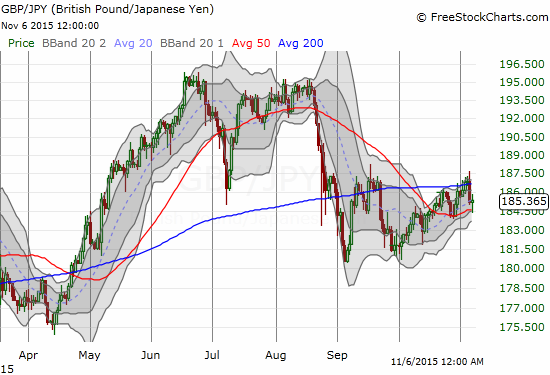

This past week was an important one for monetary policy. The Bank of England (BoE) made clear it is willing to put off rate hikes as long as necessary. Despite its words that suggest otherwise, the Bank is NOT biased for action. U.S. Federal Reserve Chair Janet Yellen made it clear that, all else being equal, the Fed prefers to get going with hiking rates. The Fed now clearly occupies a policy island where it is the only major central bank seriously contemplating near-term rate hikes.

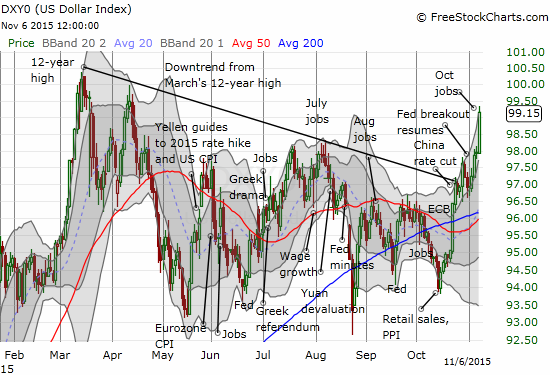

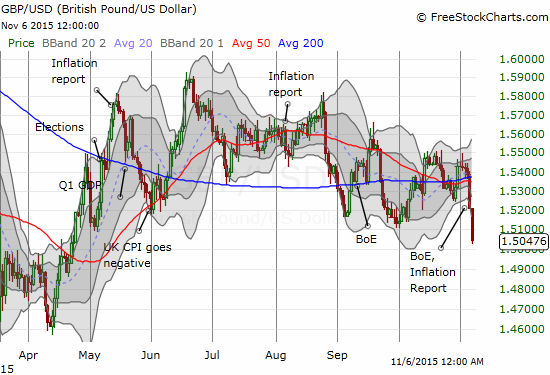

The strong economic data coming from the latest U.S. jobs report provided the perfect follow-through to Yellen’s commentary. The end result is a U.S. dollar index (UUP) charging full steam ahead, and a British pound (FXB) confirming an on-going retreat.

Source for charts: FreeStockCharts.com

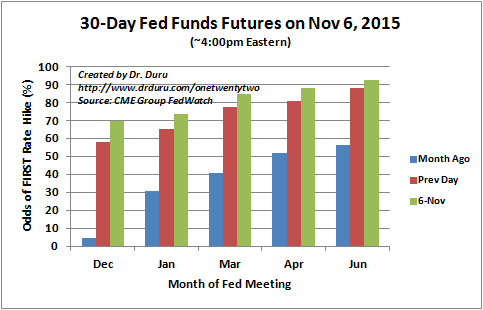

The 30-day Fed Funds Futures have effectively announced that a Fed rate hike is coming in December. I believe these are the highest odds of a rate hike for an upcoming meeting ever since the handwringing began in earnest over the timing of a Fed rate hike.

Source: CME Group FedWatch

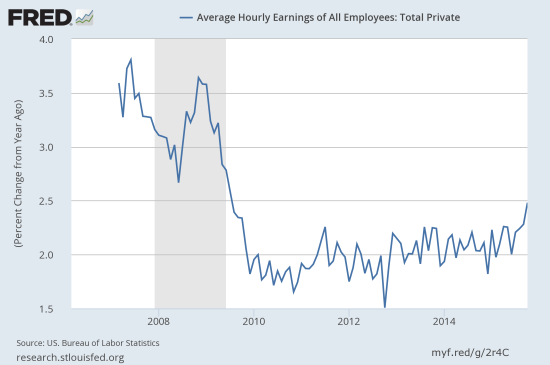

The jobs report was strong with an unemployment rate at 5.0% and the addition of 271,000 jobs for October. Perhaps most telling is a breakout in wage growth. The Fed has had a habit of hesitation in the face of sluggish wage growth. It looks like one more excuse for inaction is fading to the background.

Source: US. Bureau of Labor Statistics, Average Hourly Earnings of All Employees: Total Private [CES0500000003], retrieved from FRED, Federal Reserve Bank of St. Louis, November 7, 2015.

The Bank of England is surprisingly dovish. The tone during last week’s Inflation Report sometimes made me think that the BoE is still locked into the dour sentiment from the August Angst. The Bank appears just as bearish on global growth as it is bullish on UK economic strength. The BoE is particularly concerned with growth in emerging markets and how any fallout will impact UK economic performance (through exports). The BoE used these concerns as an easy excuse to pedal ever-softer on rate hikes.

The November Inflation Report from the Bank of England was surprisingly dull. I did not even find much of interest in the Q&A session as Carney seemed prone to ramble and use a lot of words to say next to nothing. So this time around, I am not summarizing the report and just have a few points to make. The headline message on the British pound is one of weakness. The BoE implied several times that it prefers a weaker currency. As the charts above demonstrate, the market is all too happy to comply right now.

“By themselves, weaker global activity and associated falls in risky asset prices are expected to weigh on the outlook for UK GDP and inflation, but a lower level of sterling and the lower path for Bank Rate support it. The MPC’s latest projections for growth and inflation (Charts 5.1 and 5.2) are therefore broadly similar to those in the August Report in the medium term, although inflation is a little higher by the three-year point (Chart 5.4).”

In other words, if the British pound resumed earlier strength, it would act as a headwind economic growth and inflation…and further dissuade the Bank of England from hiking interest rates anytime soon.

“Since August, commodity prices have fallen further but a lower sterling ERI is likely to support import prices.”

In other words, the Bank of England is expecting a weaker currency in the near future.

Yet, in a reverse twist, the Bank of England complains that the strength since the pound last bottomed in 2013 is helping to hamper exports.

“Although sterling has depreciated by around 2% since the August Report, it remains 18% above its trough in March 2013 (Section 1). That appreciation of sterling, together with weak world GDP growth, is expected to weigh on UK exports and boost imports such that net trade continues to drag on GDP growth over the next few years (Section 5).”

Supporting the BoE’s currency concerns is a refinement of its model of pass-through inflation from the currency. The Bank now expects a slightly greater transmission of deflationary pressures from a stronger currency.

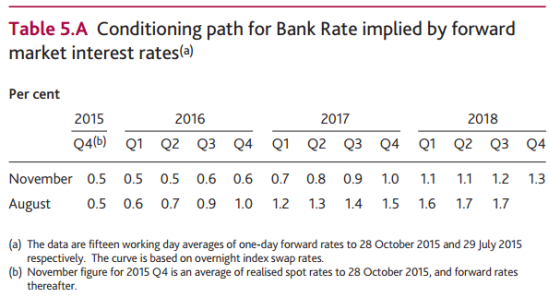

The most revealing moments came from the Bank’s commentary on the market’s expectation for rate hikes. The chart below shows how the market has pushed out the first rate hike from Q1 2016 to Q3 2016. The trajectory has also flattened out a bit.

Source: Bank of England, November, 2015 Inflation Report

Governor Mark Carney claimed that the Bank is not simply endorsing a market view. However, the Bank also did absolutely nothing to disabuse the market’s assumption rate trajectory projections. This effectively endorses the projections. Recall that Carney had no problem a year and a half ago scolding the market over projections hee felt were not properly pricing in the likely imminent arrival of rate hikes. On this point, the Bank of England has further diverged from the U.S. Federal Reserve on monetary policy. The Fed through Chair Yellen has actively worked to convince the market to pull its rate hike expectations forward in time.

Under these conditions, I can no longer bias bullish for trading the British pound. I am now much more flexibly going short the British pound. I am fully bullish on the U.S. dollar. I am using GBP/USD as a bridge that hedges my trading.

With the Bank of England in retreat, the Fed is truly on its own policy island. Just call the Federal Reserve “Gilligan”…as in stuck on Giligan’s (policy) island. The rest of the world is like “shutdown” football cornerback Darrelle Revis…circling the Fed waiting and waiting and waiting for the Fed to make a move…

Be careful out there!

Full disclosure: net long the U.S. dollar, net short the British pound (a hedge on both positions is a long GBP/USD)