Stock Market Commentary

A market calm emerged thanks to a pause on reciprocal tariffs and then a ceasefire in the US vs China trade war. This market calm shattered as a new tariff shock came in the form of President Trump threatening the European Union (EU) with a 50% tariff while at the same time claiming he is not looking for a deal and a 25% tariff on iPhones made outside of the U.S. This double whammy added to the market pressure that began in earnest mid-week following a poor auction on Treasury bonds sent yields soaring and stocks lower. The lackluster demand came on the heels of an important downgrade of U.S. debt by Moody’s and ahead of the passage of a budget-busting bill that passed in the House of Representatives. The sum total of the market dynamics took the S&P 500 to the brink of critical support.

The Stock Market Indices

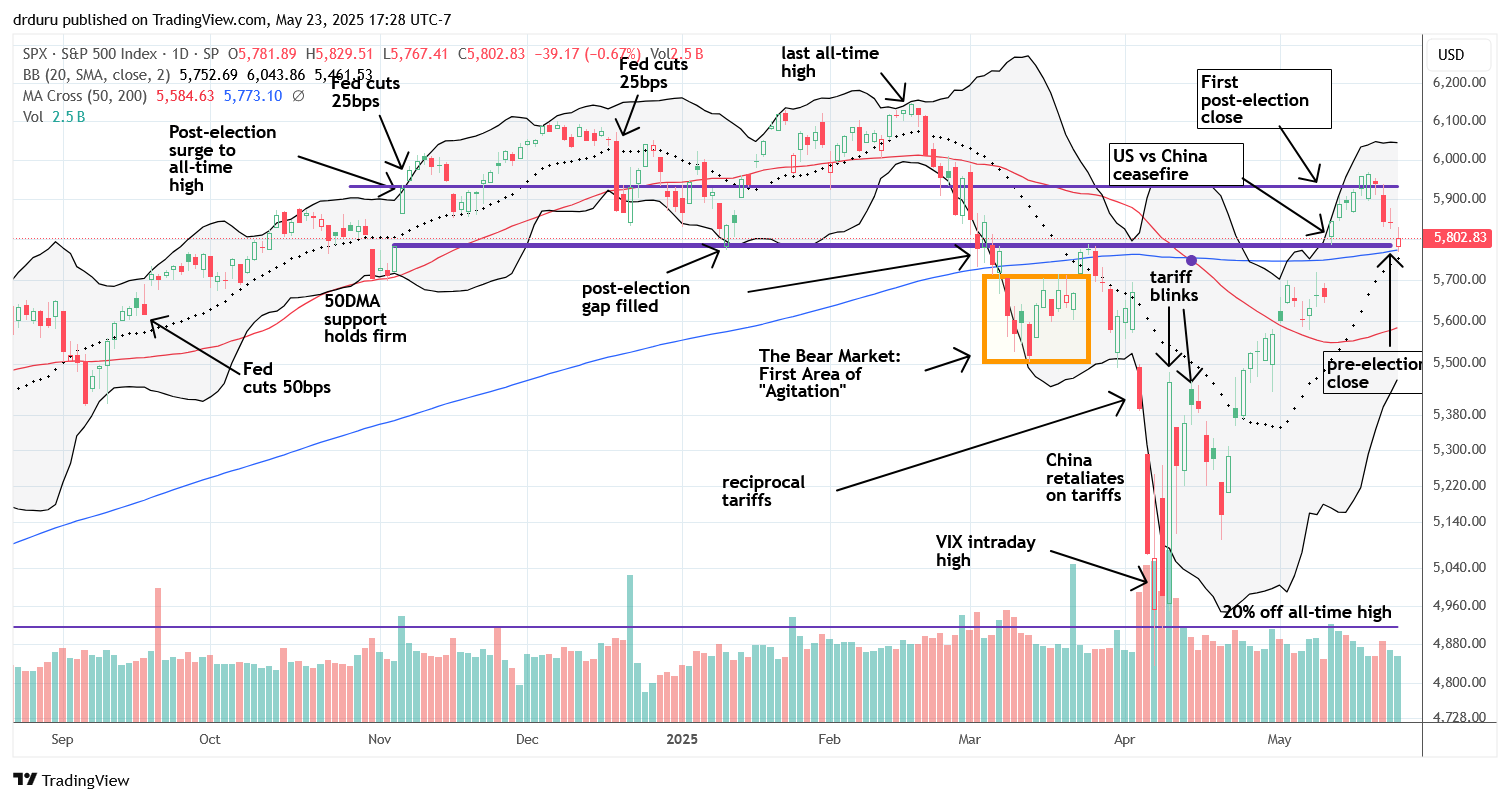

S&P 500 (SPY)

The S&P 500 gapped lower on tariff headlines right to converged support created by the pre-election open, the 200-day moving average (DMA) (the blue line), and the 20DMA (the dotted line). Buyers reflexively stepped in and almost completed a full intraday recovery. A fade from the intraday high gave me the opportunity to speculate on an SPY calendar call spread at the $590 strike. If the S&P 500 closes below 5782 (converging support), I will downgrade my short-term trading call to neutral. If the index falls further and breaks 50DMA support (the red line) around 5600, I will finally take the cue from market breadth and the AT50 trading strategy and flip bearish. See below for more on my evolving short-term trading strategy.

The chart of the S&P 500 is getting busier and busier thanks to the blitz of market-moving headlines from policymakers. Going into last week, I assumed the market had mostly immunized itself from further tariff drama, trauma, and noise. With the breakout above the first post-election close, the index looked all clear to challenge and even surpass its all-time high….even with overbought trading conditions. Instead, the S&P 500 now sits at critical support and in danger of testing lower support levels before a new “immunization” (or even numbing) process takes hold against further tariff shocks.

NASDAQ (COMPQ)

The NASDAQ is positioned similarly to the S&P 500 but remains above its 200DMA support. I am not initiating trades here and will wait for a test of support near 18,424 where the 200DMA and 20DMA are converging.

iShares Russell 2000 ETF (IWM)

One big disappointment of the week was IWM, which broke a steady, solid uptrend from the April bottom. Per my revived trading strategy for IWM, I bought a call option on the last test against support at the uptrend. I doubled down on the test of 20DMA support. Now, I am bracing for a test of 50DMA support around $197.75. A further breakdown from there puts IWM right back in the crosshairs of another visit to bear market territory.

The Short-Term Trading After Calm Shattered

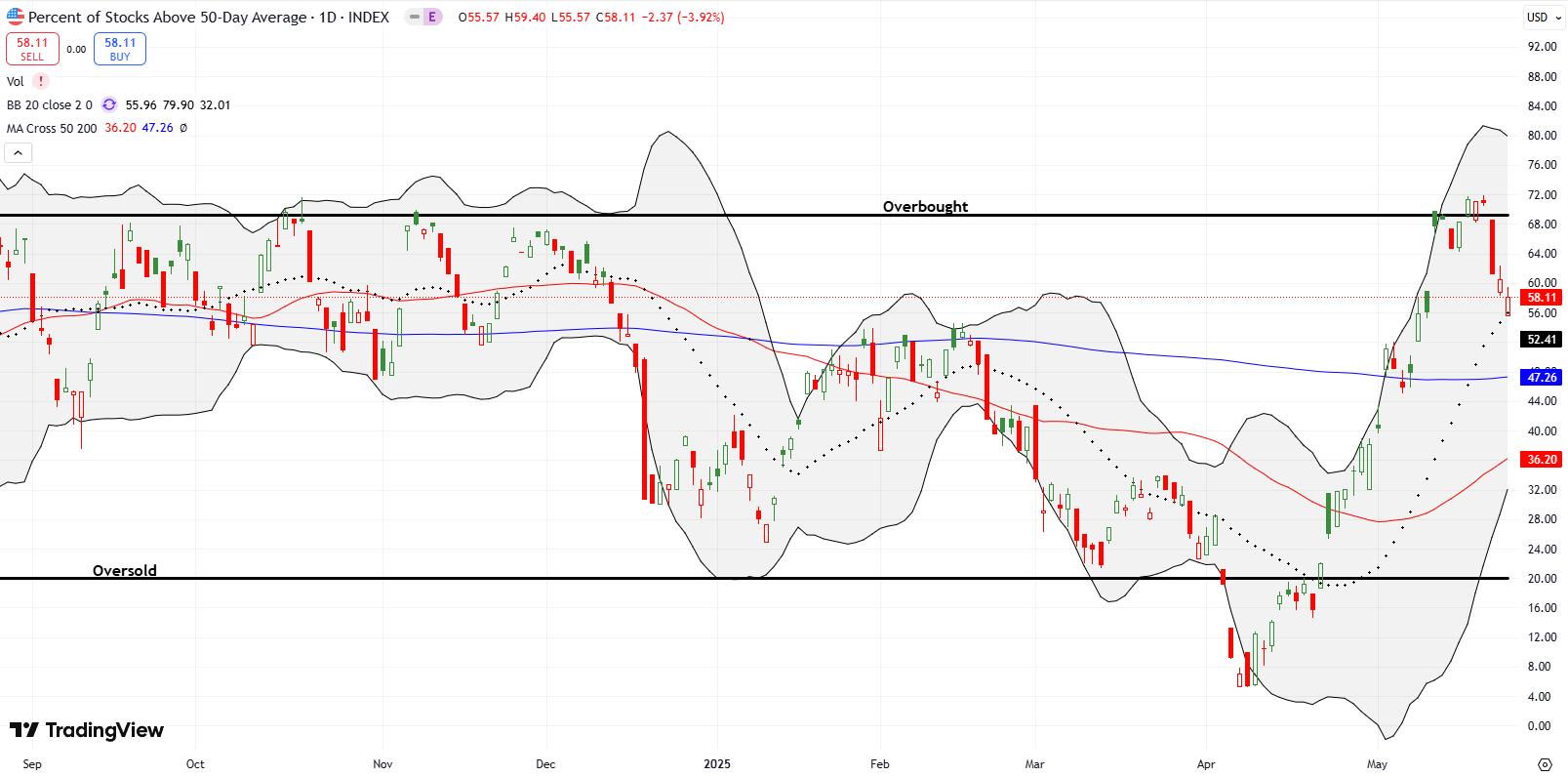

- AT50 (MMFI) = 58.1% of stocks are trading above their respective 50-day moving averages

- AT200 (MMTH) = 38.1% of stocks are trading above their respective 200-day moving averages

- Short-term Trading Call: cautiously bullish

The drop in AT50 (MMFI) from the overbought 70% threshold came with ominous timing—Wednesday’s yield-driven sell-off aligned with rising budget deficit concerns. Normally, I would have flipped bearish per the AT50 trading rules, but the S&P 500 is well-supported…for now. The reflexive bounce after Friday’s gap down is an early sign of the meaningfulness of support. Thus, despite the shattered calm, the short-term trading call stays at cautiously bullish. However, a 200DMA breakdown moves me immediately to neutral. I do not want to remain overly deferential to the bull market as I was when the S&P 500 last suffered a 200DMA breakdown ahead of all the tariff drama. At that time I stayed cautiously bullish because AT50 was too close to oversold trading conditions for me to get bearish or even neutral; I could not foresee an imminent historic plunge into deep oversold conditions. What a flip in trading environment to have this challenge of 200DMA support fresh off overbought trading conditions!

The 3-day overbought trading period lasted about as long as most overbought periods. The last overbought period (July, 2024) lasted just two days, yet the S&P 500 managed to maintain an upward bias and even survived six subsequent failures from the overbought threshold before finally succumbing to selling pressure in December (thanks to the Federal Reserve).

The Volatility Index (VIX)

The VIX bounced from its previous low just as tariff noise re-emerged. The VIX conveniently ended its descent at the same level that preceded the last bout of tariff drama. The move back above 20 confirms a new regime of “elevated” volatility that brings higher risks of sharp pullbacks. Thus, traders need to tread carefully again. Be ready so you don’t have to get ready!

The Equities: Calm Shattered

SPDR Gold Trust (GLD)

Unlike stocks, gold had a positive reaction to the downgrade of U.S. debt. The subsequent gap higher by GLD (a 1.2% gain) created a picture-perfect and successful test of 50DMA support. GLD was down only one day the rest of the week. I am still holding my June $305/$315 GLD call spread. I might take profits if GLD slips from current levels or stalls at a fresh test of the all-time high where a bearish engulfing top brought a sharp run-up to a screeching halt.

Apple (AAPL)

AAPL was suspiciously weak all week. A friend and I discussed the bearish setup and agreed it was time to bet against the stock. While we were a day late given AAPL confirmed 50DMA resistance on Wednesday’s 2.3% loss, we were just in time ahead of the 3.1% loss on the iPhone tariff threat. While Trump is likely to back down yet again, the timing along with EU tariff threats means this cloud could loom over AAPL for a few weeks, especially if CEO Tim Cook needs the time to think of a new way to try to placate the President. My friend is likely holding the Drixeon Daily AAPL Bear 1x Shares (AAPD) for the “long-term”, but I do not like sitting in these inverse ETFs too long given they “leak” over time similar to how options suffer time decay. Note that, unlike the S&P 500, AAPL has little downside support left before the April lows. Also note how 50DMA resistance has mostly capped AAPL since February.

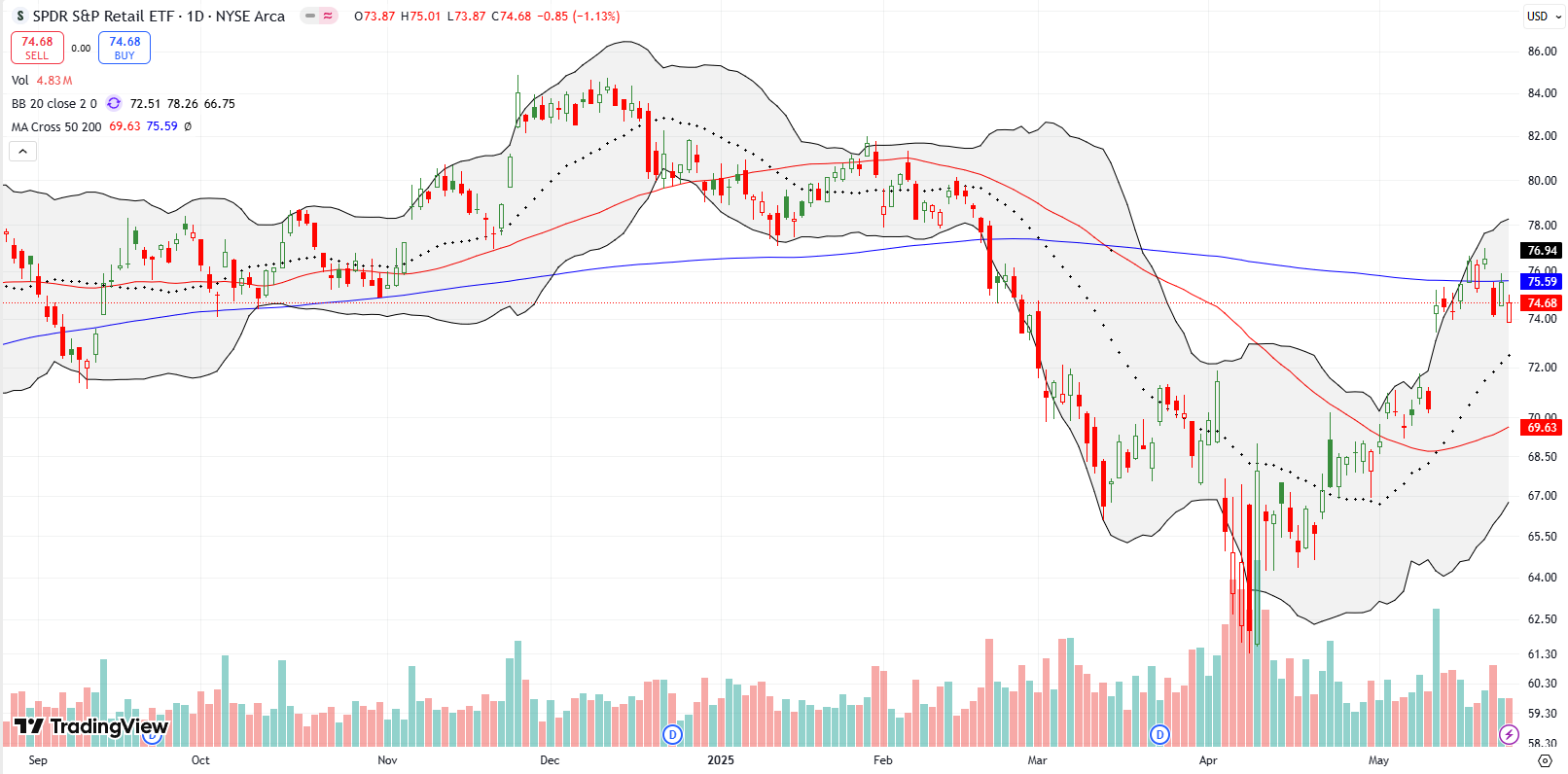

SPDR S&P Retail ETF (XRT)

XRT failed to hold a breakout above its 200DMA resistance. I was waiting to buy a breakout confirmation that never came. This breakdown is ominous as the retail earnings season kicks into high gear. XRT is an early short candidate for me if the S&P 500 breaks down from current levels.

Fair Isaac Corporation (FICO)

FICO was my week’s biggest letdown. I missed the first 8.1% drop, which should have been my sell signal in order to preserve my remaining profits on the trade. Next, the stock plunged another 15.7%, breaking both its 50DMA and 200DMA support levels. A close below April’s low will confirm a major technical breakdown where I will need to take my loss. This plunge seems overdone based on criticism from Federal Housing Finance Agency director William J. Pulte, but I want to respect the technicals given the significance of a breakdown to new lows on the year. FICO has not faced this much technical pressure in many years.

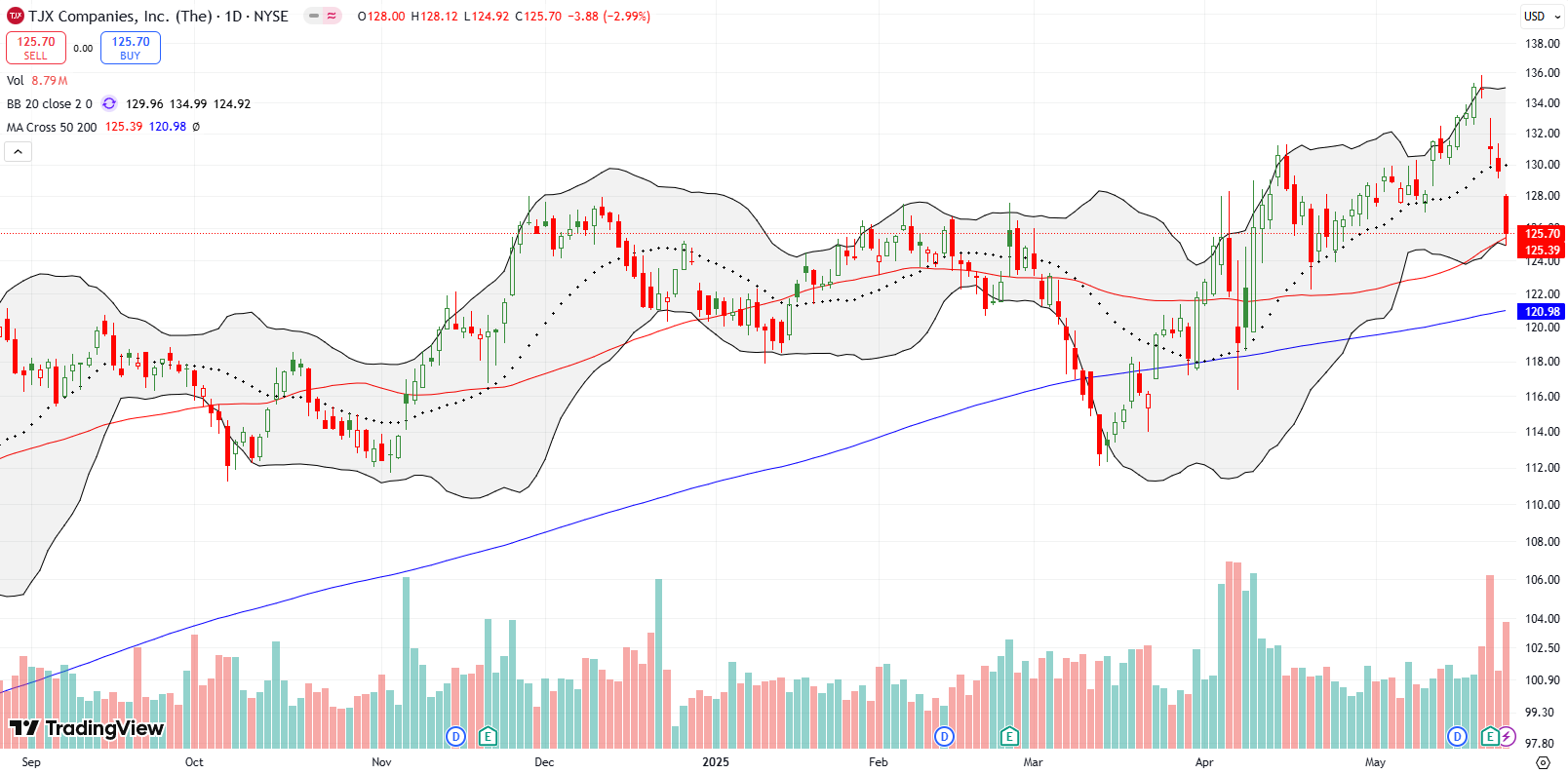

TJX Companies (TJX)

Favored retailer TJX reported disappointing earnings, leading to a 2.9% loss. The stock closed at its 50DMA ($125.70). I will consider buying if TJX pulls back further to its 200DMA around $121.

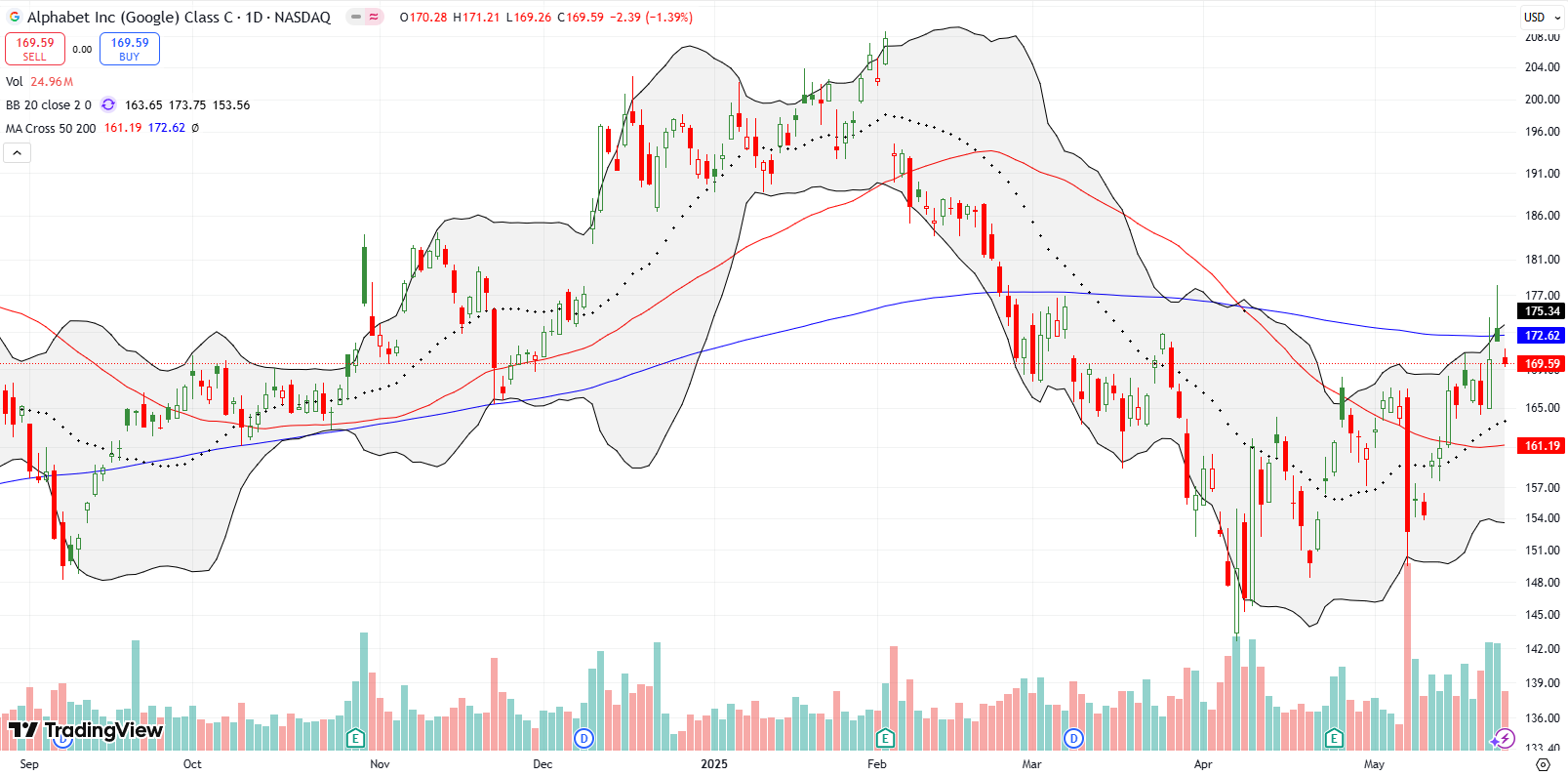

Alphabet Inc. (GOOG)

GOOG was volatile post-Google I/O, rallying 2.9% and crossing its 200DMA but reversed sharply from its intraday high. I took small profits on a call spread at that point given an imminent expiration. The stock is now between its 50DMA and 200DMA. I will re-enter on a confirmed 200DMA breakout or at a test of 50DMA support on the downside. In between is an area of trading limbo. I now relieved over the improved technicals given the significant damage from May 7th’s 7.5% plunge.

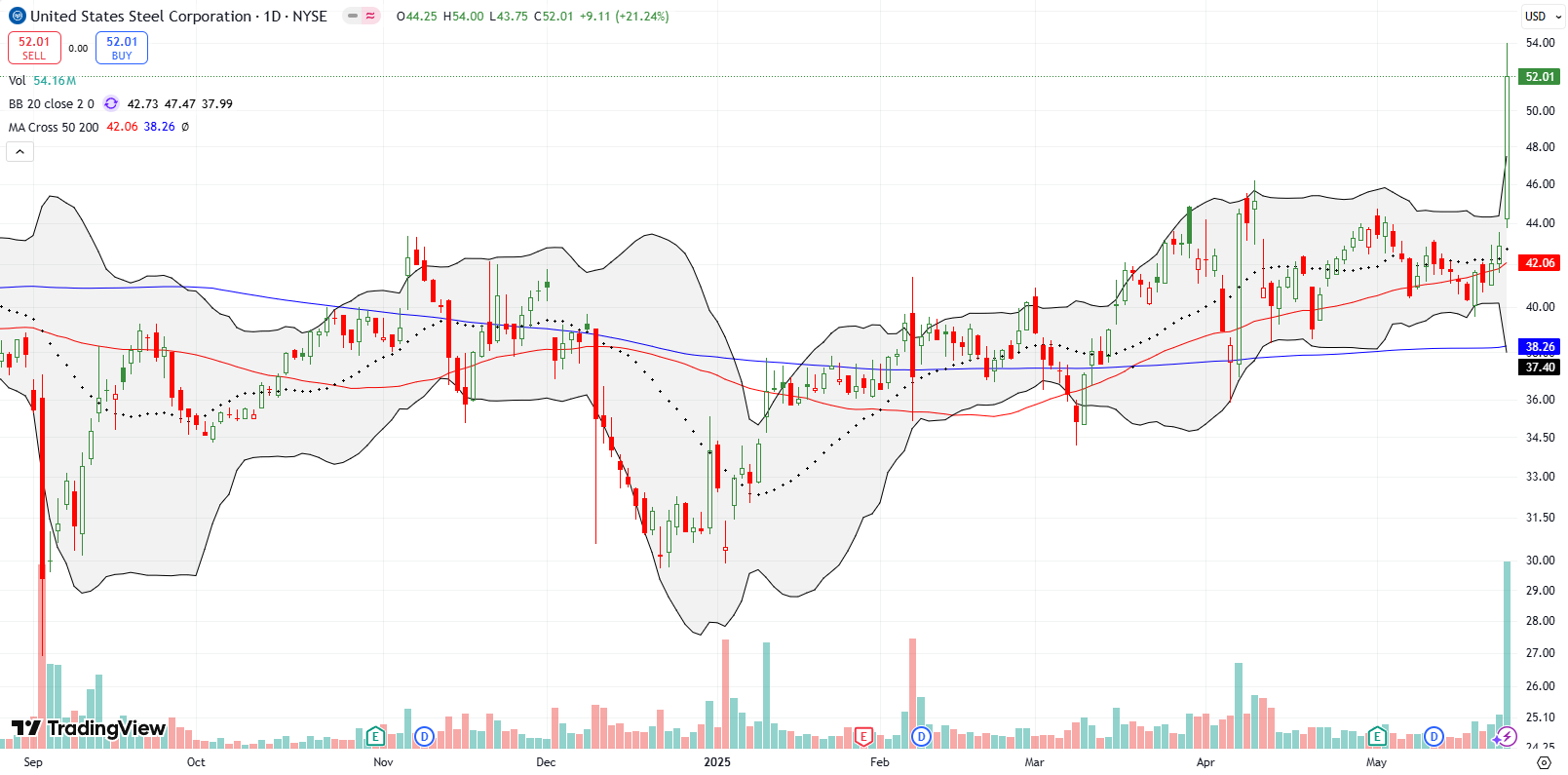

United States Steel Corporation (X)

US Steel surged 21% on news that Trump supports a “partnership” with Nippon Steel, following a successful security review. The stock was up 2% on each of the two previous days off 50DMA support, an early buying signal I completely missed!

Deckers Outdoor Corporation (DECK)

DECK collapsed 20% post-earnings and returned to April’s tariff-related lows. This is a confirmed technical breakdown, and I am staying away from long trades here. I prefer to fade DECK on rallies from here even with the stock cut in half since its all-time high just 4 months ago.

Landstar System, Inc. (LSTR)

LSTR is a logistics and transportation play focused on trade across Canada, the U.S. and Mexico. Thus I keep an eye on the stock as a potential indicator for sentiment on the prospects for trade in this moment of economic chaos. LSTR had a brief respite after gapping higher post-earnings. However, sellers quickly took the stock down and LSTR ended the day with a loss. At Friday’s tariff-burdened close, LSTR finished closing the gap higher from the US vs China trade ceasefire. LSTR looks ready to test the March and April lows.

Informatica Inc. (INFA)

INFA provided a significant reminder of the importance of price alerts as a trading tool. Late into Friday’s trading, I received a price alert that analytics platform INFA had jumped 6%. I jumped into action as well. I saw no immediate news on briefing.com. The Stocktwits chatter reminded me about last year’s drama around Salesforce’s (CRM) plans to acquire Informatica. Despite ultimately getting burned by INFA’s on-going sell-off, I held out hope that at some point the stock would turn around. I next reviewed options action and found my confirming buy signal. Options volume had surged for June and July expirations. I rushed to buy shares and call options. In less than an hour, the call options doubled and, per rule, I took profits. I held the shares into the close with the stock finishing the day up 17.6%.

After the market close came the news: Salesforce Back In Talks To Buy Informatica: Reports. If the rumors are true, CRM will need to move fast before price runs away from them. Note how at one point INFA closed the post-earnings gap down from February.

Domo, Inc. (DOMO)

INFA’s news took on extra significance for me because of a strong post-earnings performance from analytics platform DOMO the day before. The stock rallied 26.9% post-earnings. I missed the trade, and I am holding out hope for a pullback to $10. Friday’s follow-through buying makes such a pullback increasingly unlikely. I first used Domo over three years ago when the platform was mediocre at best and my colleagues hated it. I am using Domo again for one of my analytics consulting clients, and now I am greatly impressed with the platform. With earnings coming up, I just could not bring myself to speculate just yet. DOMO remains almost 90% down from all-time highs in 2021.

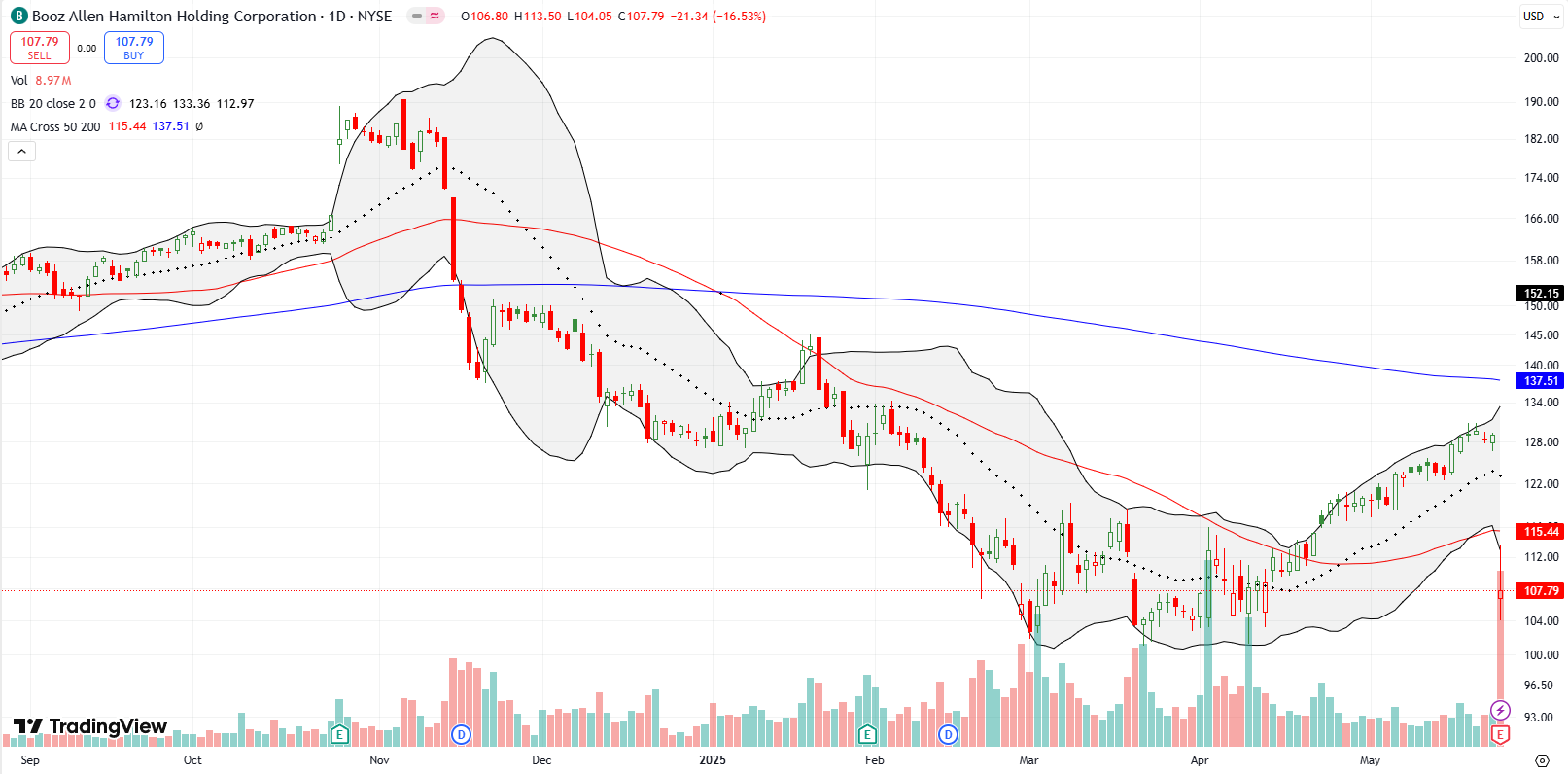

Booz Allen Hamilton Holding Corporation (BAH)

I am still waiting for the full fallout from the on-going cuts in the Federal bduget. Consulting company BAH dropped 16.5% post-earnings, reigniting concerns about the impact of federal budget cuts on consulting and contracting firms. BAH went from bold talk in its January’s earnings call like:

“….we find ourselves in an excellent position to support the priorities of the new administration. First, our multiyear effort to become faster at everything allows us to match the velocity of change underway. Second, we are one of the few technology companies able to both innovate and deliver at scale. We have long been advocates of maximizing dual-use commercial technologies and increasing the use of AI to generate efficiencies. The combination of our own technology, our highly productive partnerships across tech and our extraordinary people give us the edge on speed to outcome.

And third, speaking of outcomes. For quite some time now, we have prepared and advocated for a move towards outcome-based contracting as a model to create both efficiency and faster impact across the missions we support. We expect this trend to accelerate in the current environment. For all these reasons and more, I am excited about what’s ahead.”

To this more sober perspective in last week’s earnings call:

“The federal government is rethinking agency emissions, finding ways to accomplish those missions differently and looking for ways to reduce spending and increase efficiency. To get there, we are seeing agency reorganizations, reductions in government personnel and spending levels as well as contract reviews. These are especially acute in civilian agencies, and as a result, we are seeing a decrease in the pace of awards in civil, as well as run rate changes in some of our contracts.

At the same time, the government is leading initiatives to improve procurement regulations and practices such as the revision of the federal acquisitions regulation or far, and we expect to see more contracts move to fixed price and outcome based. We also see a focus on massively upgrading legacy systems and rapidly injecting advanced technology into revised missions…

In combination, these dynamics are currently impacting Booz Allen’s view of FY ’26. We believe that our defense and national security portfolio will continue to grow this year, as we accelerate the injection of AI and commercial technology into missions. In contrast, we expect our Civil business to decline this year…

…the run rate on five large technology contracts has been reduced significantly in support of the administration’s desire to reduce spending overall…As we proactively anticipate continued market and budget dynamics, we have made the decision to restructure and reset our civil business. We are making targeted cost and head-count reductions to match anticipated demand. These are a combination of reductions in bench, delayering of management and adjusting our infrastructure to match. These decisions are difficult, and they are not taking lightly. Our actions are very targeted, and we believe that they will preserve and enhance our ability to invest both in our business and in our people.”

I have to assume this sobering reality will be even more clear for more companies in the next earnings cycle and beyond. I will watch for a BAH retracement into the $83–100 range as a potential long-term buy. In the meantime, this sell-off also makes me much more wary of hanging onto Accenture (ACN) through its next earnings announcement.

Be careful out there!

Footnotes

Subscribe for free to get email notifications of future posts!

“Above the 50” (AT50) uses the percentage of stocks trading above their respective 50-day moving averages (DMAs) to measure breadth in the stock market. Breadth defines the distribution of participation in a rally or sell-off. As a result, AT50 identifies extremes in market sentiment that are likely to reverse. Above the 50 is my alternative name for “MMFI” which is a symbol TradingView.com and other chart vendors use for this breadth indicator. Learn more about AT50 on my Market Breadth Resource Page. AT200, or MMTH, measures the percentage of stocks trading above their respective 200DMAs.

Active AT50 (MMFI) periods: Day #24 over 20%, Day #22 over 30%, Day #17 over 40%, Day #12 over 50%, Day #10 over 60%, Day #3 under 70%

Source for charts unless otherwise noted: TradingView.com

Full disclosure: long IWM shares and calls, long FICO, long SPY shares and put and calendar call spread, long GLD call spread, long AAPD, long GOOG, long INFA, long ACN

FOLLOW Dr. Duru’s commentary on financial markets via StockTwits, BlueSky, and even Instagram!

*Charting notes: Stock prices are not adjusted for dividends. Candlestick charts use hollow bodies: open candles indicate a close higher than the open, filled candles indicate an open higher than the close.

* Blog notes: this blog was written based on the heavily edited transcript of the following video that includes a live review of the stock charts featured in this post. I used ChatGPT to process the transcript.

Wall Street has coined an acronym for the numbness you mention in your SPY commentary: TACO.

“Trump Always Chickens Out”

Good one! ROFL!!!!

Is LSTR a buy at this price?

I don’t want to buy LSTR because of its reliance on Canada – Mexico -US trade.