Stock Market Commentary

Reality bites. And right now those bites are clamping down on rotten eggs in the form of a swift repricing of risk. Once high priced eggs are now eggs few shoppers want. Last week’s theme of bring the pain continued in force at this week’s open: more economic uncertainty, more economic fears, more geopolitical tensions. Just one rotten egg after another. The economic warfare unfolding between the U.S. and Canada is one of many symbols of the disrupted assumptions that have formed firm foundations for market complacency for quite some time. The feisty and fiery rhetoric from recently appointed Canadian Prime Minister, and former Governor of the Bank of Canada and Governor of the Bank of England, Mark Carney symbolizes well the economic risks ahead. I use key quotes from his speech to say everything I need to say on why traders and investors should brace themselves. (I discuss what “bracing” means after I review the major stock market indices).

“There’s someone who’s trying to weaken our economy: Donald Trump. And Donald Trump as we know has put, as the Prime Minister just said, unjustified tariffs on what we build, on what we sell, on how we make a living. He’s attacking Canadian families workers and businesses, and we cannot let him succeed and we won’t…I am proud of the response of Canadians…

Americans want our resources, our water, our land, our country. Think about it, if they succeeded, they would destroy our way of life. In America health care is a big business. In Canada, it is a right. America is a melting pot. Canada is a mosaic…

Canada never ever will be part of America in any way shape or form…

These are dark days. Dark days brought on by a country we can no longer trust. We are getting over the shock, but let us never forget the lessons. We have to look after ourselves.”

The Stock Market Indices

The S&P 500 (SPY) failed to hold important support at its 200-day moving average (DMA) (the blue line below). The 2.7% loss on the day sent the index to a 6-month low. This milestone also erases all the S&P 500’s gains since the Federal Reserve’s first rate cut…as if losing all its gains since the election was not already ominous enough! The purple horizontal line below that defines the bottom of the post-election gap now looms overhead as ominous price resistance when combined with the 200DMA.

Once the S&P 500 lost 3% on the day, I finally took profits on my put spread. I was reluctant to lose that partial hedge on bullishness given all the rotten eggs stinking up the market. However, the index was also trading well below its lower Bollinger Band (BB) beyond which price action becomes a statistical outlier. There is no need to get greedy with bearish positions when the market is so close to oversold trading conditions.

The NASDAQ (COMPQX) plunged like a basket of rotten eggs no one wants to hold. The tech-laden index lost 4.0% on the day and also closed at a 6-month low. The NASDAQ index looks even worse than the S&P 500 because it confirmed a 200DMA breakdown last week with a second lower close below that trend line. Today’s plunge put an exclamation point on the confirmation. Moreover, the NASDAQ is below the double-top formed across last summer and fall. Thus, 200DMA resistance looms overhead even more ominously.

The iShares Russell 2000 ETF (IWM) edged ever closer to returning to an official bear market, defined as a 20% pullback from all-time highs. IWM lost 2.5% and closed at a 9-month low. Unlike previous extreme moves in IWM, I took a rest on taking a chance buying IWM call options.

The Short-Term Trading Call With Rotten Eggs

- AT50 (MMFI) = 25.2% of stocks are trading above their respective 50-day moving averages

- AT200 (MMTH) = 35.8% of stocks are trading above their respective 200-day moving averages

- Short-term Trading Call: cautiously bullish

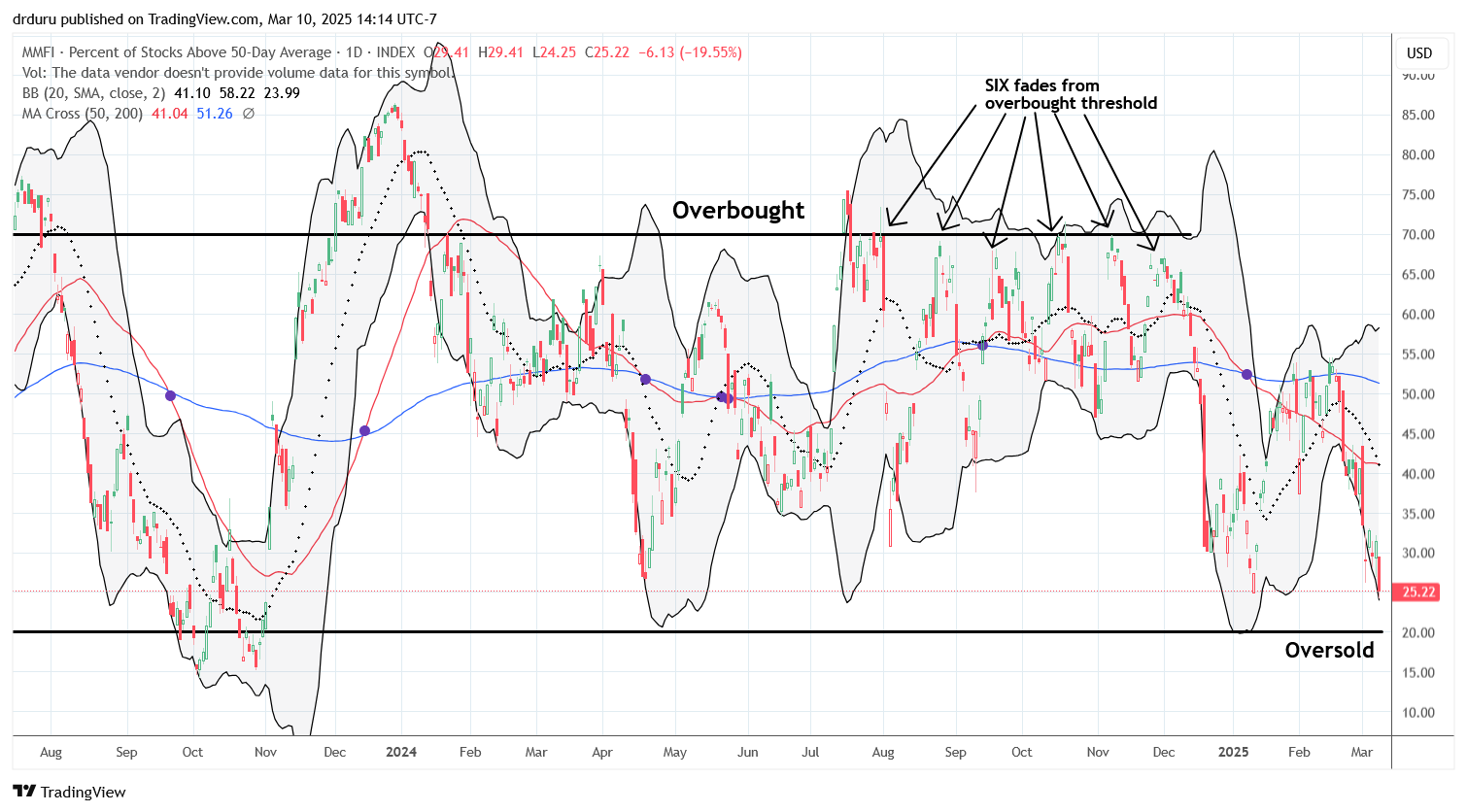

AT50 (MMFI), the percentage of stocks trading above their respective 50DMAs, lost another six percentage points to close at 25.2%. My favorite technical indicator is now within 5 percentage points of the official oversold threshold of 20%….and I wish AT50 would hurry up with this downward trajectory, so I can comfortably trigger the AT50 trading rules.

With the major indices below their 200DMAs, the market is effectively in bearish territory with rotten eggs dropping everywhere. AT200 (MMTH), the percentage of stocks trading above their respective 200DMAs, plunged even further than AT50. This gauge of the longer-term health of the market fell to a 16-month low and looks set to test its lows from October before some kind of sustainable bottom sets in.

This biting reality means “oversold enough” is no longer a thing; that concept only applies in bull markets. I now think of this market as a bear market even though neither the S&P 500 nor the NASDAQ have met the official definition with a 20% loss off all-time highs. Still, my short-term trading call remains at cautiously bullish as I tentatively pick through the rotten eggs for some resilient hard-boiled eggs…eggs I hope will stay intact at least for bounces back to overhead resistance levels.

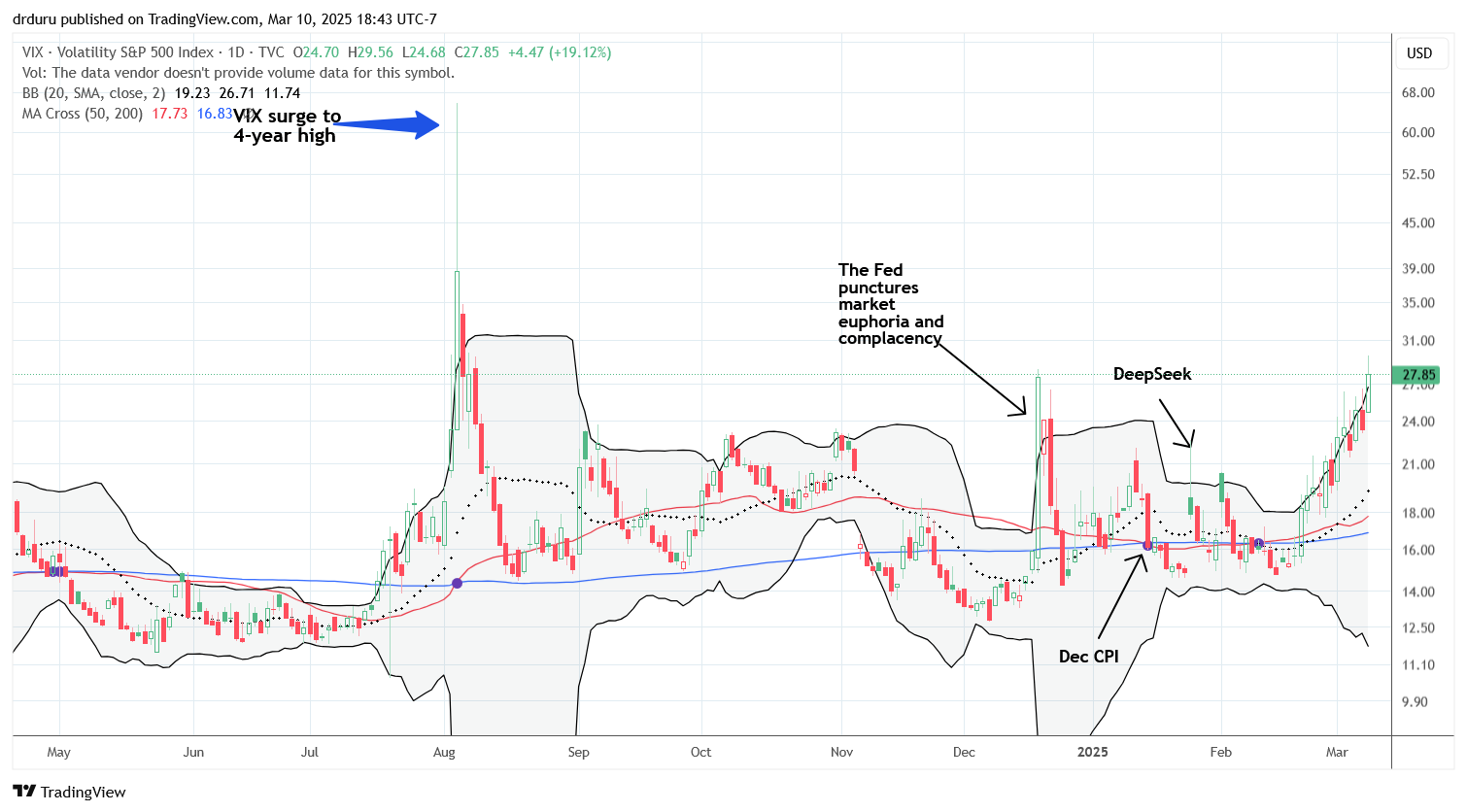

With persistent selling and the oversold threshold in sight, I have my eye on the volatility index (VIX). The best short-term trades coming out of oversold trading conditions occur with the VIX soaring to relatively new heights followed by an implosion in volatility. Three major spikes shown below delivered buying opportunities after volatility imploded. However, the last three major spikes created lower lows, meaning maximum fear became less and less intense. The current VIX has violated that comfortable pattern. Thus, this gauge of fear threatens to soar a lot higher before the much-anticipated volatility implosion. In other words, traders and investors need to brace themselves.

Long-term investors should not ignore what is going on. While this dip represents a good buying opportunity for high quality companies with good long-term prospects, the 200DMA threshold serves as a convenient tool for the risk averse who want to avoid chasing prices lower for an indefinite period. Simply wait for two closes above the 200DMA before allocating fresh capital. This approach also helps long-term investors avoid getting fooled and spun around by rebounds which soon get faded (dead cat bounces).

Short-term investors and aggressive long-term investors should now be on full alert for buying into oversold conditions accompanied by a large surge in the VIX and/or a VIX implosion. I plan to post such an event on my social media channels and/or Youtube (see links at the end of this post).

Now here is the tiniest of samples of the rotten eggs in the stock market.

I never understood how or why Reddit, Inc (RDDT) soared so high. Thus, I am less startled by its 52.4% plunge from all-time highs set just last month and more amazed at how the stock tripled from its pre-earnings price in October. RDDT now sits on the precipice of 200DMA support with a close well below its lower BB. Thus, the “rubber band” is quite stretched for RDDT, and the stock could easily snap back and reverse today’s nasty 19.9% loss. Otherwise, a further breakdown from here sets the stock up to fill that October post-earnings gap.

Robotic surgery company Intuitive Surgical, Inc (ISRG) is one of those high quality companies with a high quality stock that must look attractive here for long-term investors. ISRG has even filled the gap from its October earnings. With the stock opening AND closing below its lower BB two days in a row, ISRG is primed for a snap back to 200DMA resistance conveniently sitting at the round number $500. Two closes above the 200DMA will motivate me to buy shares.

I end on a semi-positive note. Redfin Corporation (RDFN) has been in trouble ever since the Federal Reserve started hiking rates in 2022. Three years later, the unprofitable company has found a savior in Rocket Companies, Inc (RKT). RKT offered to buy out the company, sending its stock higher by 68%. Incredibly, that monster gain only took the stock back to where it traded in December. RDFN once traded close to $100…talk about rotten eggs falling from the sky.

As a RKT shareholder (from a previous job), I am quite displeased with this acquisition. I cannot image how RKT will be any better running this transactions-impaired business. Perhaps Rocket will pick the company apart for a few gems. RKT fell 15.4% on the news. The stock has been making a long, slow, painful recovery from the 2022 housing bear market.

Be careful out there!

Footnotes

Subscribe for free to get email notifications of future posts!

“Above the 50” (AT50) uses the percentage of stocks trading above their respective 50-day moving averages (DMAs) to measure breadth in the stock market. Breadth defines the distribution of participation in a rally or sell-off. As a result, AT50 identifies extremes in market sentiment that are likely to reverse. Above the 50 is my alternative name for “MMFI” which is a symbol TradingView.com and other chart vendors use for this breadth indicator. Learn more about AT50 on my Market Breadth Resource Page. AT200, or MMTH, measures the percentage of stocks trading above their respective 200DMAs.

Active AT50 (MMFI) periods: Day #308 over 20%, Day #1 under 30% (underperiod ending 28 days over 30%), Day #6 under 40% (underperiod), Day #18 under 50%, Day #45 under 60%, Day #146 under 70%

Source for charts unless otherwise noted: TradingView.com

Full disclosure: long IWM calls, long RKT

FOLLOW Dr. Duru’s commentary on financial markets via StockTwits, BlueSky, and even Instagram!

*Charting notes: Stock prices are not adjusted for dividends. Candlestick charts use hollow bodies: open candles indicate a close higher than the open, filled candles indicate an open higher than the close.

RDFN: my guess is, RKT has big plans for the data RDFN has and will acquire.

That’s a good culprit!