In most of my Housing Market Reviews this year, I chronicled the growing warning signs in the housing market and the on-going technical damage in the stocks of home builders. Until the last few months, I remained hopeful that a turn-around waited around the corner; I kept looking for the reassurances of the home builders to translate into renewed buying interest. I took advantage of the October sell-off to launch the seasonal trade right into the teeth of the worsening technicals and fundamentals. Last week’s earnings warning from KB Home (KBH) may have prematurely ended the prospects of a good seasonal run. If so, this letdown would be yet one more in a long line of disappointments.

Market skepticism has been high for the most of the year. One big warning sign came when KBH raised guidance in April and investors still faded the stock. In January, 2016 and before that in January, 2015, disappointing results from KBH took down the stock and the sector. In the midst of the January, 2016 selling I recommended buying KBH (and other home builders) as contrary bets against the recession the market seemed eager to front-run. That call worked out extremely well. This time around, I am not recommending a contrarian bet (without technical confirmation) because KBH’s earnings warning gave me serious concerns.

Basically, KBH acknowledged a slowdown in the housing market. The warning brought an immediate flashback to August’s warning from Redfin (RDFN) of a market slowdown. The warning took a day to register losses in home builder stocks, but they rebounded. A true breakdown took another month to happen.

Management used the term “slowdown” and allowed analysts on the conference call to freely throw that term around. The final warning that forced the company to reduce guidance was a quarter-to-date (the first 10 weeks of Q4) 14% year-over-year drop in net orders. KBH explained that this drop came from a reduced community count, deferred orders, and a longer decision-making process for consumers as they “absorb” and “digest” higher prices and higher mortgage rates. KBH is also facing competitive pressures as other builders increase incentives. KBH is mainly responding to this slowdown by focusing on selling lower-cost homes as it pushes an increase in community count. KBH expects this change in focus to increase its pool of buyers without inviting an expanded pool of competition (quite a balancing act!). The company even reduced square footage plans in existing communities.

Interestingly, this “rotation” began earlier in the year. Here is how management explained things in the Q3 earnings conference call in late September (emphasis mine):

“And while the national numbers are four months [of new home inventory], many of the markets we’re in today it’s still two months, a month and a half, and then when you get into the price points we play at, it’s even less. So there’s not a lot of inventory out there at the affordable price bands, and much of the headlines, I think, are tied to higher price points that are seeing some slowdown. And we’re trying to stay ahead of that at the price points that are slower, are well above us today and where we’re operating. But if it comes down, we have to be prepared for that, and it’s in part why we’re rotating to lower-priced communities, positioning smaller models in higher-priced areas even to keep affordable and keep some insulation there.”

That last line was one of those telling moments and was likely part of the reason why investors continued selling KBH after the Q3 earnings report. The announcement confirmed Redfin’s earlier warning.

With the rotation in full swing, KBH thinks it can maintain targets for margin percentages from its “Returns Focused Growth Plan” but not absolute revenue numbers. Revenue guidance for 2019 dropped from a range of $5.0-5.3B to $4.7B to $5.2B. This guidance of course holds out the hope that KBH can still figure out how to stay within the original range. At the low range, KBH may only generate 4.4% year-over-year revenue growth, just under 2018’s expected year-over-year growth of 4.7% and significantly below the 2017 year-over-year growth of 19.4%.

KBH guided 2019 gross margin to the range of 17.7-18.7%. During the Q3 earnings call, KBH projected 18% gross margin for 2018 and that remains the same. The company emphasized that its 2018 expectation for operating income margin of 8.1% means the company hit its 8-9% 2019 target a year early. Similarly, 2018’s expected 10.4% return on invested capital (ROIC) hurdles the 2019 10% target threshold. Unfortunately, 2019 guidance allows for operating income margin allows for a possible miss of the 2019 target: the new guidance is for a range of 7.7% – 8.7%.

The market’s reaction to the warning was harsh and swift. The stock gapped down and lost 15.3% to close around a 20-month low. Friday’s 7.8% rebound recovered the previous low set in the October sell-off.

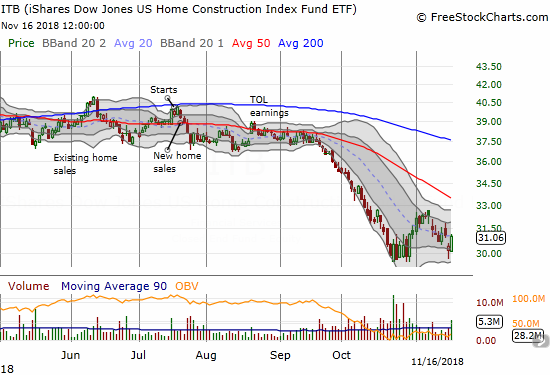

Sympathy selling was widespread across home builders. It was enough to send the iShares US Home Construction ETF (ITB) back to its October low. However, Friday’s rebound was enough to close that gap right away – a potentially bullish sign, especially with Thursday’s trading action forming a “hammer” bottoming pattern.

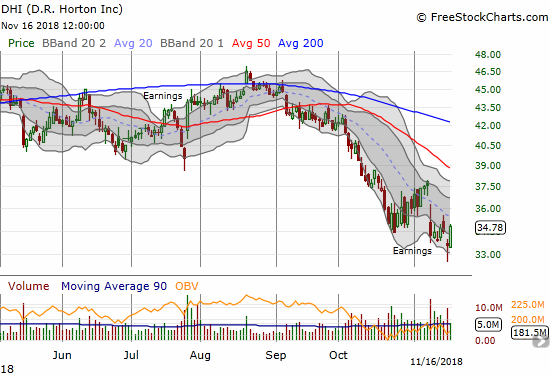

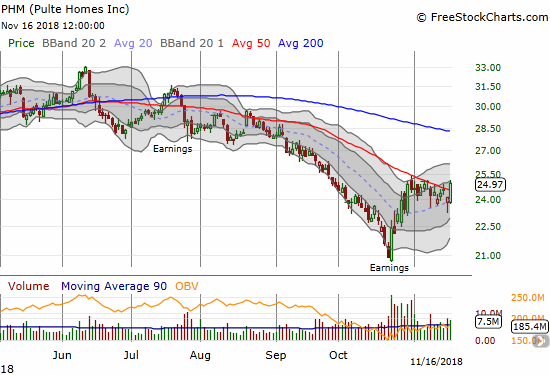

Over the last two trading days, the stocks of three other home builders stuck out the most to me: D.R. Horton (DHI), Pulte Home (PHM), and Toll Brothers (TOL). The charts below speak volumes.

Source for charts: FreeStockCharts.com

Based on the above reactions, DHI looks like it remains in trouble. PHM is still a strong stock and buyable here as a part of the seasonal trade on home builders. TOL is troubling because it sold off like the company reported bad earnings news alongside KBH. I assume that investors were alarmed by KBH’s assessment of a demand slowdown in higher price points. This commentary strikes right at the heart of TOL’s high-end market. TOL reports earnings in two weeks on December 4th after market. TOL earnings are always heavily watched and covered, but this next one will take on extra prominence and importance given the bearish context.

In the meantime, the fresh selling in KBH pushed the stock deeper into recessionary valuations. Price/book is 0.8. Price/sales is a meager 0.4. Trailing P/E sits at 12.0 while forward P/E is a meager 6.4. These metrics make KBH look like a screaming buy if not for the deteriorating fundamentals. Still, KBH is worth speculating for a short-term bounce with a stop under the post-warning intraday low ($16.82). Beyond that, I see no reason to rush in for a longer-range play until/unless KBH can close Thursday’s gap and, preferably, break through 50DMA resistance.

Be careful out there!

Full disclosure: long ITB call options