(This is an excerpt from an article I originally published on Seeking Alpha on April 29, 2012. Click here to read the entire piece.)

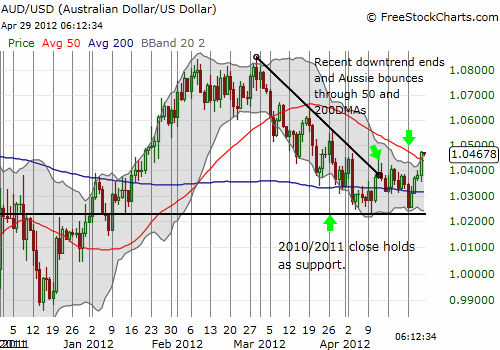

One of my reasons for recently turning bearish on the Australian dollar (FXA) is what I see as the likelihood of additional rate cuts through the year. It seems the consensus has come around to this view as well. According to DailyFX, the market expects the Reserve Bank of Australia (RBA) to cut interest rates from 4.25 to 4.0% when it next announces monetary policy on the evening of May 1st (U.S. timezones). Despite these expectations, the Australian dollar has actually held firm going into this likely rate cut. In fact, against the U.S. dollar, the Australian dollar looks ready for another rally.

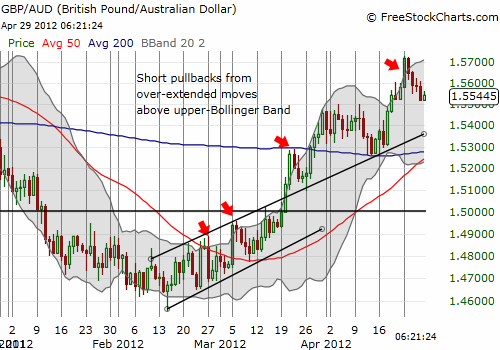

Over the past two weeks, the Australian dollar has also held steady against the Japanese yen (AUD/JPY) and Swiss franc (AUD/CHF). The Aussie has lost a lot of ground against the British pound (GBP/AUD), which has been my focus for making bearish bets. In my last post on the this currency pair, I pointed out how the last big surge would give way to a pullback. {snip}

Source for charts: FreeStockCharts.com

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on April 29, 2012. Click here to read the entire piece.)

Full disclosure: long AUD/USD, AUD/JPY, AUD/CHF, GBP/AUD