This is an excerpt from an article I originally published on Seeking Alpha. Click here to read the entire piece.)

Commodities across the board have suffered mightily during the stock market’s recent correction. In the first phase of the sell-off (from late July to early August), a few commodity-related stocks triggered buys by erasing all of their “QE2-inspired” gains…{snip}… Oversold market conditions persisted longer than almost every other oversold period since 1987, producing numerous buying opportunities. I wrote several pieces describing these opportunities (for some examples, see archives under “commodities crash playbook.”). After the market finally bounced, I decided to take profits in most of the recent purchases of commodity-related stocks.

The sell-off in commodities entered a second phase once the S&P 500 dove back to the bottom of its trading range by mid-September. This phase ended with the S&P 500’s break to new 52-week lows and its immediate bounce back into the previous trading range. {snip} I have re-entered several of the previous commodities trades and added new ones in this second phase of selling. I am still biting small chunks at a time because the primary premise of the commodity crash playbook rests on a potential contraction in prices based on a drop in Chinese demand. So far, no significant drops have happened. In case this drop never occurs, I want to make sure I have taken advantage of some of today’s low prices. If the drop finally happens, I want to be ready to buy at bargain-basement prices.

{snip}

“Preparing for Profits in a Resource-Constrained World”

“Profiting from Physical Assets in a Resource-Constrained World – Rules and Picks”

I created all the weekly charts below using FreeStockcharts.com.

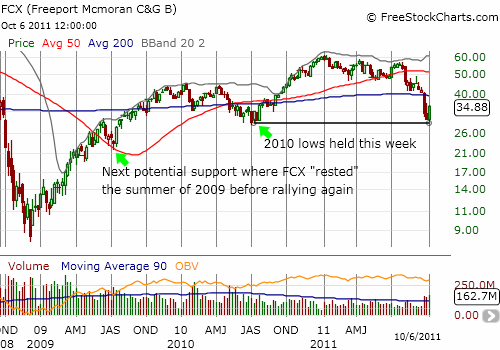

Copper: Freeport McMoran (FCX)

{snip}

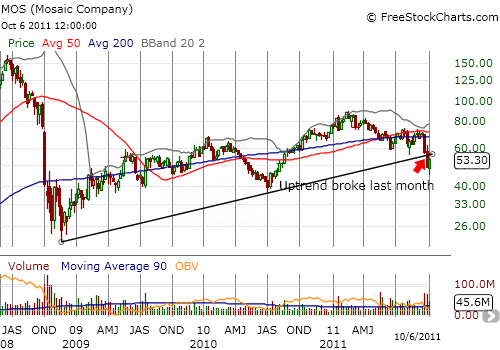

Potash: Mosaic (MOS)

{snip}

Country-index: iShares MSCI Australia Index Fund (EWA)

{snip}

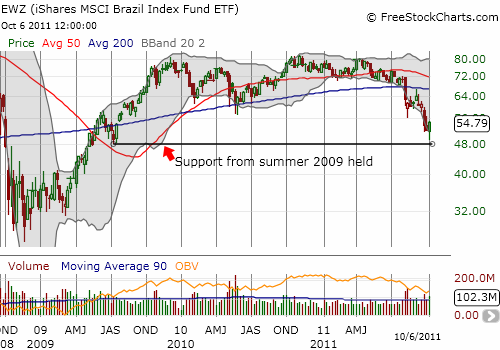

Country-index: iShares MSCI Brazil Index Fund ETF (EWZ)

{snip}

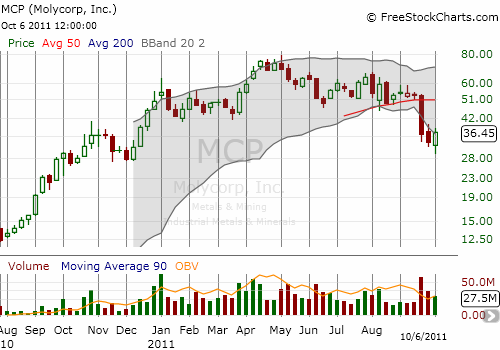

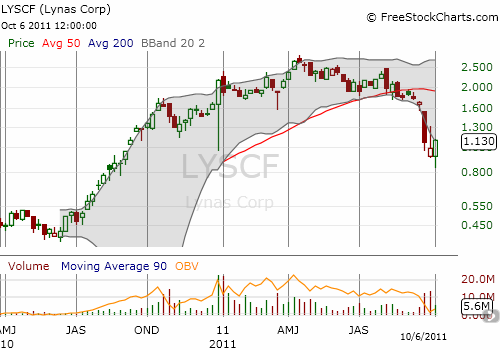

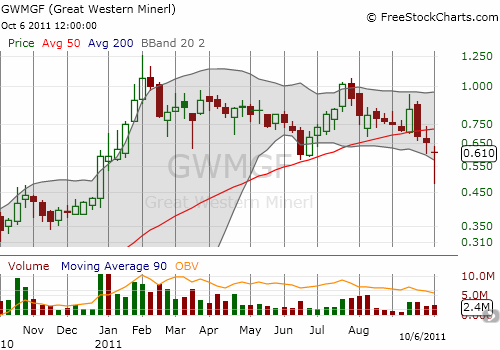

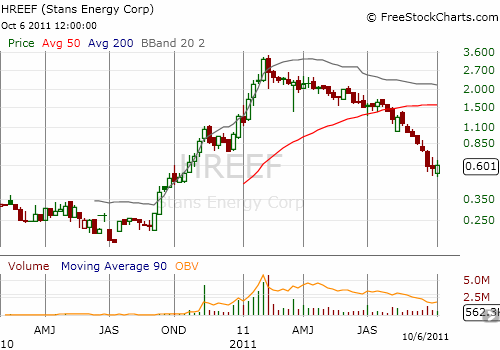

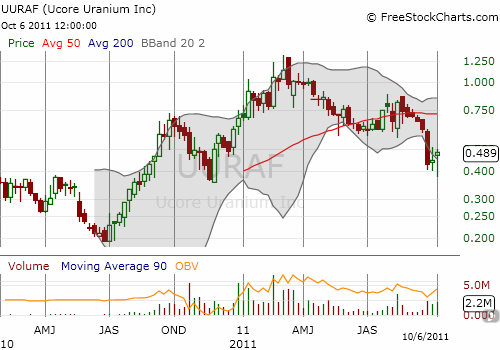

Rare earths: Molycorp (MCP), Lynas Corporation Limited (LYSDY, LYSCF.PK), Great Western Mineral (GWMGF.PK), Stans Energy Corp (HREEF.PK), Ucore Rare Metals, Inc (UURAF.PK)

Rare earth companies occupy a special place in the commodities crash playbook.{snip}

I will have more to say on rare earths in a future post (click here for an archive of Molycorp blog pieces). {snip}

Gold and silver

I have not yet made significant additions to my gold and silver holdings. I have only added a small tranche of shares in Goldcorp (GG).{snip}

Finally, I will be moving to re-establish my hedge on a crash in commodities and general economic weakness. As explained in previous posts, Caterpillar (CAT) represents a sensitive focal point and nexus of many of the important economic trends, especially in commodities and construction. {snip}

{snip}

Be careful out there!

This is an excerpt from an article I originally published on Seeking Alpha. Click here to read the entire piece.)

Full disclosure: long FCX, MOS, EWA, EWZ, MCP, LYSCF, GWMGF.PK, HREEF.PK, UURAF.PK, SSO, long CAT puts