Housing Market Intro and Summary

Softening housing data pointed to more normalization in the housing market. Normalization is returning housing data to prior trends and in some cases suggesting important plateaus. Home builder stocks powered through the softening data to show strength in sharp rebounds and fresh all-time highs. The arrival of the Spring selling season is likely driving the seasonal excitement in these stocks. Moreover, the sharp uptrend in mortgage rates cooled off last week.

Housing Stocks

The iShares Dow Jones US Home Construction Index Fund (ITB) found fresh life with a breakout to an all-time high. Big news from Lennar (LEN) about a rental housing venture stoked the flames the prior week, and last week delivered the convincing follow-through across the housing sector.

The fresh bullishness for housing-related stocks even quickly erased initial post-earnings disappointment for KB Homes (KBH). KBH gapped down 6.7% but ended the day up 2.3%. The stock closed the week just short of its all-time high set the prior week.

After a lukewarm post-earnings response for LGI Homes (LGIH) turned negative, the stock rallied nearly straight up to all-time highs. The rebound secured support at the 200-day moving average (DMA) trendline (the blue line below). LGIH stands out once again among home builders.

The seasonal trade in home builders is still in play thanks to Lennar and the surrounding strength in the housing sector. This year seems to feature the more typical rally into the season. ITB is even out-performing the S&P 500 (PY) year-to-date as expected for the seasonal trade: 22.8% vs 5.8%. Home builder stocks powered right through softening housing data.

Housing Data

New Residential Construction (Single-Family Housing Starts) – February, 2021

Single-family housing starts show quite clearly softening housing data. Housing starts continue to march toward normalization in the housing market by essentially dropping to the same level as a year ago. Single-family home starts dropped to 1,040,000 which was 8.5% below January’s 1,136,000 starts (revised downward from 1,162,000). Starts were up just 0.6% year-over-year, the lowest growth rate since May. The rate of year-over-year change has been positive for eight straight months.

Source: US. Bureau of the Census, Privately Owned Housing Starts: 1-Unit Structures [HOUST1F], first retrieved from FRED, Federal Reserve Bank of St. Louis, March 17, 2021.

Year-over-year growth slowed yet again, but it will pick up with the comparisons to last year’s initial pandemic-related plunge. As I noted in previous Housing Market Reviews, I expected housing starts to slow back to the trend. This reversion happened with the February data.

The West was the big (and surprising) laggard in January by hitting a 6-month low in year-over-year growth. For February, the regions were exactly split with large year-over-year changes. Housing starts in the Northeast, Midwest, South, and West each changed +19.4%, -19.7%, -11.0%, +38.4% respectively year-over-year.

Existing Home Sales – February, 2021

Existing home sales fell to a 6-month low a month after two months of small gains. The seasonally adjusted annualized sales in February of 6.22M decreased 6.6% month-over-month from the marginally downwardly revised 6.66M in existing sales for January. The National Association of Realtors (NAR) blamed the decline on exceptionally low inventory levels even as absolute inventory was almost flat with January. Year-over-year sales increased 9.1%.

(As of the March, 2018 data, the NAR further reduced historical data to just 13 months. For historical data from 1999 to 2014, click here. For historical data from 2014 to 2018, click here) Source for chart: National Association of Realtors, Existing Home Sales© [EXHOSLUSM495S], retrieved from FRED, Federal Reserve Bank of St. Louis, March 22, 2020.

The absolute inventory level of 1.03M homes dropped by 0.01M from January. Inventory plunged an all-time record 29.5% from a year ago (compare to January’s 25.7%, December’s 23%, November’s 22%, October’s 19.8%, September’s 19.2%, August’s 18.6%, July’s 21.1%, June’s 18.2%, May’s 18.8%, and April’s 19.7% year-over-year declines, unrevised). The inventory situation remains extremely tight for existing homes with no relief in sight. “Unsold inventory sits at a 2.0-month supply at the current sales pace, slightly up from January’s 1.9-month supply and down from the 3.1-month amount recorded in February 2020.” The year-over-year decline set a new record that surpassed January’s record since the NAR started recording these data in 1982.

I was surprised last month by the NAR’s optimistic forecast for an 8.2% year-over-year increase in single-family existing home sales. The forecast did not align with the on-going issues of affordability and tight inventories. The softening housing data the generated poor February sales may already have the NAR rethinking that forecast. The NAR “…cautioned of a possible slowdown in growth in the coming months as higher prices and rising mortgage rates will cut into home affordability.”

The average 20 days it took to sell a home set a new all-time record that slipped by the records set and then tied from September to January. The on-going year-over-year decline in inventory is on a 21-month streak. The tightening constraint pushes prices ever higher and further worsens affordability issues.

The median price of an existing home hit $313,000 and tied October’s record high. Prices have increased year-over-year for 108 straight months, and February’s was a 15.8% year-over-year gain. The median price increased from January by 3.1%, ending three straight month-over-month declines.

First-time home buyers took a 31% share of sales in February. This drop from January’s 33% share could be the first signs of an affordability squeeze on these buyers. The NAR’s 2017 Profile of Home Buyers and Sellers reported an average of 34% for 2017, 33% for 2018, 33% for 2019, and 31% for 2020. Investors took a 17% share of sales, up from January’s 15% and equal to a year ago.

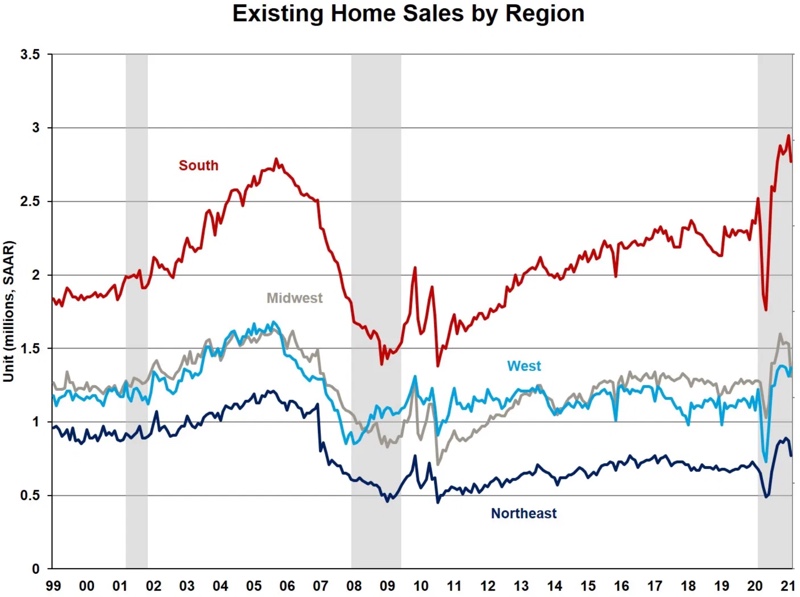

The Midwest broke a 6-month streak of soaring regional sales increases. The regional year-over-year changes were: Northeast +13.2%, Midwest +2.3%, South +9.9%, West +12.3%.

All regions have registered strong year-over-year price gains since May. For February: Northeast +20.5%, Midwest +14.2%, South +13.6%, West +20.6%.

Single-family home sales decreased 6.6% from January and increased on a yearly basis by 8.0%. The median price of $317,100 was up 16.2% year-over-year.

California Existing Home Sales – February, 2021

For February, the California Association of Realtors (C.AR.) reported 462,720 in existing single-family home sales for California. Sales decreased 4.5% from January and increased 9.7% year-over-year. In January, the Far North was the only Californian region to suffer a year-over-year decline in existing single-family home sales. This time around the Central Valley held this distinction.

At $699,000 the median price dropped ever so slightly by 0.1%. The median price was still up 20.6% year-over-year. Each region and county in California enjoyed year-over-year price increases. The San Francisco Bay Area hit a new price record on its highest year-over-year gain in seven years (26.5%).

Inventory increased off an all-time low and reached 1.9 months of sales in January (revised higher). Inventory nudged higher to 2.0 in February. A year ago, inventory was at 3.6 months of sales. California will hit the Spring selling season with sparse offerings. Active listings dropped 52.5% year-over-year, an eighth straight month of 40%+ declines (revised). Sellers only waited a median 10 days to sell a home in February. A year ago, they waited 23 days.

New Residential Sales (Single-Family) – February, 2021

Softening housing data drove new home sales to the lowest point since the early months of the pandemic. For February, sales dropped 18.2% to 932,000, down from January’s upwardly revised 948,000 sales. Sales were up 8.2% year-over-year. The chart below shows that the pace of new home sales is slowing back to trend, another sign of normalization.

Source: US. Bureau of the Census, New One Family Houses Sold: United States [HSN1F], first retrieved from FRED, Federal Reserve Bank of St. Louis, March 23, 2021.

Median home prices fell for a second month in a row. The 1.1% drop took the median sales price to $349,400 which was a 5.3% year-over-year increase. Despite the small sequential pullback, prices are still trending upward.

The monthly inventory of new homes for sale declined from 4.8 in May to 3.4 in August. Since then, inventory jumped back up to 4.3 for December and is now back to 4.8. A well-balanced market has inventory around 6 months worth of sales.

The regions were exactly split in February for year-over-year sales growth. The Northeast decreased 11.6%. The Midwest increased 4.9%. The South increased 20.2% and led the way again. The West decreased 8.1%.

Home Builder Confidence: The Housing Market Index – March, 2021

The National Association of Home Builders (NAHB) reported a two point decrease in the NAHB/Wells Fargo Housing Market Index (HMI) to 82. However, the tone of the report suggests confidence is a lot lower than the numbers reveal. The NAHB’s commentary was very negative in January and even more dour for February. Even the title of February’s report was a bit ominous: “Builder Confidence: High Demand Offsets Higher Costs – For Now” (emphasis mine). For March, the NAHB was outright pessimistic as it blamed higher mortgage rates and lumber prices for a mere two point drop in confidence. (In an earlier post I noted how these factors were weighing on the price of home builder stocks).

“Though builders continue to see strong buyer traffic, recent increases for material costs and delivery times, particularly for softwood lumber, have depressed builder sentiment this month…

…Builder confidence peaked at a level of 90 last November and has trended lower as supply-side and demand-side factors have trimmed housing affordability…While single-family home building should grow this year, the elevated price of lumber is adding approximately $24,000 to the price of a new home. And mortgage interest rates, while historically low, have increased about 30 basis points over the last month..”

Source for data: NAHB

Despite the pessimism, the Single-Family Detached Present was the only component that fell. Clearly, it has an outsized influence on the index. Even more surprising, the SF Detached Next Six Months increased by the same number of points that the Single-Family Detached Present fell (I confirmed these numbers with the NAHB). In other words, while builders are looking more negatively at the current situation, they remain hopeful for better days down the road. That kind of optimism is likely good enough for the stock market even with the softening housing data driving housing indicators back to trend.

The regional data showed drops consistent with the overall Housing Maarket Index. The South was the only region to avoid declines by staying flat.

Home closing thoughts

The Future in Single-Family Homes for Rent

Lennar (LEN) made a splash earlier this month when the company announced a major deal to supply new homes into the rental market. A week and a half before that news, Fundrise announced a $847,000 deal to buy 4 single-family rental homes from Lennar in the greater Dallas Fort Worth area. The connection to Lennar was not the only item that caught my attention. Fundrise’s strategy statement speaks to an important undercurrent in American housing:

“At a strategic level, this investment fits within our affordably-priced Sunbelt apartment / rental housing thesis. From millennials to retirees, a broad group of Americans have been taking part in a migration from northern to southern states over the past decade, driving continued demand for well-priced, well-located real estate, and supporting steady returns for disciplined investors.

As we stated in our mid-year and year-end letters to investors, we believe that this long-term trend has only been further accelerated by the pandemic. In an economy where remote work is becoming the norm for more and more people, we expect that an increasing share of the population won’t need to live in expensive gateway cities and will instead seek out locations that offer lower living costs and more agreeable climates.”

Unstated in this strategy is that the migration wave is facing affordability issues even in Texas. As a result, rental housing becomes an attractive alternative. The dedication of single-family inventory to rental housing will in turn drive up prices on for-sale homes. Indeed, Fundrise is banking on long-term appreciation on its homes.

Ooops: Too Much Pessimism A Year Ago

Mea culpa time. In the immediate wake of the pandemic, I criticized a Freddie Mac forecast for the housing market as being overly optimistic. I thought the sharply softening housing data would remain soft for an extended period of time. I completely missed the possibilities opening up for work-from-home and assumed that sellers and buyers would not figure out contactless transactions. Ironically, Freddie Mac’s forecast for 5.1M homes sold in 2020 was not optimistic enough. Existing home sales alone hit 5.64M and new single-family home sales hit 823K for the year. Sales for 2020 surpassed Freddie Mac’s forecast for 6.1M homes in 2021! The forecast for median homes prices turned home similarly too low. Fortunately, I did not allow my negative sales outlook to impact my moves to grab housing-related stocks for extremely cheap prices.

Be careful out there!

Full disclosure: long LEN calendar call spread