It was just this past weekend when I laid out my latest strategy trading Apple (AAPL) pre-earnings including updated historical data. Much to my surprise, my calendar call spread closed out at its pre-earnings profit target as AAPL followed through on Tuesday from Monday’s big 2.3% rebound. (As a reminder, my ideal scenario featured the short side of the position expiring worthless and then AAPL rallying into earnings next week).

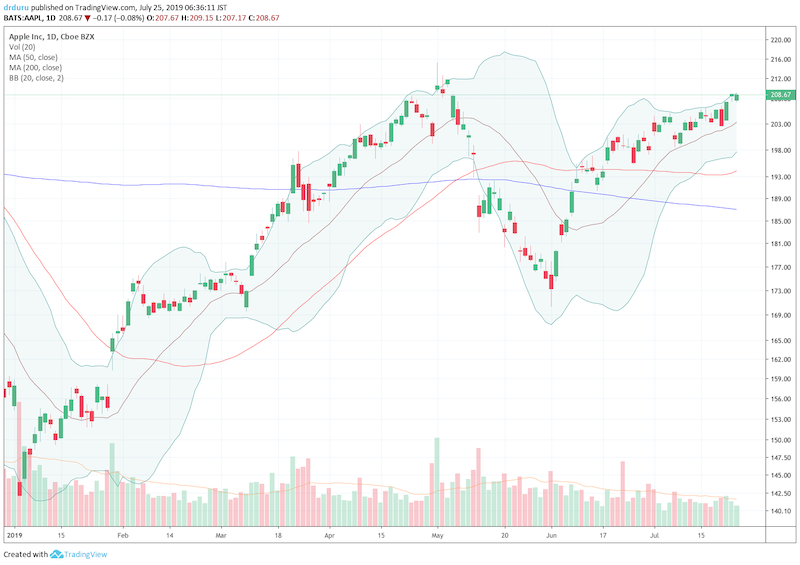

Source: TradingView.com

The profit paid for my hedge using a put spread, but I am left with the question “should I reload on a new trade?” The answer is “it depends.”

At Wednesday’s closing price of $208.67, the options market is still pricing in about a 10-point move by the first post-earnings expiration of August 2nd. The market is clearly fixated on the 10-point price move even though this size of a move, plus or minus 4.8%, is larger than what history suggests is likely. With the hedge paid for, I am more inclined to sell premium back into the market. However, I do not want to take the risks of doing something like selling the Aug 2 $215 call option (closed today at $2.20). So, my preferred option is just to wait and react.

If AAPL manages to pull back 3 to 5 points, I will either reload on the original calendar call option or, more likely, buy am Aug 2 $210/$215 call spread. If AAPL continues to rally into earnings, I will either stand down or sell short a $220/225 call option. The lowest strike will be set at 10 points higher than the price at the time of the trade.

If I make any new moves, I will be sure to write about it.

Be careful out there!

Full disclosure: long AAPL put spread