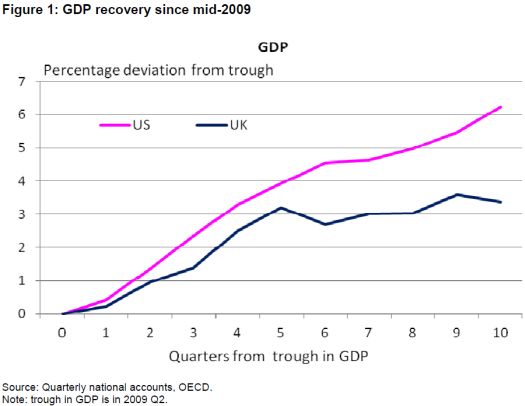

Total GDP in the U.S. has finally returned to pre-recession levels whereas GDP in the U.K. is not likely to achieve that milestone this year thanks to a current stall in growth. The latest economic news showed that the U.K. economy officially dipped back into recession last quarter. This is the U.K.’s first double-dip recession since the 1970s.

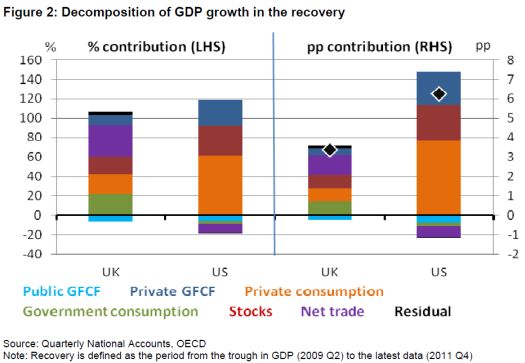

In a March 27, 2012 speech titled “Why is their recovery better than ours? (Even though neither is good enough),” Adam Posen, External Member of the Monetary Policy Committee (MPC), Bank of England (BoE) and Senior Fellow, Peterson Institute for International Economics, quantifies the differences between the U.S. and U.K. economies and attempts to explain the reasons for the gap in economic performance. {snip}

{snip}

Source of economic charts: Posen’s speech

{snip}

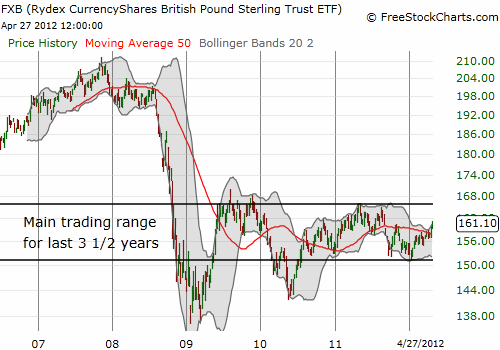

Source: FreeStockCharts.com

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on April 30, 2012. Click here to read the entire piece.)

Full disclosure: Short GBP/USD