Brutal Failure

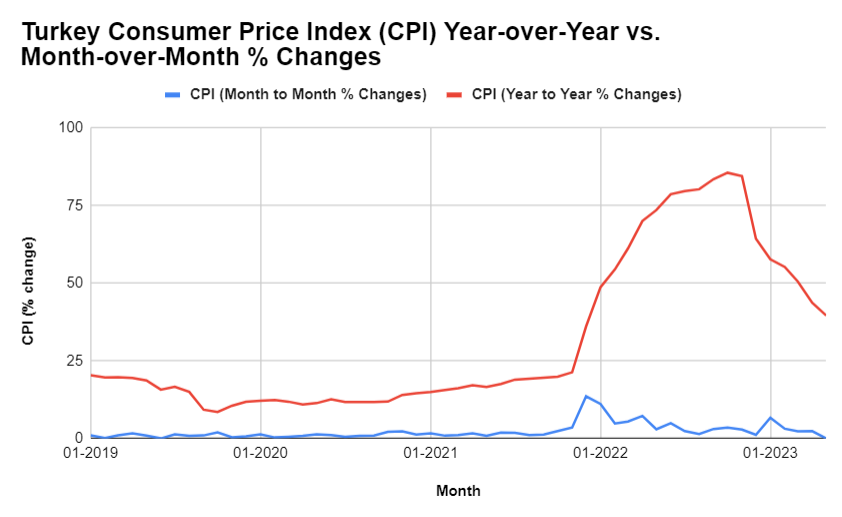

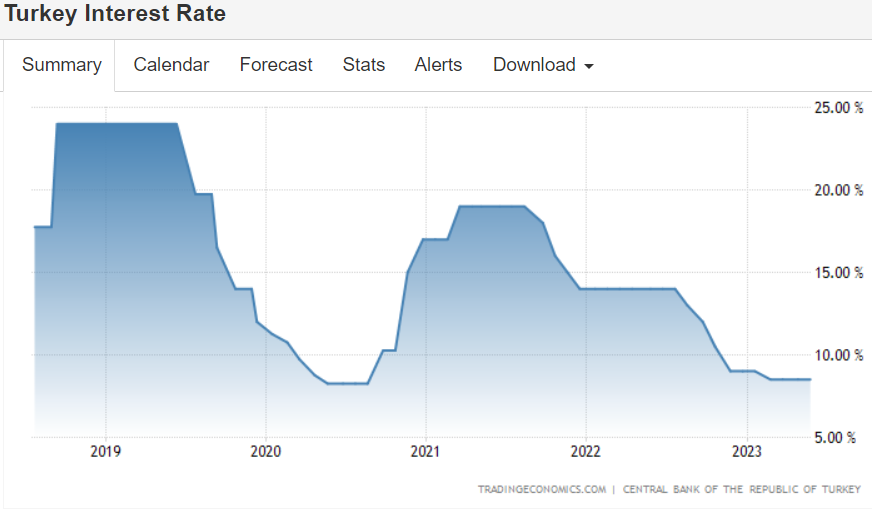

Turkish President Recep Tayyip Erdoğan’s “war of economic independence” has ended in a brutal failure. The president used his central bank to fight inflation with rate cuts and lost in spectacular fashion. This experiment with unconventional monetary policy severely devalued the Turkish lira (USD/TRY) and helped to generate massive inflationary pressures. The chart below shows surge of inflation in Turkey as the Central Bank of the Republic of Turkey (CBRT) marched to Erdoğan’s economic orders with rate cuts starting in September, 2021. The second chart shows the path of CBRT interest rates. Each subsequent rate cut has supported further devaluation for the Turkish lira. (Data from the CBRT and Trading Economics).

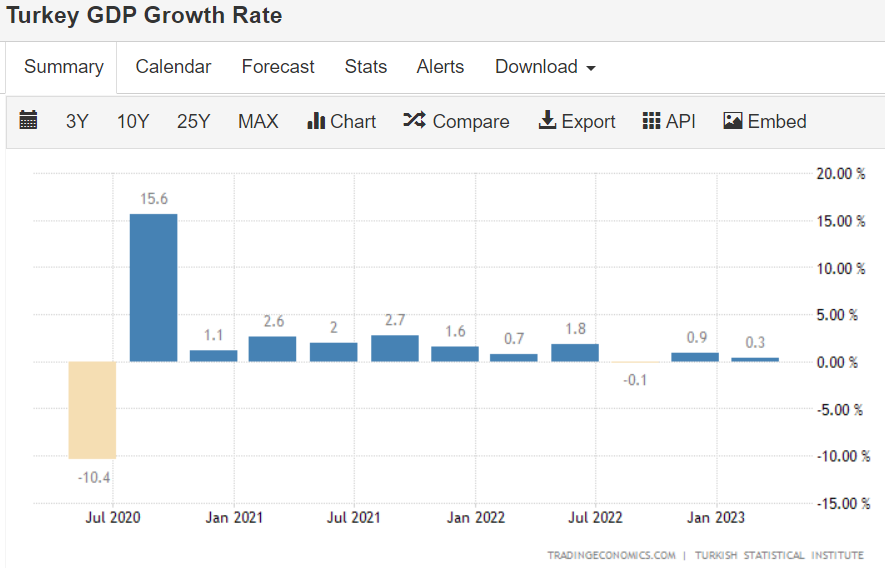

While the purchasing power of Turkish citizens eroded at an alarming rate, economic growth remained anemic. Quarterly GDP growth has been barely above zero during the time of the rate cuts. I am frankly surprised growth has been positive at all. (Data from Trading Economics)

Despite these economic issues, Turkish citizens re-elected Erdogan on May 28th to a third 5-year term. He in turn will reportedly appoint a free marketer for his next Finance Minister, Mehmet Simsek. Reuters described Simsek as “a former deputy prime minister who is well regarded by foreign investors.” Erdogan may also replace the head of the CBRT with Hafize Gaye Erkan, “a U.S.-based senior finance executive.” Reuters did not speculate on whether Erkan would be allowed to do her job without interference from Erdogan, but I find it instructive that Erdogan is making Sahap Kavcioglu, the current head of the CBRT, the latest fall guy for failed monetary policies. So much for receiving thanks for following instructions!

Accelerated Losses for the Turkish lira

This combination of news accelerated losses for the Turkish lira. Rate cuts since 2021 have driven USD/TRY higher (which means a weaker Turkish lira). Free market policies will likely stop the bleeding of reserves that were used to prop up some semblance of value for Turkish lira deposits. Lira sellers are getting ahead of this change. The announcement of this lira support program drove USD/TRY sharply lower for a week. USD/TRY has trended higher ever since….and caused massive losses for Turkish currency reserves.

The Trade

With the interest rates back to levels last seen in 2020, rate hikes are likely around the corner. However, the on-going recovery from the massive earthquake on February 6th complicates near-term policy prescriptions. In its last statement on monetary policy, the CBRT held rates steady including the following explanation:

“While level and underlying trend of inflation continue to improve with the support of the implemented integrated policy approach, the effect of earthquake-driven supply-demand imbalances on inflation is closely monitored. It has become even more important to keep financial conditions supportive to preserve the growth momentum in industrial production and the positive trend in employment after the earthquake. Accordingly, the Committee has decided to keep the policy rate unchanged. The Committee assessed that the current monetary policy stance is adequate to support the necessary recovery in the aftermath of the earthquake by maintaining price stability and financial stability. The effects of the earthquake in the first half of 2023 are closely monitored.”

Still, I shorted a small amount of EUR/TRY to play the prospect of rate hikes (I did not want to short the dollar ahead of this week’s Federal Reserve meeting). If nothing else, last week’s acceleration of lira losses is extreme and bound to exhaust itself soon. If rate hikes come, I expect some trigger buying in the lira. But just as prior rate hikes only provided a brief respite for the lira, I expect the same to happen here. The Turkish economy has accumulated structural problems that will require many years to fix. The election of a third-term President is not likely to spark meaningful reforms. Thus, my long Turkish lira trade is short-term trade.

Epilogue

In “The Price of Time: The Real Story of Interest“, author Edward Chancellor points out how over the centuries governments and banksters have debated the role and control of rates in economies and societies. Chancellor points out how time and time again, low interest rates have been used to goose the value of assets and inject a quick fix salve for ailing economic growth. Yet, over-reliance on low rates tends to beget lower rates over time. Chancellor argues that advanced economies are currently stuck in this cycle. Turkey’s attempt to keep up with the low rate trend should get its own chapter in a future edition!

That chapter should start with the nearly laughable objectives of the CBRT in the face of its stratospheric inflation rate (emphasis mine):

“The CBRT will continue to use all available instruments decisively until strong indicators point to a permanent fall in inflation and the medium-term 5 percent target is achieved in pursuit of the primary objective of price stability. The CBRT will implement Liraization Strategy in order to create an institutional basis for permanent and sustainable price stability. Stability in the general price level will foster macroeconomic stability and financial stability through the fall in country risk premium, continuation of the reversal in currency substitution and the upward trend in foreign exchange reserves, and durable decline in financing costs. This would create a viable foundation for investment, production and employment to continue growing in a healthy and sustainable way.”

Be careful out there!

June 22 update: The Central Bank of the Republic of Turkey hiked rates as expected, but the Turkish lira sold off sharply anyway. Apparently, the move from 8.5% to 15% was apparently short of expectations for a hike to 20%! So, I will likely need to stop out of my long position soon.