Ahead of the May decision on monetary policy from the U.S. Federal Reserve, I concluded that the stars had aligned for a potential (sharp) relief rally for the SPDR® Gold Shares (GLD) and the iShares Silver Trust (SLV). In that post, I extrapolated from the market’s waning enthusiasm for two more rate hikes in 2017. I was thoroughly punished for trying to over-anticipate the Fed’s next move!

To my surprise, the Fed stood solidly behind the current rate hike momentum by dismissing current weak economic data as “transitory”:

“The Committee views the slowing in growth during the first quarter as likely to be transitory and continues to expect that, with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace, labor market conditions will strengthen somewhat further, and inflation will stabilize around 2 percent over the medium term.”

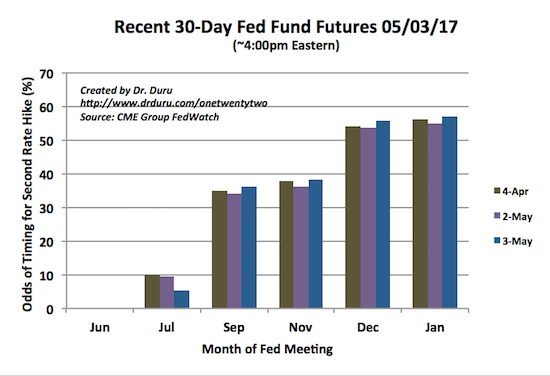

The market got the message. The odds for a rate hike in June strengthened further. The odds for two rate hikes by December increased to 55.8%. (Note that with the May results known, the current odds are not quite comparable to the odds I reported ahead of the Fed).

Source: CME FedWatch Tool

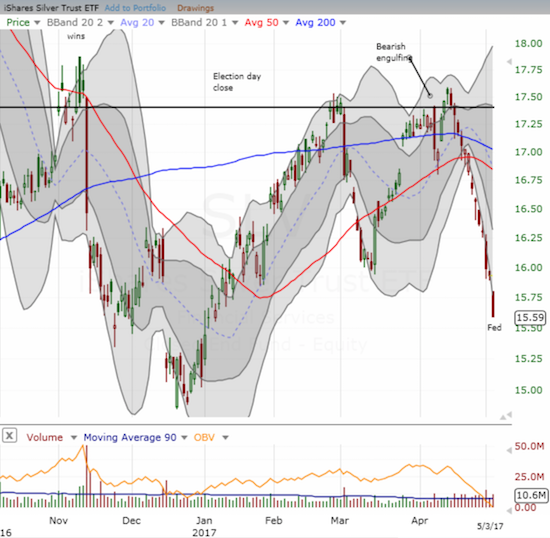

The changes look small, but they were enough to help smash GLD and SLV. GLD sliced right through its support at its 50-day moving average (DMA) with a 1.4% loss. SLV lost a whopping 2.2% on its way to a record 13th straight down day.

The pain for GLD and SLV was a gain for the U.S. dollar index. The dollar traded away from the edge of a major 200DMA breakdown and even closed higher than the previous 7 trading days which also featured tests of 200DMA support.

My pre-Fed trade to increase longs in GLD and SLV was worsened by the surprisingly weak performance of my hedge with put options on the iShares 20+ Year Treasury Bond (TLT). While TLT did decline post-Fed as I would have expected given the market’s reaction to the announcement, TLT started out the day with a gap up and finished the day with a fractional gain. I would have expected TLT to decline by 1% to 2% given the big moves in precious metals.

Source of charts: FreeStockCharts.com

Now I will just observe the ultimate depth of the slides in GLD and SLV. Speculators in futures contracts in gold and silver have been caught rowing against the tide, so I cannot use their trades as a functional signal for now. Instead, I will revert to the old rules on trading a bottom: celebrate with the buyers and do not argue with the sellers.

Be careful out there!

Full disclosure: long GLD shares and call options, long SLV shares and call options, long TLT put options, long and short various positions against the U.S. dollar

What are your thoughts about CAD? Record spec short interest 110 contracts, the most in the last 20 years (since 1993).

How did you get the data going back that far? I use Oanda which compiles and presents the data just back to 2008. The net short interest is not yet at a high so I assume you are talking about gross positioning?

I am currently short USD/CAD to play a retest of 20DMA uptrend. I am watching oil closely to see how far to keep holding this trade. I am surprised the shorts are so aggressive against CAD!

Hi Duru, yes I meant gross short positioning which presumably would need to be unwound at some stage. I got that figure from an article from Marc Chandler on seeking alpha at the end of last week. He is usually quite accurate. The gross short position in CAD as at end of last week was 110 contracts. The net position is not yet at a record.

The longer CAD stays at the current level the more twitchy shorts will get. In retrospect I should have expressed this as a short AUD.CAD rather than short USD.CAD as the spec interest in long AUD was getting large and paired with the high short interest in CAD, this would have used both of extremes. I did think about it but gave it a miss as AUD.CAD has been so slow and frustrating to trade in the past for me.

Ah ha. Got it. Since I am still bearish on the Australian dollar, I like shorting AUD/CAD as an idea. I also need to pay more attention to gross positioning. I entirely focus on net positioning and sometimes open interest.

AUD/CAD keeps bouncing off 200DMA support. I don’t think the pair wants to cooperate with your evil plan…