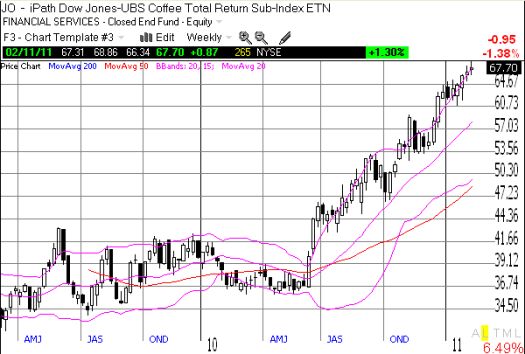

Coffee prices have soared along with most other commodities over the past year and more. For example, the iPath Dow Jones-UBS Coffee Total Return Sub-Index ETN (aka JO) is up 70% since the end of 2009.

The last earnings results from Starbucks (SBUX) demonstrated the stress from these higher coffee prices. The company slightly lowered FY11 (fiscal year 2011) earnings guidance to $1.43-1.47 EPS (earnings per share) versus $1.49 Thomson Reuters consensus (according to briefing.com) and reported expectations for a significant hit to the bottom line from coffee prices:

“Commodity costs, which are now expected to have an unfavorable impact on EPS of approximately $0.20 for the full fiscal year attributable primarily to higher coffee costs, are reflected in the revised EPS target.”

The stock stumbled a bit in the days following the earnings report, but SBUX has almost fully recovered now. Similarly, the stock’s recovery from recessionary lows stumbled a bit when coffee prices first spiked upward last summer, but the stock’s 45% jump from the end of August is well-ahead of the S&P 500’s 27% increase from that time. It certainly helps to have dedicated and committed customers!

This kind of strong demand and robust marketplace has also helped specialty coffee roasters (organic, fair trade and kosher) like Dean’s Beans come up with creative ways for coping with this inflationary environment. Dean’s Beans has raised prices on its coffees, created substitution blends, and negotiated reductions in shipping prices with UPS (which has generally been driving rates up).

I am a new customer of the company’s delicious dark chocolate chips and a recent subscriber to the Dean’s Beans newsletter. In a recent newsletter titled “New Year Challenges,” proprietor Dean Cyon described how price, availability, and shipping are pressuring his business. I was most fascinated with the following explanation for rising coffee prices:

“Why the crazy price increases? Some of it is legitimate, climate change is skewing rainfall patterns, leading to bad flowering, mudslides and all sorts of growing problems. On top of that, since the bank and housing failures two years ago much of that speculative money has poured into commodities, including coffee, bringing that frenetic trading mentality to the coffee world. So where there may have been a price spike before on news that the Colombia crop will be smaller, now there is a stampede of overblown trading for no other reason than to make money on the projected supply shortage. While nobody has a crystal ball on this, most people expect prices to keep rising for the next several months.”

Mr. Cyon’s complaint about speculators and their hot money is a nice reminder of one impact of easy money on the economy. This apparent destabilization of coffee prices is one of many prices we are paying in the effort to boost the deflationary parts of the economy, primarily housing and employment. If housing and employment continue to prove unresponsive to monetary stimulus, the apparent principle of “pouring syrup on the markets until they finally sweeten” will force ever increasing amounts of easy and hot money into parts of the economy that will respond because of supply problems combined with robust demand.

The prospect of climate change destabilizing markets is also of more and more interest to me. Jerry Grantham described some investment implications of weather and climate instability on commodities in his latest newsletter (“Pavlov’s Bulls“, fourth quarter 2010):

“Climate and weather are hard to separate. My recommendation is to ignore everything that is not off the charts and in the book of new records. The hottest days ever recorded were all over the place last year, with 2010 equaling 2005 as the warmest year globally on record. Russian heat and Pakistani floods, both records, were clearly related in the eyes of climatologists. Perhaps most remarkable, though, is what has been happening in Australia: after seven years of fierce drought, an area the size of Germany and France is several feet under water. This is so out of the range of experience that it has been described as ‘a flood of biblical proportions.’ More to the investment point: Russian heat affects wheat prices and Australian floods interfere with both mining and crops. Weather-induced disappointment in crop yield seems to be becoming commonplace. This pattern of weather extremes is exactly what is predicted by the scientific establishment…Weather instability will always be the most immediately obvious side effect of global warming.”

To the extent there remain plenty of people who do not believe the climate is changing, I strongly suspect there is on-going underpricing of the critical production capacity most impacted by such climate instability. Moreover, to the extent future risks are under-appreciated, opportunities abound for securing production capacity “on the cheap” (for example, think about all the doubts in 2008 and 2009 regarding reflation). The speculators who have committed themselves to profiting from supply disruptions will certainly continue to cause severe headaches for producers like Mr. Cyon. However, these price signals will ultimately provide the forcing function that motivates action to resolve supply disruptions.

In the meantime, it appears coffee prices will continue upward and the slightest sneezes in the supply chain will cause ever larger price swings.

Be careful out there!

Full disclosure: long SSO puts