“Haters gonna hate.”

That phrase was a great way for CNBC’s Jim Cramer to begin his monologue introducing his interview with Toll Brothers CEO Douglas C. Yearley. In 2018, investors have exhibited plenty of loathing for the stocks of home builders despite an on-going string of strong earnings results and the backdrop of a strong economy. Toll Brothers (TOL) was the latest victim of post-earnings skepticism after sellers went to work reversing a tremendous post-earnings pop.

Source: FreeStockCharts.com

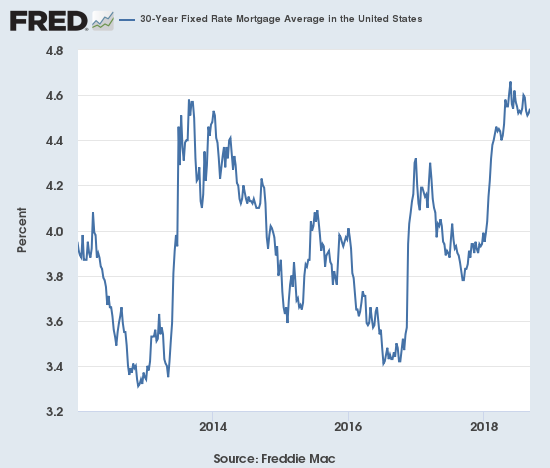

Cramer noted that the hedge fund playbook instructs managers to sell home builders when rates are rising. Yet, rates rose sharply alongside home builder stocks from September, 2017 to January, 2018. Moreover, the Fed has been normalizing interest rate policy for several years. So rising rates cannot sufficiently explain the aversion to home builder stocks.

Source: Freddie Mac, 30-Year Fixed Rate Mortgage Average in the United States [MORTGAGE30US], retrieved from FRED, Federal Reserve Bank of St. Louis, September 11, 2018.

Cramer admitted to confusion when contrasting the stock performance to the financial performance which such markers as record third quarter contracts. Yearley underlined the strength of the TOL story with some of the following highlights:

- Loan-to-value ratio of buyers is 67%. Down from 70%.

- 25% of customers paying cash, up from 20%.

- Bought back about 7% of outstanding shares.

- Top 10 brand in the world.

- Largest price premium of a new home to an old home in at least the last 28 years

Yearley explained that “softness” in California came from tough comparables with the summer of 2017. That summer was an outlier because TOL sold more homes then than during the Spring which is usually the peak of new home sales for the year. Looking forward, California is “in great shape.” California is a key issue for TOL because about 25% of its business is in the state. About 5 to 10 years ago the company made a strategic move to do more business in California.

Overall, Cramer summed up the contrasting picture between the price action and the financial action: 1) “Some of these things are just not making any sense to me” – implying that the stock is extremely undervalued; 2) “I still don’t get it but one day it will come back” – in other words, Cramer suspects a bottom is near, but his deference to the bearish price action prevents him from getting bold. The mystery of TOL’s weakness remains.

The chart above shows that TOL may actually have started the process of bottoming. The previously downtrending 50-day moving average (DMA) is flattening. TOL has yet to follow-through on recent breaks below its 50DMA. A close above $38 – an important peak from last week – gets me more interested. Otherwise, I am content to wait until October or November when the seasonally strong period for home builder stocks begins.

Millennials are marrying later, but that’s not exactly bad for homebuilders, Toll Brothers CEO says from CNBC.

Be careful out there!

Full disclosure: no positions

Wonderful article, Thanks for sharing

Thanks for reading!