The Message in Home Builder Sentiment

The National Association of Home Builders (NAHB) reported a tremendous surge in the sentiment of home builders. The Housing Market Index (HMI) soared from 37 in May to 58 in June. Just two months after suffering a historic plunge, sentiment among home builders is right back to positive territory. The HMI for June is now where it was in January, 2019, a marked improvement from the recent 8-year low.

The NAHB trotted out familiar drivers for this sharp rebound in sentiment:

- Tight inventory

- Increased mortgage applications

- Low interest rates

Moreover, the NAHB reported that “buyer traffic more than doubled in one month.” Accordingly, the Traffic of Prospective Buyers component of the HMI surged from 21in May to 43 in June.

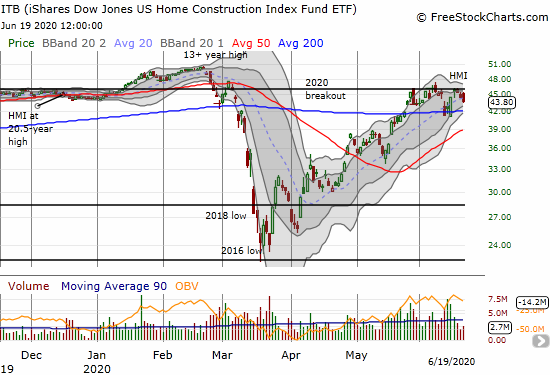

The Message in the iShares Dow Jones US Home Construction Index (ITB)

The recovery in HMI was fantastic economic news. However, investors effectively yawned. The iShares Dow Jones US Home Construction Index (ITB) lost 0.6% on the day the NAHB reported June’s HMI. Selling continued for the remainder of the week.

There are at least three ways to understand this seemingly counter-intuitive, short-term reaction:

- ITB has already gained 80% from the lows of March when the stock market suffered rolling crashes. The V-like recovery since those March lows represents the stock market racing to get ahead of anticipated good news. In other words, this sharp rebound in the HMI was well anticipated by investors.

- At the time of the HMI report, ITB was already trading where it was in December when the HMI hit an historic 20 1/2 year high. Investors are already signaling they feel better about homebuilders than they did seven months ago when excitement was building about a strong Spring selling season. The Spring selling season is over, and there is no reason to believe that all that demand will return this year given today’s extremely high unemployment rate. In other words, similar to the first point, ITB has effectively already priced in a return to extremely robust housing market activity.

- From a technical perspective, ITB is struggling to break through the point of the big 2020 breakout point. The breakout announced the anticipation of a very strong Spring selling season. At that time, ITB went on to rally to a 13 1/2 year high even as the HMI cooled off from its 20 1/2 year high. A break through this important technical resistance will signal a fresh, fundamental improvement in the prospects for the housing market.

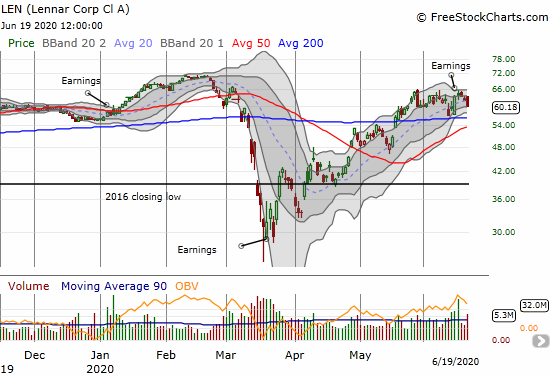

The Message in Lennar Corp.

Lennar Corp (LEN) provided another sign that investors likely realized they have already priced in a lot of good news.

Lennar delivered a strong earnings report last week. The stock rallied off its 200-day moving average (DMA) going into the report. After the earnings news, LEN gained just 0.7%. Sellers wiped out those gains the next day and have pressured the stock ever lower since then. The stock still trades above the January, 2020 earnings report when investors looked forward to a strong Spring selling season.

Lennar became the first home builder to deliver forward-looking guidance since the pandemic forced builders into a retreat. This milestone was a strong confirmation of the growing confidence implied in the Housing Market Index. Lennar provided the following guidance for the full year: “50,500 – 51,000 homes with a gross margin on home sales of approximately 21.5% and a net margin on home sales of approximately 13.0%.”

Compare this to the guidance from January: “we expect our fiscal 2020 deliveries to be in the range of 54,000 – 55,000 homes, homebuilding gross margin percentage to be in the range of 20.5% – 21.0% and our cash flows to continue to accelerate as we continue to refine our overall land program.”

In other words, Lennar will take a hit of about 7% in home deliveries. A potential 0.5% gain in previous guidance on margins is not sufficient to make up for the lost revenue. Thus, LEN should remain capped around current levels. The May high looks like it got “close enough” to the February high which itself stopped just short of the all-time high hit in January, 2018.

Source for charts: FreeStockCharts

The Trade

Lennar’s guidance helped me determine that company-specific downside risks are limited going forward. Upside potential is also capped by that same guidance. The resulting likely churn in the stock provides a good setup for a covered call strategy. I started with a single short weekly call at the $65 strike that expires this Friday. I would love to get assigned that call, but assuming that call goes out worthless, I will switch to selling monthly cals around the $65 strike.

I am still holding some shares in ITB I bought during the March sell-off. Given my outlook, I will move this week to start selling covered calls against the position. The July $47s look attractive around $1.00, and I will be fine taking profits on my position above $47.

Be careful out there!

Full disclosure: long ITB, long LEN shares and short a call