Canadian Dollar

After the Bank of Canada announced its latest update on monetary policy, the U.S. dollar gained about 1.7% on the Canadian dollar. I thought perhaps the Bank of Canada delivered some incredibly awful news. Nothing in the statement was a surprise. Indeed, the Bank of Canada essentially suggested it would not take rates even lower given they are already at their “effective lower bound.” Instead, the Bank of Canada is ramping up efforts with unconventional monetary measures to ease strains on the financial system.

Source: TradingView.com

USD/CAD peaked on March 18/19 after a parabolic run-up. The currency pair quickly tumbled from there to support at its 20-day moving average (DMA). USD/CAD spent 7 trading days bouncing off that support before slicing through. Last Wednesday’s surge into the 20DMA as resistance looks like a relief rally in the overall context. As such I doubled down on a short position I happened to initiate directly ahead of the Bank of Canada’s monetary policy report (MPR). The stop loss is above last week’s intraday high.

No Forecasts and Extraordinary Monetary Actions

After watching the press conference, I concluded that perhaps what temporarily unsettled markets was that the BoC decided not to provide its typical slew of economic forecasts. From the press release (emphasis mine):

“The outlook is too uncertain at this point to provide a complete forecast. However, Bank analysis of alternative scenarios suggests the level of real activity was down 1-3 percent in the first quarter of 2020, and will be 15-30 percent lower in the second quarter than in fourth-quarter 2019. CPI inflation is expected to be close to 0 percent in the second quarter of 2020. This is primarily due to the transitory effects of lower gasoline prices.”

One concerned reporter asked (see the 16:50 mark in the video below) whether the decision not to release detailed figures on the economic outlook could send “concerning” signals to financial markets and the public and as well generate negative interpretations. Governor Stephen S. Poloz flatly responded “no.” He did proceed to acknowledge that the lack of detailed forecasting countered past conventions. However, the Bank does not have sufficient information to make an “honest” forecast. Poloz reassured the audience that the Bank conducted a rich set of analyses to support the scenarios in the MPR.

The Bank’s approach makes sense to me. Too many view central banks as Oracles of economic knowledge and crystal balls of insight. They look at the same data as everyone else and make their best judgments. It was refreshing to see the Bank of Canada look at the current chaos of data and admit that detailed forecasts made no sense under the circumstances. The situation remains too fluid and dynamic.

From the press release here is a list of all the actions the Bank of Canada has taken to address the economic fallout from the coronavirus (COVID-19) pandemic:

- Lowered the target for the overnight rate 150 basis points over the last three weeks.

- Purchasing at least $5 billion in Government of Canada securities per week in the secondary market.

- Temporary and immediate increase up to 40% in the acquisition of Treasury Bills at auctions.

- A new Provincial Bond Purchase Program of up to $50 billion to supplement the Provincial Money Market Purchase Program.

- A new Corporate Bond Purchase Program to acquire up to a total of $10 billion in investment grade corporate bonds in the secondary market.

- Further enhancement of the Bank’s term repo facility to permit funding for up to 24 months.

Oil

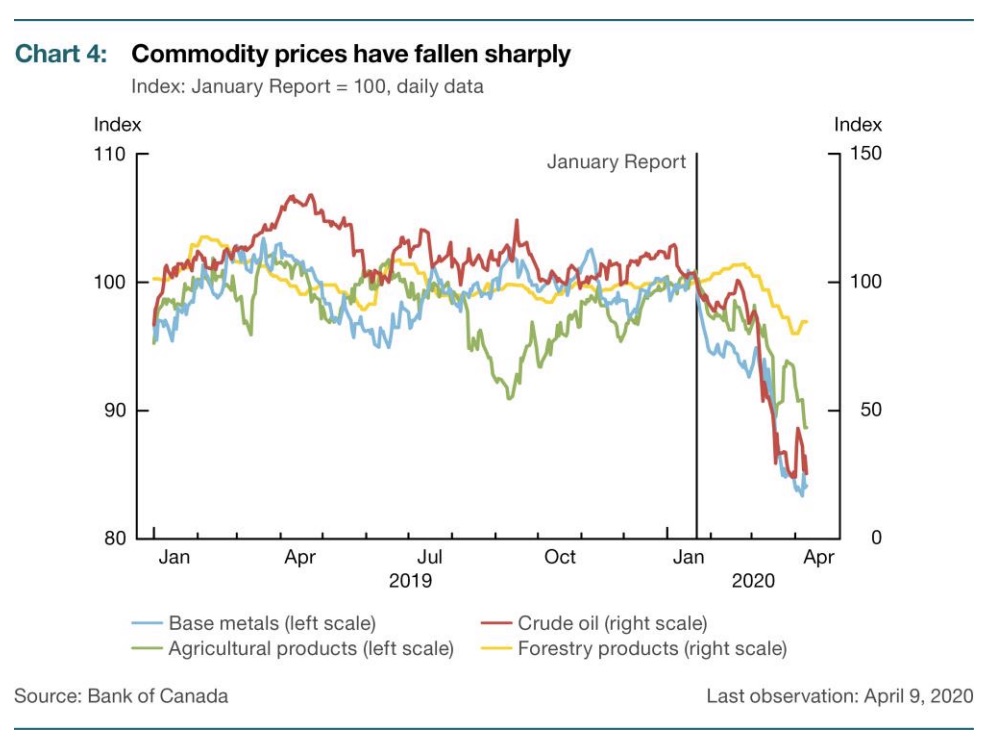

Source: Bank of Canada Monetary Policy Report

Canada’s economy has a high amount of dependency on the energy sector. The Bank of Canada sees the current plunge in prices as a kind of double-whammy on the Canadian economy.

…layered on top of the direct impacts of the COVID-19 pandemic is

the plunge in global oil prices, which will weigh heavily on the Canadian

economy. In particular, the recent drop in prices has dealt a major setback to the oil and gas sector. Production and investment in the sector have declined sharply and will remain low, and could deteriorate further if prices remain well below levels prevailing earlier in the year…Even with all the policy actions that have been put in place, the effects of

COVID-19 on both total supply and total demand in the near term are significant and negative—and are amplified by the oil price shock.

The total rig count has fallen back to levels last seen during the 2016 plunge in oil prices. The price of Western Canadian Select (WCS) is down almost 90% since January! The collapses are dramatic, but I strongly suspect they are also at maximum levels. As conditions slowly improve over time, the Canadian dollar should strengthen in parallel. This “as bad as it can get” assumption forms the new basis for my attraction to buying the Canadian dollar.

Be careful out there!

Full disclosure: short USD/CAD, long USO calls