Clearly, I am not yet bearish enough on the Japanese yen.

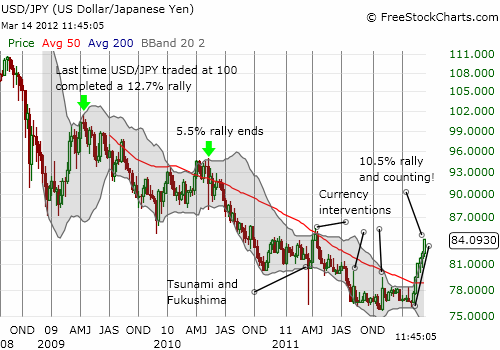

When the U.S. dollar last traded at 100 versus the Japanese yen (USD/JPY), the dollar completed a 12.7% rally from its lows in December, 2008 and January, 2009. This was also the last time the U.S. dollar generated as large and sustained a rally as it has now against the yen. This time, the rally from the lows is 10.5% and running. The rally has also been nearly straight up. I was clearly far too premature in proclaiming last week that the “Weakness in the Yen Is Over.” Still, I am left doubting even more that the current rally is sustainable. The currency market typically does not tolerate such strong and swift trends and the end usually delivers an equally intense reaction in the reverse direction. Unlike last time I had doubts, I do not currently have any “just in case” positions short against the yen. (In fact, I am short GBP/JPY to hedge other positions!)

This weekly chart provides some perspective on the unusual nature of the current rally in USD/JPY:

Source: FreeStockCharts.com

Surprisingly, not even the Federal Reserve’s latest statement on monetary policy slowed the train on the U.S. dollar. These statements, or their context, often contain reminders that the direction of the U.S. dollar is lower. This time, the dollar barely took a breather before resuming its rally.

Be careful out there!

Full disclosure: short GBP/JPY