A surprise increase in margin requirements after the close of business November 10th apparently contributed to the climactic end to silver’s parabolic move on Tuesday. This also explains why gold’s fade was not nearly as bad a silver’s. Details are available in the following references in order of publication:

- CNBC (Tues): “CME Taps the Brakes on Silver” (uses the lingo of futures trading)

- Marketwatch (Tues): “Silver leads metals selloff after margin changes”

- CNBC (Wed): “Gold, Silver Markets Roiled By Move to Curb Speculation”

The CME sent a letter explaining the change in margin requirements as part of a “…normal review of market volatility to ensure adequate collateral coverage.” One analyst noted that the “…reaction to such margin adjustments are ‘sharp but short’.” So far, we definitely have sharp. The last time margin requirements were changed was after the close of business on June 7th. Interestingly enough, SLV, the iShares Silver Trust ETF, closed up 4.5% that day. At that time, SLV was in the last stages of what became a long, 11-month consolidation period. SLV never went lower than the open on June 7th.

Fast forward to today and SLV closed up 2% immediately ahead of the margin increases. Although silver futures plunged overnight, they quickly recovered by the beginning of the U.S. trading session. SLV opened up 3.5%, faded, and twice tested Tuesday’s lows before finishing in the green. So, the last trading day ahead of the margin increase compared relatively favorably to the last increase, but the context is dramatically different. This last change has come on the heels of a 50%+ run in just 2 1/2 months, so it has all the appearances of an attempt to curb rampant speculation and drain the market of some of its “hot” money. The greater significance is clearly reflected in trading volumes in both the ETF and futures contracts.

SLV experienced record trading volume on Tuesday of 148.7 million shares. Wednesday’s trading volume was the second highest ever at 79.7 million shares. The volume on June 7th was merely average at 11.4 million shares traded. The silver contract experienced record volume on Wednesday with 201,216 contracts. The previous record was 127,890 contracts on Dec. 30, 1976. (The silver ETF has only traded for four years).

Time should soon tell whether all this jostling and repositioning leads to the confirmation of a near-term top in silver. A healthy, bullish outcome would be another period of consolidation that allows silver to “cool off” as it awaits the next catalyst, like the U.S. dollar breaking support on its way to 11-month lows and worse. A rapid resumption in parabolic-style trading will likely setup an eventual fade and correction much worse than Tuesday’s move.

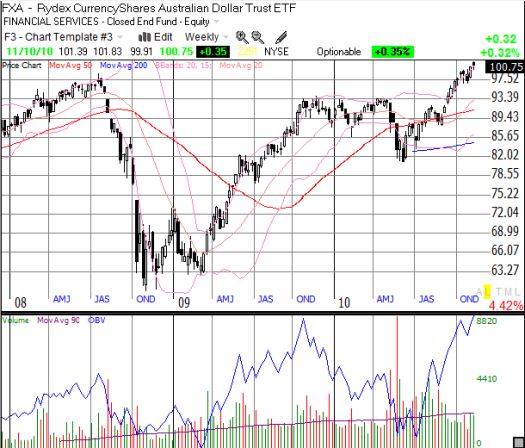

I am mainly interested in silver (and gold) as an anti-dollar bet. So, as long as the dollar seems to be positioning for a relief rally, I am disinclined to participate in such a hot market. Moreover, parabolic moves typically end badly (Toll Brothers (TOL) provided a great example in April). I am currently left with a core anti-dollar bet in the Australian dollar. FXA (Rydex CurrencyShares Australian Dollar Trust ETF) has now taken over from gold and silver as one of my longest standing positions (a grand total of 13 months so far). After a stomach-churning plunge in May, FXA is up 13% for the year, moderately outpacing the S&P 500’s 8.1%. gain.

Overall, going forward, I am triggering fresh anti-dollar bets on key technical levels for the dollar. I will be caught in a tough strategic bind if the dollar breaks down further before silver and/or gold have had a chance to cool off.

Be careful out there!

Full disclosure: long FXA, long AUD/USD, long TOL puts