The Federal Reserve released its report on Financial Stability with an interesting emphasis on potential vulnerabilities from “elevated risk appetites”. The Fed included an evaluation of valuation measures. The report even called out “meme stocks” as part of its evidence. However, the report stopped short of calling the market outright over-valued. Instead, the Fed took its classic approach of dropping hints around topics that could cause the market to throw a tantrum. While the Federal Reserve expressed big confidence in the economy just a few weeks ago, this latest edition of the Financial Stability Report seemed built to tap the brakes on exuberance in the stock market without taking action like tightening monetary policy.

An Elevated Risk Appetite

Governor Lael Brainard made sure that readers did not miss the hints. Brainard added an intro that summarized the Fed’s assessment of the vulnerabilities coming from excess exuberance (emphasis mine).

“The latest Financial Stability Report provides valuable analysis to track increases in financial system vulnerabilities….Vulnerabilities associated with elevated risk appetite are rising. Valuations across a range of asset classes have continued to rise from levels that were already elevated late last year. Equity indices are setting new highs, equity prices relative to forecasts of earnings are near the top of their historical distribution, and the appetite for risk has increased broadly, as the “meme stock” episode demonstrated. Corporate bond markets are also seeing elevated risk appetite, and the spreads of lower quality speculative-grade bonds relative to Treasury yields are among the tightest we have seen historically. The combination of stretched valuations with very high levels of corporate indebtedness bear watching because of the potential to amplify the effects of a re-pricing event.”

Governor Lael Brainard, Financial Stability Report, May 6, 2021

While “re-pricing” is a mild way of saying “sell-off,” Brainard’s message is clear. If financial markets do not stop rallying sometime soon, the Fed expects what some see as a long overdue correction. The report included plenty of details on measures to detect exuberance in financial markets. In the following quote, the Fed essentially warned of an excess in risk appetites causing elevated financial markets. Indeed, the market faces the prospect of “significant declines” with an accompanying drop in risk appetites.

“Prices of risky assets have generally increased since November with improving fundamentals, and, in some markets, prices are high compared with expected cash flows. Long-term Treasury yields have risen over the past few months but remain low by historical standards. High asset prices in part reflect the continued low level of Treasury yields. However, valuations for some assets are elevated relative to historical norms even when using measures that account for Treasury yields. In this setting, asset prices may be vulnerable to significant declines should risk appetite fall.”

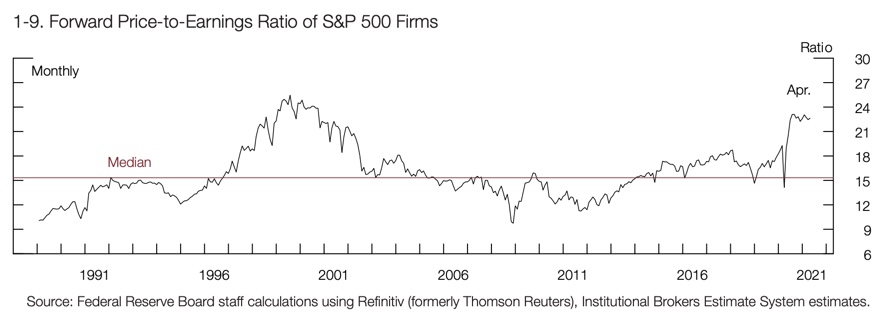

The most compelling evidence of elevated valuations comes from the forward price-to-earnings ratio of S&P 500 firms. The Fed’s calculation shows that valuations were last this high leading into the bursting of the doct-com bubble.

SPACs and Meme Stocks

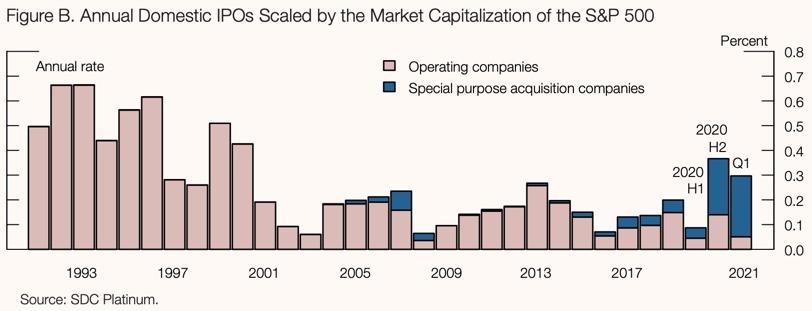

The Fed also looked at the rising issuance of IPOs, particularly SPACs (Special Purpose Acquisition Companies), as evidence of exuberance.

“The pace of initial public offerings (IPOs) has increased to levels not seen since the 1990s. In addition, a rising share of IPOs is supported by special purpose acquisition companies (SPACs), which are nonoperating corporations created specifically to issue public equity and subsequently acquire an existing operating company…Elevated equity issuance through SPACs also suggests a higher-than-typical appetite for risk among equity investors.”

While the emergence of SPACs is truly startling, the IPO market as a whole has a long way to before replicating the dizzying pace of the 1990s. Indeed, if financial markets will revisit the 1990s, then the fun has yet to heat up.

Finally, the Fed also went after meme stocks. The evidence would have been more compelling with relative quantification of the (dollar) volume of trading.

“…indicators pointing to elevated risk appetite in equity markets in early 2021 include the episodes of high trading volumes and price volatility for so-called meme stocks—stocks that increased in trading volume after going viral on social media.”

A Yellow Flag of Exuberance

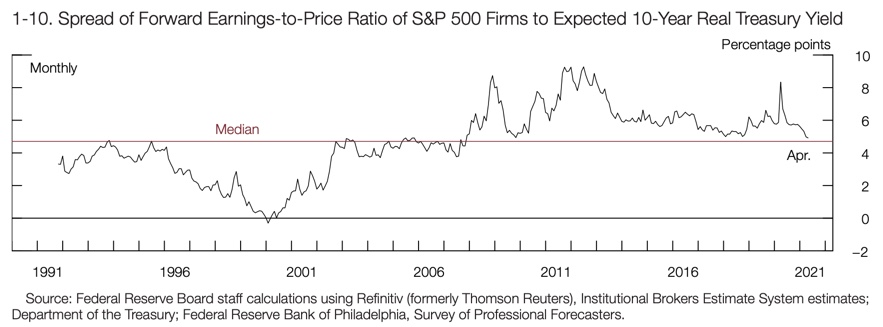

Another measure of market exuberance is throwing a yellow flag but has room to stretch further. The spread of forward earnings-to-price ratio of S&P 500 firms to expected 10-Year real treasury yield is at its lowest point since the months and years before the financial crisis. However, the ratio remains above the median in place since 1991.

The Fed expressed concern but could not outright say this measure reveals exuberance.

“…the difference between the forward earnings-to-price ratio and the expected real yield on 10-year Treasury securities—a rough measure of the compensation that investors require for holding risky stocks known as the equity premium—has declined since November (figure 1-10). A lower equity premium generally indicates investors have a higher appetite for the risk of investing in equities. However, this measure of the equity premium remains above its historical median, suggesting that equity investor risk appetite, though higher since November by this measure, is still within historical norms. That said, this measure is close to its lowest level over the past 15 years.”

Is the Fed Prepared to Do Anything About Exuberance?

Does the Fed have the appetite to provide the catalyst for forcing the issue of a re-pricing? In the report, the Fed talked a lot about monitoring but said little about acting proactively. Even when it comes to high amounts of leverage at hedge funds, the Fed only stated it “restarted its Hedge Fund Working Group to better share data, identify risks, and strengthen the financial system.” The practical implication is that the Fed is ultimately relying on the financial market to do its own re-pricing ahead of an outright calamity. If markets fail to avoid a calamity, the Fed will do its best to pick up the pieces afterward. As we know by now, the Fed’s main tool consists of flooding the system with yet more liquidity…an action which of course helps create the conditions for the next cycle of exuberance.

Be careful out there!

Full disclosure: long S&P 500 put spreads