Why Sell In May?

“Sell in May” is an old stock market adage that advises investors to sell in May and leave the stock market alone until November. According to Investopedia, the adage identifies May through October as a period of under-performance. The adage survives despite its persistently poor performance as a stand-alone strategy. For example, the average underperformance is not average negative performance. Instead, the performance falls short of the seasonal strength from November through April. Exiting the market during from May through October leaves money on the table in an effort to sidestep the big drawdowns that can occur during the most dangerous months of the year. Investors should instead build cash to buy into those drawdowns. Buying the extremes of the market can enhance returns. The adage is now a throwaway.

Do Not (Automatically) Sell In May

I created scenarios to quantify the poor performance of the sell in May adage. I examined the performance of the S&P 500 (SPY) during May, the summer months (June through August), and the “go away” months of June through October using the 71 years from 1950 to 2020 (inclusive). For each time period I counted out the occurrence of positive performance over the 71 years. The table below summarizes the results as a percentage.

For example, the 59% for the “Positive May” time period from 1950-2020 means 42 of the 71 years from 1950-2020 delivered a month of May with a positive performance for the S&P 500. Not only does May tend to deliver upside for investors, but also the summer AND the go away periods tend to deliver positive performances. In all but one case, these counts are even better so far in the 21st century.

| Time Period | 1950-2020 | 2000-2020 |

| Positive May | 59% | 67% |

| Positive Summer | 63% | 62% |

| Positive summer after negative May | 55% | 57% |

| May + Summer better than May | 63% | 62% |

| Positive Go Away | 72% | 76% |

| May + Go Away better than May | 72% | 76% |

Even a negative May performance does not suggest a negative summer lies ahead. More than 50% of the years with a negative May delivered a positive summer. Moreover, combining May with either the summer or the entire go away period delivers a better performance than May alone. Timing the year when a significant drawdown warrants selling in May and going away appears futile.

Strength in Numbers

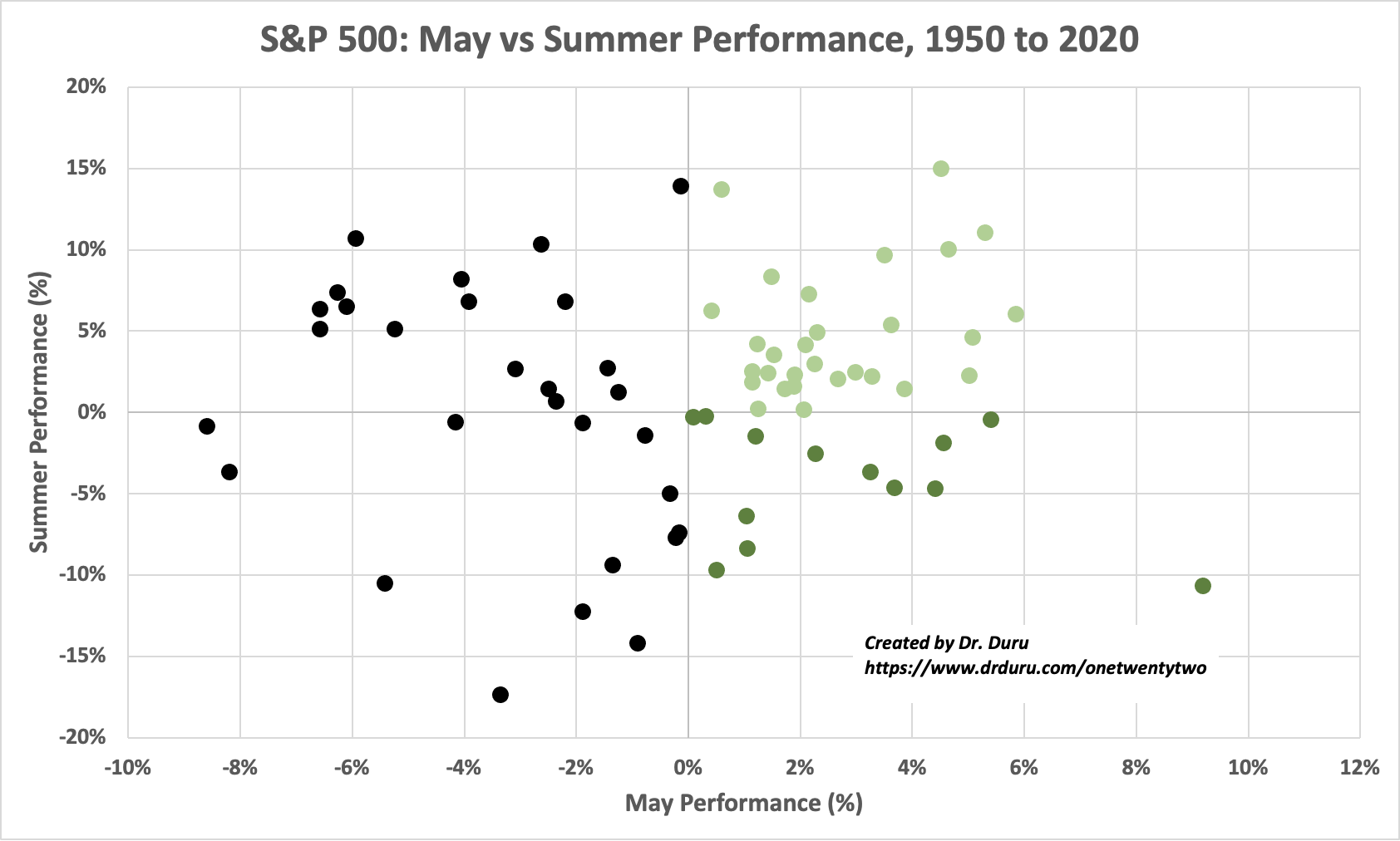

The following scatterplot juxtaposes the performance of May with the subsequent summer performance for a given year. The graph shows the magnitude of positive and negative periods. The green shading indicates positive Mays. The light green indicates years with both positive Mays and summers. The black dots indicate negative Mays.

Note how the data are skewed towards negative performance. These outliers create low averages. However, the positive performances have the strength in counts as demonstrated by the medians in the table below showing S&P 500 performance for the different scenarios.

| Years | Period | Average | Median |

| 1950 – 2020 | May | 0.2% | 1.1% |

| Summer | 1.3% | 2.0% | |

| Go Away | 1.4% | 2.8% | |

| 2000 – 2020 | May | 0.3% | 1.2% |

| Summer | 0.8% | 2.5% | |

| Go Away | 0.9% | 1.4% |

I posted all the data and analysis in a Google spreadsheet.

Be careful out there!

Full disclosure: long SPY puts

Well, the narrative that big-money traders retire to their summer homes and/or their yachts in May was a powerful one, so it was going to take a lot to convince me.

I think you did it.

Now rich investors can access the markets from their yachts with smartphones while the rest of us are tied to land and laptops. 😉

It rhymes so nicely and is easy to remember!! It was always bound to be erroneous.

I think it falls into the category of “For every complex problem, there is always an easy solution…. and it’s always WRONG!!!”

That’s a great way to put it! 🙂