Housing Market Intro and Summary

The housing data for April and now May confirm that the housing market had a kind of false start to the Spring selling season. Normalization continues to pressure short-term trends. Housing starts, new home sales, existing home sales, and home builder sentiment are in key downtrends. These measures are now well off pandemic highs set late last year. Yet, demand remains strong enough to continue pushing prices higher and constraining absolute inventory levels. The on-going bullishness of home builders masks the potential for or specter of an outright slowdown in the housing market even as the Federal Reserve finally considers bringing an end to its extraordinary monetary supports to the market.

Housing Stocks

The iShares Dow Jones US Home Construction Index Fund (ITB) fell for a second month in a row. The month of June ended ITB’s uptrend as defined by the 50-day moving average (DMA) (red line below). The wavering underperformance of ITB aligns with an underwhelming Spring selling season. As normalization takes hold in the housing market for many more months, I expect ITB to trade sideways at best.

On a relative basis, M.D.C. Holdings (MDC) is one of the worst performers among the builders. After a short post-earnings recovery in early May, sellers took control of the stock. A two-month downtrend took MDC nearly straight down for a 19.7% loss at one point off the May peak.

KB Home (KBH) recently suffered a 6.7% loss following its last earnings report. While sellers have failed to follow through on the post-earnings downward pressure, the overall downtrend in KBH from its May highs matches the pattern of many home builders. The price action confirms the disappointing messaging from the Spring selling season.

Ironically, while Lennar Corporation (LEN) suffered greatly from the pullback in May, the stock is now out-performing the group. A strong earnings report last month turned LEN into a relative out-performer. The stock even managed to break out above 50DMA resistance. I wrote more about the lessons from Lennar’s earnings in Lennar Corp Throws Another Save for the Trade On Home Builders.

Housing Data

New Residential Construction (Single-Family Housing Starts) – May, 2021

Single-family home starts increased to 1,098,000 which was 4.2% above April’s 1,054,000 starts (revised downward from 1,087,000). Starts were 49.8% above last year’s pandemic impacted levels. The rate of year-over-year change has remained positive for eleven straight months.

The chart below shows the return to the post financial crisis trend for housing starts has created a definitive downtrend from the 14-year high set in December, 2020. Assuming the longer-term trend holds, starts should hold the 1,000,000 level as a low.

Source: US. Bureau of the Census, Privately Owned Housing Starts: 1-Unit Structures [HOUST1F], first retrieved from FRED, Federal Reserve Bank of St. Louis, July 4, 2021.

The Northeast led year-over-year gains across all regions for a second month. Housing starts in the Northeast, Midwest, South, and West each changed +80.0%, +70.7%, +46.7%, +40.3% respectively year-over-year.

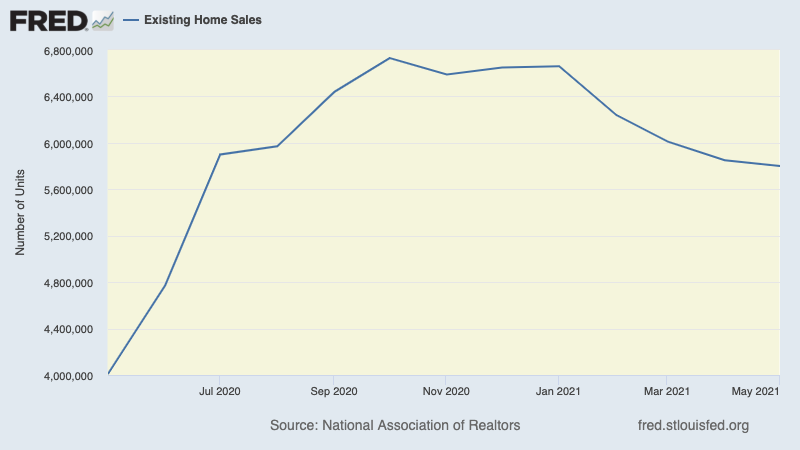

Existing Home Sales – May, 2021

For the second straight month, the report on existing home sales included classic signs of a housing slowdown: increasing absolute inventory along with declining sales. Once again, I saw no direct recognition of these developments.

Existing home sales dropped below levels last seen July, 2020. The market for existing homes essentially missed the spurt that the Spring selling season is supposed to bring. Perhaps the surge in late 2020 pulled forward a lot of demand. The seasonally adjusted annualized sales in May of 5.80M decreased 0.9% month-over-month from the non-revised 5.85M in existing sales for April. For the third month in a row, the National Association of Realtors (NAR) blamed the monthly drop in sales on insufficient inventory despite an increase in absolute inventory. The NAR still looks forward to more inventory. In the last report, the NAR talked of “the falling number of homeowners in mortgage forbearance”. This time around, the NAR did not provide a source for its optimism. Ironically and contradictorily, Lennar (LEN) announced that it has no intention of stressing out the supply chain further with an increase in production. Year-over-year sales increased 44.6% over last year’s pandemic-impacted sales.

(As of the March, 2018 data, the NAR further reduced historical data to just 13 months. For historical data from 1999 to 2014, click here. For historical data from 2014 to 2018, click here) Source for chart: National Association of Realtors, Existing Home Sales© [EXHOSLUSM495S], retrieved from FRED, Federal Reserve Bank of St. Louis, July 4, 2021.

The absolute inventory level of 1.23M homes increased 7.0% from April. Inventory dropped 20.6% year-over-year (compare to April’s 20.5%, March’s 28.2%, February’s 29.5%, January’s 25.7%, December’s 23%, November’s 22%, October’s 19.8%, September’s 19.2%, August’s 18.6%, July’s 21.1% year-over-year declines, unrevised). The inventory situation is further improving even though the NAR failed to recognize it. “Unsold inventory sits at a 2.5-month supply at the present sales pace, marginally up from April’s 2.4-month supply but down from 4.6-months in May 2020.”

The average 17 days it took to sell a home tied the all-time record set in April. The on-going year-over-year decline in inventory is on a 24-month streak.

The median price of an existing home soared to $350,300 and set a fresh record high. Prices have increased year-over-year for 111 straight months, and May’s price jump was a 23.6% year-over-year gain. The percentage gain was also a new all-time record surpassing the 19.1% record just from the previous month. The median price increased from April by 2.8%.

Soaring prices are still not slowing down first-time home buyers as a share of all buyers. Although the NAR claimed that “…falling affordability is simply squeezing some first-time buyers out of the market”, first-time home buyers held steady with a 31% share of sales in May, same as April. The NAR’s 2017 Profile of Home Buyers and Sellers reported an average of 34% for 2017, 33% for 2018, 33% for 2019, and 31% for 2020. In other words, the current share is the same as last year’s average. Accordingly, any pressures on first-timers are not showing up in these data. Investors also held steady with a 17% share of sales up from 14% a year ago.

The West towered above all other regions for existing home sales. The regional year-over-year changes were: Northeast +46.9%, Midwest +27.3%, South +47.2%, West +61.6%.

All regions registered strong year-over-year price gains – for May: Northeast +17.1%, Midwest +18.1%, South +22.6%, West +24.3%.

Single-family home sales decreased 1.0% from April and increased on a yearly basis by 39.2%. The median price of $356,600 was up 24.4% year-over-year.

California Existing Home Sales – May, 2021

April’s month-over-month increase in existing home sales in California turned out to be a brief departure from the nationwide trend. Sales have now declined 4 out of the last 5 months. For May, the California Association of Realtors (C.A.R.) reported 445,660 in existing single-family home sales for California. Sales decreased 2.7% from April and increased 86.7% year-over-year from the pandemic trough. At $818,260 the median price increased 0.5% month-over-month and 39.1% year-over-year.

California broke records in May that were set in April.

- $818,260 median price (broke April’s record)

- $387 per square foot

- Sales-to-list-price ratio of 103.8%

- 7 median number of days to sell a single-family home (tied).

For April, the increasing price pressures prompted C.A.R. Vice President and Chief Economist Jordan Levine to doubt the durability of California’s housing market. For May, Levine projected further slowing in the market: “…pending sales data for May, which was virtually unchanged from April, suggests further slowing in coming months. Fortunately, new listings have finally started to rise, which could help to sustain a higher level of home sales deeper into summer by providing much-needed supply.” In other words, a coming slowdown will have a high floor.

Inventory increased to 1.8 months of sales in May from 1.6 in April. Active listings actually aligned with seasonal expectations by increasing 6.6% month-over-month. Still, the statewide year-over-year drop in active listings is astounding given the trough in the market from a year ago. San Francisco and Lassen were California’s only counties with single digit year-over-year declines in active listings!

California’s dramatic skew in sales toward higher-priced markets continued in May:

“With million-dollar home sales surging more than 200 percent from May 2020, its market share is nearly double what it was a year ago when it was at 15.6 percent. More million-dollar properties were sold in the past couple of months than homes priced below $500,000.

…with sales of homes priced $2 million and higher surging over 300 percent from a year ago. Sales of properties priced below $300k, on the other hand, continued to fall precipitously, with the year-over-year sales dropping 34 percent in May. Tight housing supply continues to be the primary factor constraining sales in the lower price segment.”

New Residential Sales (Single-Family) – May, 2021

Normalization is fully underway for new single-family home sales. Since peaking in January, new home sales are down 22.6%. New home sales in May of 769,000 dropped closed to the peak just prior to the pandemic but were up 9.2% year-over-year. May sales were down 5.9% from April. The Spring selling season fizzled out for new home sales. Similar to existing home sales, buyers likely pulled forward a lot of demand.

Source: US. Bureau of the Census, New One Family Houses Sold: United States [HSN1F], first retrieved from FRED, Federal Reserve Bank of St. Louis, July 5, 2021.

Median home prices set a new record at $374,400. May featured another strong skew to higher priced home sales. This time the $400,000 to $499,999 price range received the swell of interest going from April’s 13% share to May’s 21% share. The highest price tier returned to 7% of share from 6%.

The monthly inventory of new homes for sale jumped again. May hit 5.1 months of sales from April’s 4.4 months. March sat at 3.6 months of sales. The absolute inventory level of 330,000 was a second monthly increase. My red flag is waving ever more vigorously with another monthly jump in inventory accompanied by a decline sales. These numbers reveal more signs of a market slowing down (or at least normalizing).

The South joined the West in picking up the rear in regional sales levels. The Northeast ended its 2-month streak of triple-digit gains with a 57.6% gain. The Midwest increased 28.4%. The South increased just 3.1%. The West increased 6.7%.

Home Builder Confidence: The Housing Market Index – June, 2021

The National Association of Home Builders (NAHB) reported a 2 point drop in the NAHB/Wells Fargo Housing Market Index (HMI) from May’s 83 level. June’s 81 level is the lowest since August, 2020, a reminder of just how long builder sentiment has remained quite elevated despite the pandemic. In April, the NAHB pointed to strong demand as a driver boosting confidence despite supply chain issues. May’s report focused on soaring construction costs. June strung out all the issues besetting home builders: “Higher costs and declining availability for softwood lumber and other building materials pushed down builder sentiment in June. These higher costs have have moved some new homes beyond the budgets of prospective buyers, which has slowed the strong pace of home building.” The NAHB complained that escalating costs are reducing demand. Builders are also experiencing difficulties in obtaining construction loans because of delays in getting appraisals.

Source for data: NAHB

Each regional HMI shifted downward in June. The Northeast dropped from 78 to 73 but remained above its low of the year set in January at 68. The Midwest slid a point from 71 to 70 and is almost back to August’s 69 level. The South slid a point off its high of the year to hit 85. The West dropped sharply from 91 to 86. The current downtrends from last year’s all-time highs are more or less consistent with the downtrend in new home sales and starts. Based on the current data, a near-term catalyst is not likely waiting “around the corner”.

Home closing thoughts

Supply Chain Troubles

The National Association of Home Builders produces numerous reports on the economics of building homes. The latest article titled “Shortages Cause Builders to Raise Prices, Pre-Order Materials” provides a view on the set of choices builders now make to cope with the supply chain issues of shortages and higher costs.

- Raise prices on homes frequently (62%)

- Pre-ordering materials (59%)

- Price escalation clauses (45%)

- Waiting until late in the construction process before listing spec homes (39%)

- Cost-plus pricing (32%)

- None of the listed options (2%)

The results tell me that builders still have a lot of pricing power in the market. Moreover, demand remains strong enough that a good number of builders can afford to shape their demand flow.

The pre-ordering activity could exacerbate near-term shortages. More desperate builders are likely to place multiple orders in the system. As a result, when shortages finally end, prices could plunge quite sharply in the face of gluts. I wonder whether this effect helps explain plunging lumber prices.

Be careful out there!

Full disclosure: long ITB call options