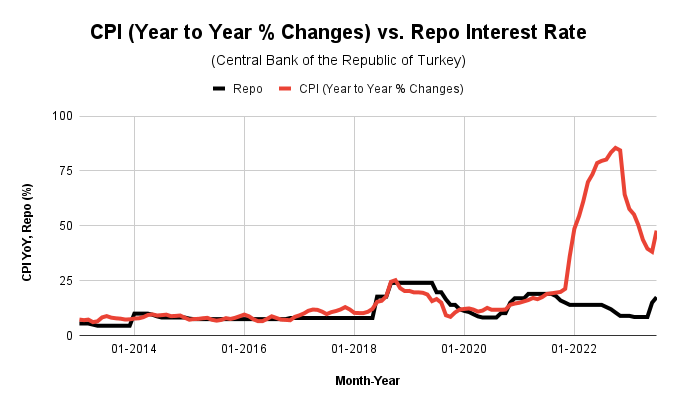

After Turkish President Recep Tayyip Erdoğan’s “war of economic independence” came to an official end, I waited for evidence that the Central Bank of the Republic of Turkey (CBRT) would get serious about fighting inflation. The monetary evidence may have arrived on August 24th in the form of a monster rate hike from 17% to 25%. In response to the surprise move, the Turkish lira gained over 5% on the U.S. dollar (USD/TRY dropped almost 6%). While lira sellers reversed half those gains the next day, I still think the CBRT sent a resounding message. This message reverses a disastrous monetary policy that help fan the flames of an inflation that has spread to 48% as of July. The graph below shows how persistent rate cuts in the repo rate from September, 2021 to February, 2023 supported an inflation raging out of control.

The CBRT is undoubtedly alarmed by the recent jump in inflation after several months of a sharp decline. The central bank cannot afford to let inflation resume an uptrend.

The Statement

Here is what the CBRT had to say about its decision to hike rates as much as it did:

“The Committee decided to continue the monetary tightening process in order to establish the disinflation course as soon as possible, to anchor inflation expectations, and to control the deterioration in pricing behavior.

Recent indicators point to a continued increase in the underlying trend of inflation. The strong course of domestic demand, cost pressures stemming from wages and exchange rates, stickiness of services inflation and tax regulations have been the main drivers. In addition to these factors, also driven by the rise in oil prices, higher-than-anticipated deterioration in inflation expectations and in pricing behavior implies a year-end inflation close to the upper bound of the forecast range provided in the Inflation Report (Report)”

The CBRT seems well aware that inflation is out of control. The central bank also has a LOT of work to do given its 5% inflation target! Thus, it is quite possible the repo rate will go higher still.

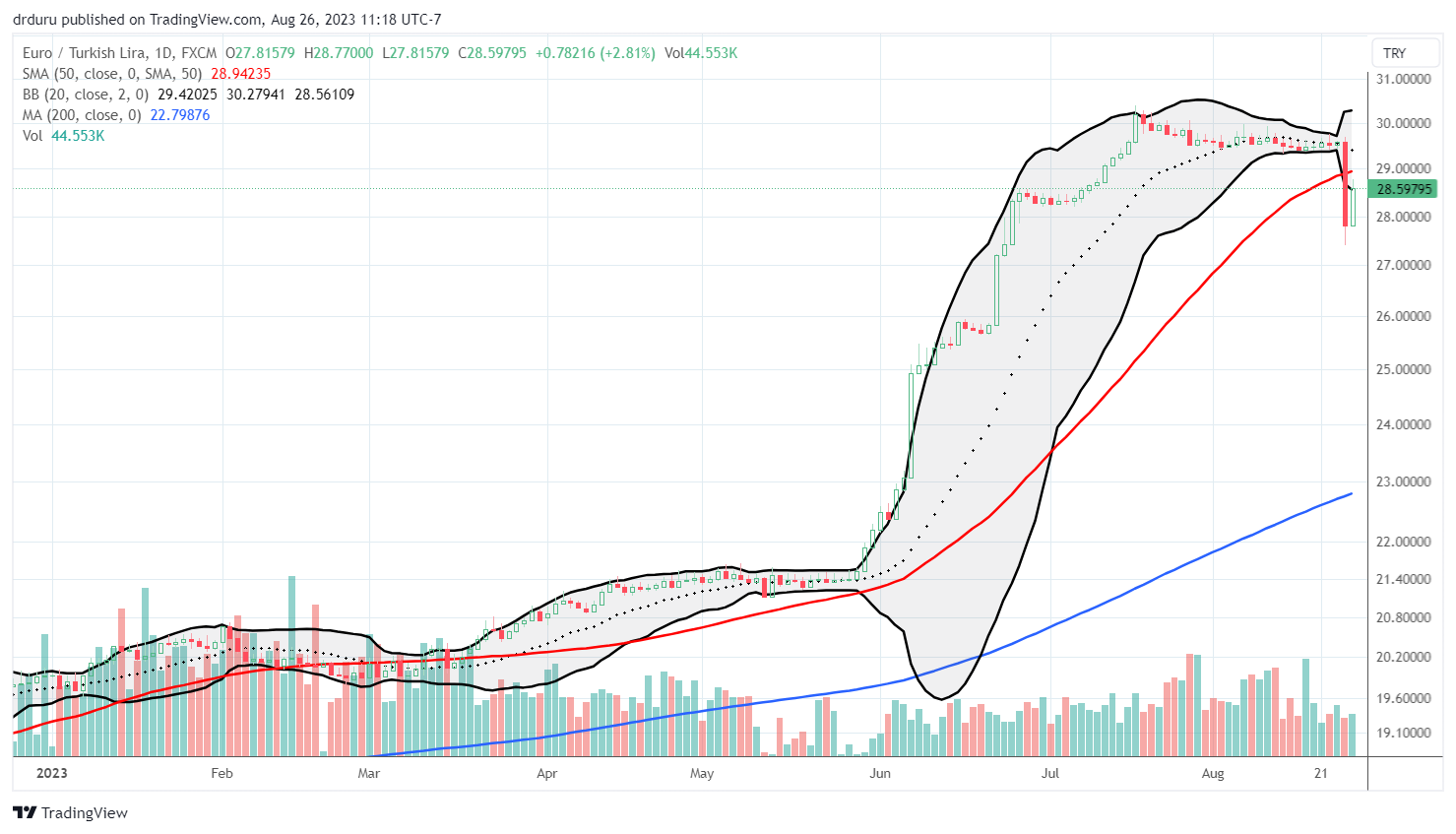

The Trade

I was short EUR/TRY going into this decision on monetary policy. The currency pair was drifting downward mainly thanks to weakness in the euro. EUR/TRY fell over 6% on Thursday before rebounding 2.8% on Friday. While I was sitting on a small (net) loss on my position, the breakdown below the 50-day moving average (DMA) (red line) made me comfortable enough to double down on my position by fading the rebound. If EUR/TRY moves significantly above the 50DMA again, I will be forced to rethink my position. Such a resumption in lira weakness would signal an alarming lack of faith in Turkey’s economic prospects. In the meantime, I will enjoy the much higher yields on my short EUR/TRY.

Interestingly, iShares MSCI Turkey ETF (TUR) has rallied the past two months and has well-outperformed U.S. markets in August. For example, the S&P 500 (SPY) is in a bearish technical position after selling off for most of August. TUR responded favorably to the CBRT decision with a 3.5% rally. TUR rebounded from initial selling on Friday. I am a buyer if TUR manages to confirm a breakout above the 2023 high set at the beginning of the year. At that time, TUR hit a 4 1/2 year high.

Be careful out there!

Full disclosure: short EUR/TRY