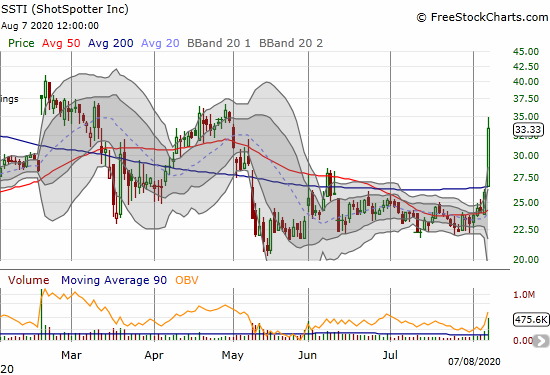

Gun-fire detection company ShotSpotter (SSTI) is lagging the recovery in the general stock market. Even with a 28.3% post-earnings surge on Friday, the stock still trades below its April high. Yet, those earnings suggest that ShotSpotter is on track and successfully navigating its business through the COVID-19 pandemic.

Earnings Results

ShotSpotter has a lumpy business – meaning that revenues do not flow in regular patterns – but these year-over-year results for the second quarter are encouraging:

- Revenues: +10%, including $300K delayed from the first quarter.

- Gross profit margin: +300 basis points

- Net income: +124%

- Adjusted EBITDA: +41%

- Cash and cash equivalents: +5.2% (from December, 2019)

ShotSpotter grew its total live square miles to 761 after adding 26 net new “go-live” miles in Q2. These gains came from expansions in Cincinnati and New York City (which is likely built out now with 74 square miles) and new miles in Springfield (Illinois), Albuquerque (New Mexico), the U.S. Virgin Islands, and Mammoth County (New Jersey).

I was particularly encouraged reading through the commentary in the transcript of the earnings call (from Seeking Alpha). CEO Ralph Clark described a business that is gaining momentum and securing opportunities during the pandemic.

The sales team is now able to make some customer visits and has developed a system for doing Zoom presentations. Local governments clearly remain interested in the ShotSpotter gunfire detection system given the impressive expansion reported for Q2. The company suffered no attrition in the second quarter and re-signed 6 customers worth a total of $7M in revenue. ShotSpotter newly booked Cleveland and Fort Lauderdale, and Broward County signed on for gun detection services for part of the county. ShotSpotter indicated that Broward has Florida’s largest sheriff’s department, so this deal is a big win. (There was no update on the Congressional support ShotSpotter received last year.)

ShotSpotter is making moves internationally as well. The company won an international tender in the City of Nelson Mandela Bay in South Africa. This potential deal begins to open up a lot of growth potential for ShotSpotter. The company also expects to announce a deal in Latin America by the end of the year. Based on previous discussions, I suspect the country will be Colombia.

This momentum allowed ShotSpotter to provide a little more certainty on guidance. The company narrowed the previous full-year range of $43-$46M to $43.5-$45.5M which means the midpoint stays the same and is a more likely outcome. Revenue will be flat from Q2 to Q3 with an increase in Q4. ShotSpotter expects to stay profitable for the remainder of the year. Clark maintained: “…our pipeline is strong. Probably as strong as it’s ever been and we are seeing some opportunities that are even maybe more [short] fused and have a shorter sales cycle and we’ll be talking about those in the future…”

ShotSpotter also showed confidence in the business by repurchasing 74,520 shares for $1.6M. The company has spent $8.3M of its $50M repurchase authorization.

Defund the Police

Calls to “defund” the police have increased in the midst of protest and social unrest and upheaval in the wake of the murder of George Floyd by a Minneapolis police officer. Clark provided some interesting insights on how the defund movement impacts ShotSpotter’s business.

A significant minority of the defund movement take the term literally. Apparently these folks have been quite disruptive in local meetings that are now more accessible than ever with the pandemic forcing civic meetings online. However, the essence of the movement helps make the case for ShotSpotter:

“What the core of the movement is calling for is a fundamental change in how policing happens in America. The kinds of things being demanded are changes of our technology supports and enable[s]….In my mind, it comes down to the simple choice between a posture of over-policing while underserving versus precision policing combined with community-inspired engagement…

It’s difficult for police department to credibly claim that it protects and serves the community if it doesn’t respond to 80% to 90% of gunfire events that happen on a persistent basis, even if those gunfire events are not reported in the first place. This leads to normalized violence which can produce all manner of negative outcomes, including pediatric trauma.

ShotSpotter provides “…real time awareness of gunfire events that allows police to be smart on crime and protect and serve at the same time.”

These discussions and controversies will become ever more important as gunfire incidents have unfortunately increased since George Floyd’s murder. ShotSpotter reported that gunfire incidents are up 34.6% year-over-year, year-to-date for 2020. A 68% surge since late May, the time of Floyd’s murder, has driven the large increase.

The Trade

Large one-day surges in a volatile stock like SSTI are typically unsustainable. I decided for the first time since investing in SSTI to finish taking all my profits. To-date, I was in the habit of buying dips and selling partial positions into rallies. Those efforts allowed me to build positions on the “house’s money” which in turn freed me to take on more risk with less sweat. For example, the bottoming I identified in late 2019 was a major (and fortuitous) buying opportunity. Now I have hit the reset button.

My last buy on the dip was in the immediate wake of ShotSpotter’s pandemic-driven earnings warning in March. I considered the sell-off to be a major over-reaction given the small reduction in revenue guidance in the context of a major economic calamity. SSTI soon rebounded and recovered its losses and then some. The high in April came short of February’s post-earnings high, but I held my shares as part of my prevailing conviction to buy into the stock market’s oversold trading conditions. Unfortunately, SSTI did not keep up with the stock market from there, especially the iShares Russell 2000 ETF (IWM), an ETF of small cap stocks.

Going forward, I am looking to accumulate shares all the way down to support at the 200-day moving average (DMA). If the stock manages to continue rallying from current levels with no pullback, I may have to wait until the next earnings report to devise a new investing plan. No matter what happens, SSTI has been a great run, and I harbor no complaints and no regrets!

Be careful out there!

Full disclosure: no positions