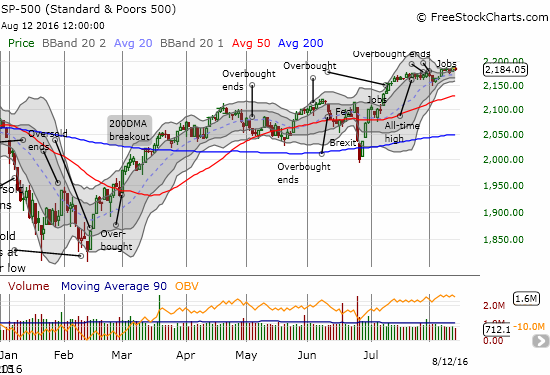

The referendum that punted the UK out of the European Union (EU), “Brexit”, is practically a forgotten memory for most people outside of Europe. For example, the aftermath of this vote now looks like an event that quickly shook out the most eager sellers in the stock market and thus paved a course for a fresh rally.

Source: FreeStockCharts.com

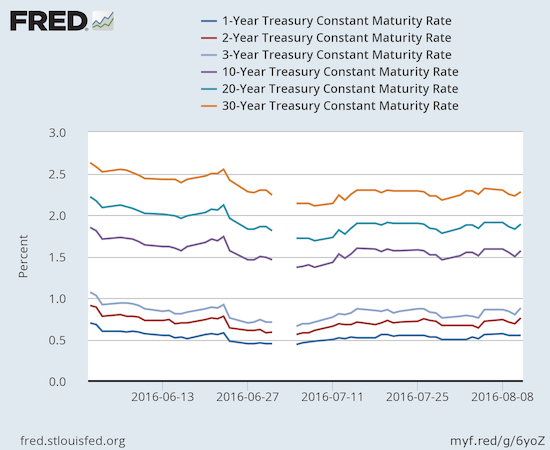

Yesterday, an email from ditech, a financial institution, brought a fresh reprise of lessons from Brexit. The email pointed to a blog post dated June 28, 2016 that dripped with excitement in the enticing title “Brexit Brings Low Rates!” The post summed up well the rosier perspective on the post-Brexit world as one of opportunity rather than one of crisis. For example, Ditech applauded the near historic impact on mortgage rates:

“Friday, June 24th, saw mortgage rates drop a full eighth of a point. And while this might not sound like a lot, it marks only the ninth time in a decade when rates have moved this much in a single day, with the most recent occurrence in October 2014. According to Matthew Graham, reporter for Mortgage News Daily, ‘it’s the single best day for mortgage rates in more than a year, not to mention the fact that outright levels are getting very close to all-time lows.'”

Source: Board of Governors of the Federal Reserve System (US), 1-Year Treasury Constant Maturity Rate [DGS1], retrieved from FRED, Federal Reserve Bank of St. Louis, August 13, 2016.

Lower rates mean greater opportunities – refinance or even buy a home. Let the world’s fears transform into the U.S.’s cheers…

“While the headlines report on the volatility of the financial markets world wide, remember that the U.S. economy remains fundamentally sound. This global unease, as reported in Forbes, has a silver lining for U.S. homebuyers looking to purchase and home owners looking to refinance —cheap loans…

Of course, if you’re a home owner with a mortgage, you should consider refinancing. Lock if you like what you see. If you don’t have a mortgage, why not take advantage of these low rates to purchase your first home, your retirement home, your second home, your vacation home, or that rental property you’ve been considering.”

Imagine – who would have thought to market a burst of global angst as a great time to buy a home!?

Even better, Brexit presumably forced the Federal Reserve to be even more cautious than it might otherwise have been. Rates should now stay lower for longer…

“Joe Bilko, Vice President of Capital Markets for ditech…’Following the Brexit outcome of the UK referendum, rates reached three year lows. We would expect rates to remain lower for longer as the Federal Reserve weighs changing global political and growth outlooks when making future rate decisions.'”

In other words, Brexit’s crisis of confidence has benefited borrowers and the indebted.

This outcome now repeats a well-worn pattern and cycle since the Great Recession. As each financial crisis or setback blows through the global economy, the debris eventually coalesces into ever higher asset prices supported by lower rates, more accommodative monetary policies, and/or weaker currencies in key markets used for leveraging into higher yielding investments. The FTSE 100, a UK index of the country’s largest companies, was just such an early winner.

Source: FreeStockCharts.com

A U.S. stock market sitting at all-time highs (the S&P 500, NASDAQ, and the Dow just closed at all-time highs together for the first time since 1999) serves as a reminder that each dip, every crisis, all periods of angst, have provided buying opportunities. The special feature of the post-Brexit angst was that it only lasted two days and did not even produce follow-on spasms in the recovery period. The comforting assurances and interventions of central banks are becoming ever more effective for financial markets!

For more context, I review the alarming reactions in the immediate wake of Brexit. Everyone “knew” that a vote in favor of Brexit would cause trouble based on warnings from just about every respected major financial institution on the planet. The follow-on rush to reassure global markets was an immediate and palpable reminder that something serious had indeed happened. Even Alan Greenspan, former chair of the Federal Reserve three regimes ago (1987-2006), helped to amplify the alarm bells.

When Greenspan gets airtime, you KNOW someone in the media thinks a historic moment is at hand!

Greenspan claimed that the fallout form Brexit was just the tip of the iceberg. He referenced renewed calls for Scottish independence and restricted movement between Northern and Southern Ireland. More importantly, Greenspan noted that Brexit reflects a more fundamental problem of slowing incomes across the “whole European spectrum”, the United States, and for that matter the entire OECD (The Organisation for Economic Co-operation and Development). Stagnant real incomes are creating political problems like Brexit. Greenspan went on to explain that the euro (FXE) itself is in trouble with Greece likely to drop out.

Just to make sure we understood the seriousness of what happened, Mark Carney, the Governor of the Bank of England (BoE), appeared in a quick press conference (no Q&A) to reassure the world that his institution was ready to act and to smooth the UK’s transition to a post-Brexit world. For those of us in the U.S., I am guessing the image of a major financial figure speaking through what looks like a service window at the Post Office was a bit surreal…

Carney started with the obvious: “The people of the United Kingdom have voted to leave the European Union.” He then continued…

“Inevitably, there will be a period of uncertainty and adjustment following this result…Some market and economic volatility can be expected as this process unfolds.”

The volatility was well underway at this point, but Carney reassured everyone that the BoE was not only already on the case, but also that the BoE has helped to create a resilient system:

“…we are well prepared for this. The Treasury and the Bank of England have engaged in extensive contingency planning and the Chancellor and I have been in close contact, including through the night and this morning.

The Bank will not hesitate to take additional measures as required as those markets adjust and the UK economy moves forward.

These adjustments will be supported by a resilient UK financial system – one that the Bank of England has consistently strengthened over the last seven years…

The best contribution of the Bank of England to this process is to continue to pursue relentlessly our responsibilities for monetary and financial stability.

These are unchanged.

We have taken all the necessary steps to prepare for today’s events.”

Accordingly, Carney made it clear that the BoE expected banks to continue normal operations, providing credit and lending to the real economy. For Carney and his peers, Brexit was not about a new opportunity to buy homes with cheaper financing but about making sure that the economy continued to function as close to normal as possible.

Across the water, the European Central Bank (ECB) chimed in from Brussels. Like the BoE, the ECB stood ready to soothe markets with liquidity and capital supports…

“Following the outcome of the UK referendum, the European Central Bank (ECB) is closely monitoring financial markets and is in close contact with other central banks.

The ECB stands ready to provide additional liquidity, if needed, in euro and foreign currencies.

The ECB has prepared for this contingency in close contact with the banks that it supervises and considers that the euro area banking system is resilient in terms of capital and liquidity.

The ECB will continue to fulfil its responsibilities to ensure price stability and financial stability in the euro area.”

Even the International Monetary Fund (IMF) sought to reassure markets by showing its solidarity with the BoE and the ECB:

“We take note of the decision by the people of the United Kingdom. We urge the authorities in the U.K. and Europe to work collaboratively to ensure a smooth transition to a new economic relationship between the U.K. and the EU, including by clarifying the procedures and broad objectives that will guide the process.

We strongly support commitments of the Bank of England and the ECB to supply liquidity to the banking system and curtail excess financial volatility. We will continue to monitor developments closely and stand ready to support our members as needed.”

The responses from major centers of finance continued rolling, almost like a chorus of urgent angst seasoned with just the right tone of confidence-boosting preparedness and readiness. The G7 felt compelled to reassure markets with statements posted on the websites of the financial centers of members:

“We, G7 Ministers and Governors, respect the intention expressed today by the people of the United Kingdom to exit from the European Union. We are monitoring market developments following the outcome of the referendum on the UK’s membership of the EU.

We affirm our assessment that the UK economy and financial sector remain resilient and are confident that the UK authorities are well-positioned to address the consequences of the referendum outcome.

We recognize that excessive volatility and disorderly movements in exchange rates can have adverse implications for economic and financial stability.

G7 central banks have taken steps to ensure adequate liquidity and to support the functioning of markets. We stand ready to use the established liquidity instruments to that end.

We will continue to consult closely on market movements and financial stability, and cooperate as appropriate.

We remain united and continue to maintain our solidarity as G7.”

The G7 must have added that last sentence in case anyone mistook the discord within the UK as representative of fissures in the rest of the industrialized world. With that press release, the G7 counted itself as another bulwark standing against financial instability.

The Federal Reserve issued its own reassurance:

“The Federal Reserve is carefully monitoring developments in global financial markets, in cooperation with other central banks, following the results of the U.K. referendum on membership in the European Union. The Federal Reserve is prepared to provide dollar liquidity through its existing swap lines with central banks, as necessary, to address pressures in global funding markets, which could have adverse implications for the U.S. economy.”

Even with statements from the G7 and the Federal Reserve, the U.S. Treasury Department still issued its own statement on Brexit in the voice of Secretary Jacob J. Lew:

“The people of the United Kingdom have spoken and we respect their decision. We will work closely with both London and Brussels and our international partners to ensure continued economic stability, security, and prosperity in Europe and beyond.

We continue to monitor developments in financial markets. I have been in regular contact in recent weeks with my counterparts and financial market participants in the UK, EU and globally and we are continuing to consult closely. The UK and other policymakers have the tools necessary to support financial stability, which is key to economic growth.”

In other words, UK voters got the FULL attention of the world’s houses and institutions of financial power. So, make no mistake about it, Brexit was considered a very big deal and a very big risk. Yet,

with major engines of monetary policy in high gear, assurance rapidly grew and held root. In parallel, the marketing departments of U.S. brokerages were confident enough to fire off emails and post articles for their members to speak to the need for confidence, patience, resilience, and, of course, opportunity. I present some examples from Etrade, Schwab, Ameritrade, and Fidelity…

Etrade:

In “Brexit Is Here: What You Can Expect,” Etrade (ETFC) basically said do not worry and stay diversified. I particularly liked how Etrade stayed vague enough to avoid giving any recommendations for action but specific enough to ask its audience to look beyond immediate events to the long-term need for a diversified portfolio. Etrade even held out the (correct) prospect of a market rebound (emphasis mine)…

“While many diversified portfolios will have some exposure to areas of the market potentially negatively impacted by Brexit, they should also have allocations to assets that stand to benefit. Regardless, depending on the specific portfolio, there may be volatility in certain asset classes.

As always, maintaining a long-term point of view is critical to weathering current market volatility. This can be made easier by owning a broadly diversified portfolio aligned with one’s goals and risk tolerance. Avoid the immediate emotional temptation to attempt to time the market. It’s quite possible, in fact, that markets may rebound over the coming days. Even more importantly, it’s far too early to make sense of the longer-term implications of this historic event, which is key to understanding how financial markets will be impacted over time.”

Schwab

In “After the Brexit Vote: What Lies Ahead for Markets?” Schwab provided an excellent, yet concise summary of what happened and the potential outcomes. Schwab braced readers for the potential of a 3 to 4 month recovery process based on the aftermaths of the Japanese earthquake, the U.S. debt ceiling debacle, and the European debt crisis. Unlike Etrade, Schwab attempted to provide specifics and some prescriptive recommendations. Rather than hold out the prospect of a quick recovery, Schwab specifically concluded that it did not see the imminent recipe for a fast recovery (emphasis mine).

“We believe it may take some time for the shock to fully work through the economic, financial and political systems in the U.K. and Europe. With no visible catalyst to halt the slide, the decline in global stocks may continue as the risk of a recession increases…

No two market shocks are the same, but in some of the other shocks since the financial crisis, markets have recovered in three to four months. Investors with longer time horizons may want to maintain their diversified asset allocations, which can help portfolios weather volatility over time.”

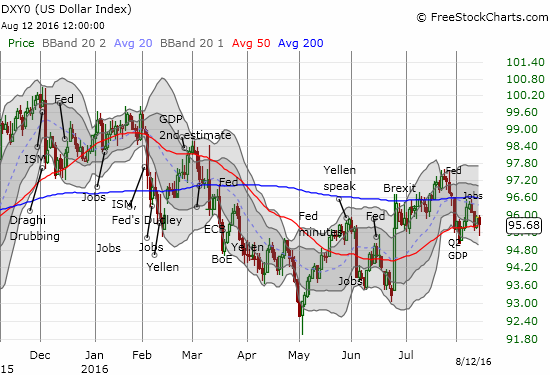

Schwab noted that after the initial response, financial markets could resume their declines before a recovery period kicked in. I was initially in this camp of thinking. Schwab was very detailed in providing potential scenarios, but more importantly, it offered some keys for determining whether the shock was ending: effective interventions from the BoE and ECB, political events in the rest of the European Union, and an end to the “flight-to-quality” buying of the U.S. dollar (DXY0) and the Japanese yen (FXY). As we know now, financial markets have rallied despite both currencies retaining their post-Brexit strength. The markets have looked well beyond what normally would have been thought of as definitive market negatives and turned conventional wisdoms on their collective head.

Source: FreeStockCharts.com

Schwab ultimately divided its advice between short-term and long-term perspectives:

“Short-term-focused traders should be prepared for further stock market declines over the next three to six months, similar to past shocks. We continue to believe volatility will remain a major characteristic of markets in 2016. However, investors with longer time horizons may want to maintain their diversified asset allocations, which can help portfolios weather volatility over time.”

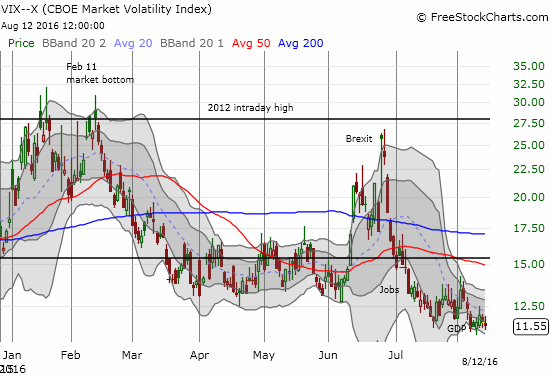

I am guessing that Schwab’s concerns were related to the season of the market. The months of August through October typically deliver the stock market’s largest drawdowns of the year. While I am currently neutral on the market, I also stare upon this period with great wariness. Schwab’s expectations for follow-on volatility have yet to materialize, but at least recent history demonstrates that the volatility index, the VIX, does not remain content at current low levels for extended periods of time. Yet, the current message of the VIX confirms that Brexit has receded far in the rearview mirror.

Fidelity

Fidelity’s post-Brexit statement took on the familiar “don’t worry, stay long-term and diversified” messaging. The core of the message could be summed up by one simple sentence from one of Fidelity’s fund managers:

“Now that Brexit has passed, I think it’s important to step back, and just watch how things play out…Continue to think longer term.”

This fund manager is unfazed when it comes to potential repercussions for the U.S.:

“The vote to leave likely has little direct impact on the U.S. economy over the long term. U.S. economic trends are heavily driven by the U.S. consumer (roughly 70% of GDP), which continues to benefit from tighter labor markets and rising income expectations (see the June business cycle update) that are little impacted by the vote in the U.K.”

Fidelity maintains an entire site called “Navigate volatile markets” that is dedicated to investing through uncertainty. The themes and advice further reinforce the commitment to hold through the storm. The site is currently laden with post-Brexit discussions. I neatly divide the familiar strategies between two age groups: younger and older. For younger investors, volatility is an episode of opportunity while holding fast to long-term goals. Older investors should not panic either: “Don’t panic and sell stocks, consider other income sources, and review your withdrawals and spending.” Older investors need to plan ahead for volatility and be ready to adjust spending plans in times of volatility in order to avoid selling low on their portfolio.

Parting thoughts

I mainly dedicate my financial blog to trading on short and intermediate-term catalysts, some fundamental but most techncial. The messages from the Brexit episode spoke as a loud reminder that the long-term view is the most important view even as shorter-term time periods can provide very lucrative trading opportunities. Ironically, being a contrarian in the face of crisis and angst is really just trusting in the conventional wisdom of long-term thinking and maintaining alignment with all the forces that work to put floors under financial markets and push winds into their sails. Brexit was a crisis that was seen from a distance and provided plenty of time for preparation and fortification. The fruits of that preparation are in full display in post-Brexit financial markets. Ditech’s call to action to refinance and buy homes is like the cream of the fruit salad.

Yet, I cannot help but wonder whether unintended consequences are somewhere over the horizon as the markets medicines may work to over-stimulate and over-correct for Brexit’s economic impact and over-sedate otherwise wary stock investors. In the future, will we look back and see this period as eerily similar to 1998/1999? At that time the world looked ahead to Y2K – the mismanagement of the change in computer clocks to a new millennia – with such fear and trepidation that the Federal Reserve worked diligently to keep markets liquid and resilient. I remember the period vividly. I worked as an independent contractor on a job to help companies efficiently manage Y2K projects. I even had a friend who took the advice of others and filled her bathtub with water in case the local utility shutdown from computer problems! Y2K concerns came right on the heels of the blow-up of Long-Term Capital Management, an event which at the time looked ready to bring down global financial markets in the way that the collapse of Lehman Brothers actually did. Just as today’s central banks, burned by the financial crisis and the Great Recession, are primed to act quickly and decisively against drivers of financial instability, the Federal Reserve was primed to stay one step ahead of the next potential financial meltdown. Y2K essentially fizzled into a non-event. In retrospect, it turned out that the Fed likely over-stimulated financial markets and helped to send tech stocks in particular into a parabolic run-up and historic bust.

Only time will tell how this extraordinary period in monetary policy works out. Right now, it seems inflation will never return. Right now, it seems the global economy will always be in slow growth mode. Right now, the march toward negative rates seems pervasive and inexorable. These impressions cannot be (all?) true, but neither can we know when the next reality will commence. In the meantime, I continue to swallow these episodes of angst one at a time…looking to my favorite indicator, the percentage of stocks trading above their respective 40-day moving averages (T2108), to warn of potential tops and to signal good risk/reward opportunities to buy.

Be careful out there!

Full disclosure: long SDS, long UVXY shares and puts, long SVXY puts, net long the U.S. dollar, net short the Japanese yen, long FXY put options