A month ago I declared the weakness in the Japanese yen had ended. At the time, the U.S. dollar versus Japanese yen currency pair, USD/JPY or the inverse ratio in the Rydex CurrencyShares Japanese Yen Trust (FXY), had slipped for three days in a row. I turned out to be about a week too early as a fresh bout of weakness swept over the yen and USD/JPY rushed to fresh 11-month highs. The end of that rally coincided with a major breakout of the S&P 500 (SPY) to fresh multi-year highs. Since then, the S&P 500 has gone nowhere and the yen’s weakness has also turned into a consolidation phase with a slight bias toward a stronger yen.

The chart below shows USD/JPY with labels showing the performance of the S&P 500 on key days of yen strength and weakness. The correlation has recently weakened a bit, but it seems that strength in the yen TENDS to correspond to weakness in the stock market on a day-to-day basis and more-so on a week-to-week basis. The performance over the last three weeks suggests that a lack of further weakness in the yen is correlating with a lack in further upside in the stock market (I am not ready to attribute causation just yet!). I imagine that if the stock market were open today, it would be selling off.

Click image for a larger view.

Note that USD/JPY is now facing a major test at the presumed support of the 50-day moving average (DMA). This sets up for a VERY interesting (and tense?) week next week.

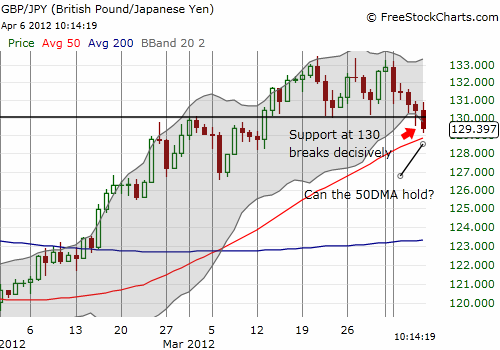

During this transition period to the next big move in the yen, I have remained positioned short GBP/JPY (the British pound vs yen currency pair). I have used bouts of yen strength to buy other yen currency pairs in relatively small amounts and then selling those at the next profit opportunity. It is a hedged strategy that has worked relatively well so far. With today’s unexpectedly weak U.S. nonfarm payrolls number sending traders scurrying to the yen, I believe we have growing evidence that the yen will not weaken much further from here for a while. GBP/JPY finally cracked support at 130 and looks ready to head much lower from here. It remains to be seen whether the stock market can regain its momentum despite the increasing weight of the yen.

Source for charts: FreeStockCharts.com

Be careful out there!

Full disclosure: long USD/JPY, EUR/JPY, AUD/JPY, sort GBP/JPY

1 thought on “Weakness in the Japanese Yen Is Over for Now, Part Two”