The Timing and the Stock Charts

During the analyst conference call explaining the deal to buy William Lyon Homes (WLH), CEO Sheryl Palmer revealed that Taylor Morrison Home Company (TMHC) began buy-out talks several months ago. That was a time of rising optimism for home builders. The announcement of the deal came shortly after investors sold off the stock in response to the Q3 earnings report. TMHC also suffered from a general pullback in sentiment right after the iShares Dow Jones Home Construction ETF (ITB) finally finished recovering all its losses from the January, 2018 climactic peak. The deal greased the skids to the tune of a 5.0% loss. Sellers are now pressing TMHC into a critical test of support at its 200-day moving average (DMA). I was very fortunate to take cues from the post-earnings 50DMA breakdown to lock in profits on my TMHC position.

Source for charts: FreeStockCharts

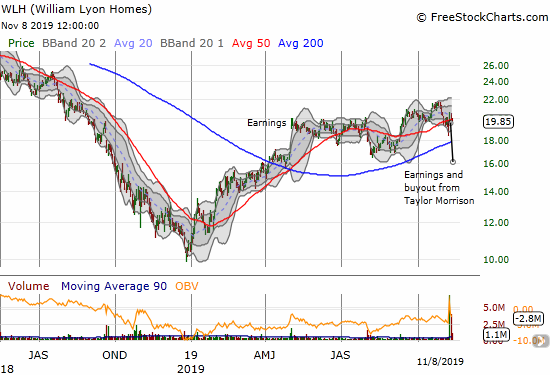

The stock chart for WLH is very striking and telling. While most home builders raced this year to erase the losses from their climactic January, 2018 peaks, WLH essentially stalled after May. At the October high, WLH was up 105% from the climactic December low. However, WLH imploded so much in 2018 that the October peak was STILL about 33% off the January top. In other words, WLH looks like damaged goods being bought at a necessary discount. For comparison, TMHC at its October peak was up 82% from its December low (which was actually not quite as low as the October, 2018 low), and exactly matched its January, 2018 peak (like ITB).

The Doubts

Several analysts on the call expressed subtle and not-so-subtle skepticism about the wisdom and pricing of the deal. Taylor Morrison bragged about the book value acquisition price for William Lyon, but that cheap price also suggested a bit of desperation from William Lyon to sell itself. Indeed, one analyst claimed that it was no secret that William Lyon was on the market. At the time of writing, WLH is trading at a 12.5 trailing P/E, 8.9 forward P/E, 0.4 price/sales, and 0.8 price/book. This valuation is recession-level pricing. TMHC trades at 11.4 trailing P/E, 7.0 forward P/E, 0.5 price/sales, and 0.9 price/book. This valuation is also surprisingly low. (All valuations from Yahoo Finance). The combination of strong financial performance and cheap valuation got me into TMHC. Yet this combination of low-valued companies does not seem poised to create a premium the market is willing to pay.

An analyst pointed out that absorptions for William Lyons are down 20% from a year ago. William Lyons has 54% of its business in the entry-level market (28% 1st move-up), and this decline in absorptions runs counter to the success most builders have experienced in that segment. This large entry-level share will move Taylor Morrison from a 28% to a 36% entry-level share. California is the largest market for William Lyons at 29%, probably another strike given the affordability issues in the state. The combined company will have a #1 position in the extremely expensive San Francisco, CA market. Fortunately, Texas is the second largest market for William Lyons at a 21% share.

Cost Efficiency Catalysts

The deal makes the combined company the #5 home builder in the U.S. and top 5 in 16 of its 23 combined markets. WLH brings new markets to TMHC in Seattle, Las Vegas, and Portland. The drive for size and scale makes sense as the other large home builders have all consistently touted their scale as key competitive advantages for driving down construction costs and the cost of land acquisition at a time when home buyers are ever more price sensitive. With these pressures at work, the CFO’s estimate that 75% of the deal synergies will come from overhead says plenty about the driving catalyst for this deal; bad for the employees under SG&A, good for the business. Taylor Morrison’s presentation indicates a total of $80M in “annualized run-rate synergies.”

Show Me

In summary, I am not interested in buying into this deal at the moment. I want to see evidence that the combined company is able to perform better than the two companies separate. Based on the management commentary in the analyst call, I do not expect this evidence to prove out for at least a year or more. In the meantime, I will be looking elsewhere for buying opportunities during the seasonally strong period for buying the stocks of home builders.

Full disclosure: no positions